Untangling Skill and Luck

Here is an interesting peace by Michael Mauboussin @ Legg Mason.

Takeaways :

-

Two main ways to assess skill and luck are

-

Analysis of Persistence of Performance

-

Reversion to the mean

-

Skill as a measure of persistence

-

Rate of reversion as a measure of Luck

-

Analogy of Change and No Change is a nice point where Change happens in the type of winners seen and No Change happens in the variation of performances.

-

-

-

Two Urn mental model to distinguish the role of Skill and Luck

-

Researchers using alternative approaches have also concluded that there is some skill in investing. 42 But the research also shows that only a small subset of the investing population is skillful, and that the percentage of funds that are skillful is declining. This is consistent with a market that steadily rises in informational efficiency over time. Note that these results take costs into consideration. One analysis suggests that about three-quarters of funds earn gross excess returns in line with the costs that they incur, making them “zero-alpha” funds. Alpha is a risk adjusted measure of excess returns.

-

Key question one must always ask - Is there transitivity in your business/ strategy / investment process ? If so , what can you do about it ?

-

Variance(Skill) = Variance(Observed) – Variance(Luck)

-

What Comprises Good Investment Process ?

-

The first part requires you to find situations where you have an analytical edge and to allocate the

appropriate amount of capital when you do have an edge.At the core of an analytical edge is an ability to systematically distinguish between fundamentals and expectations.-

Take outside view - the outside view asks what happened when others were in a similar situation before

-

In a horse race , there are no “good” or “bad” horses, just correctly or incorrectly priced ones.

-

-

The second part of skill is psychological, or behavioral. Not everyone has a temperament that is

well suited to investing, and skillful investors approach markets with equanimity. One such skilled

investor is Seth Klarman, founder and president of the highly-successful Baupost Group, who

shared a wonderful line: “Value investing is at its core the marriage of a contrarian streak and a

calculator.”- Skillful investors constantly seek input from a variety of sources, primarily through reading.

-

The third part of the process of skill addresses organizational and institutional constraints. The

core issue is how to manage agency costs. Costs arise because the agent (the money manager)

may have interests that are different than the principal (the investor).

-

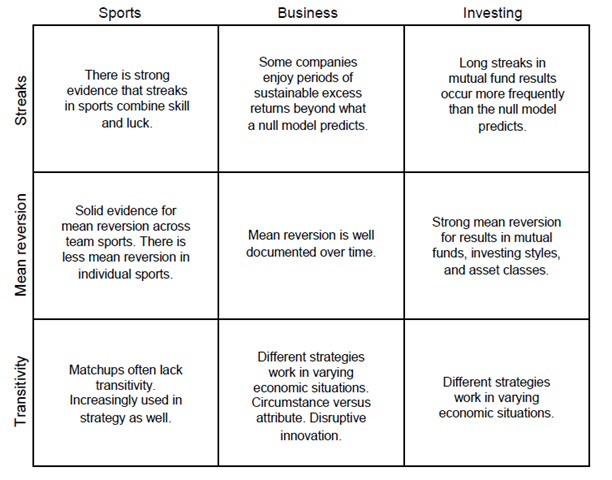

Perhaps the following table summarizes the theme of the paper