Inside the Black Box : Summary

The book is divided in to three parts. The first part of the book gives a basic primer to the Quant world which includes some description about the benefits of quant trading and intro to the structure of a basic quantitative trading system. The second part of the book deals with the key elements of the black box and the third part of the book is relevant to investors / managers who would want to evaluate various quant trading strategies.

Part I - The Quant Universe

The first part of the book introduces the reason for considering quantitative trading as a strategy, by describing the basic difference between quantitative trading and discretionary trading. The author starts off with a fact that Algorithmic / Computer driven trading is a reality, whether one likes it or not. 60% of the trades in US from the buy side are computer driven and about 45% of the trading volume in Europe are system driven. Given that quant trading is a market reality, what is it that one can learn from a quant’s approach to markets. The book cites three main reasons for understanding quant trading

1. Deep thought : Since quant trading strategies are executed using a system, it becomes very important to pen down the exact strategy , signal generation , signal checking conditions, stop-loss rules etc . The rules have to be precise, at least in the probabilistic sense. Thus unlike a discretionary trader, who most often than not, cannot verbalize or pin down his trading strategy , a quant trader can exactly tell the strategy in a series of steps(almost). One of the other skills a quant brings to the table is “Data Visualization”. Well, as is well known that 80% of our brain is allocated to visual processing. So, by providing visuals to the various trends about parameters / P&L / simulated scenarios, one can look at an investment strategy from multiple angles and reduce Type I error (Trade when there is no signal) and Type II error( Not trade where there is signal).This reduction of Type I & Type II error itself can add value to an investment strategy.

2. Measurement and Mismeasurement of Risk : This is a very debatable aspect of the use of quant methods to measure risk. Taleb has rallied against anyone who uses math to define risk. However there are a lot of situations where it is possible to tame risk. I strongly believe that some map is better than no map. At least it gives some sense of direction to the portfolio manager who can then use a mix of Bayesian and Fischerian stats to get an idea of risk. Well, whatever be math used, Black swinish events are anyways beyond the scope of quant’s work as they come under the category unknown-unknowns. So any risk metric for that matter should always be taken with a pound of salt!.

3. Disciplined Implementation: Quant trading tries to cut out emotion, fear , greed, manual mistakes out of the execution process and thus brings in a discipline in to a trading process / investment strategy.

The above three reasons should make any investor, trader , portfolio manager to be interested in the quant world.The book gives an interesting definition of quant strategy. It goes like this:

There is a full spectrum between fully discretionary strategies to fully automated strategies. The key determination that puts quants on one side of spectrum and everyone else on the other side is : Whether daily decisions about the selection and sizing of portfolio positions are made systematically or discretionarily. If both the questions of “what positions to own?” and “how much of each to own?” are answered systematically, that’s a quant strategy. If either of the two questions are answered by a human, that’s not a quant strategy

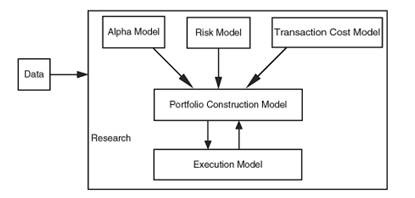

It then goes to describe a schema for understanding quant trading black box

The above flow chart is merely a schema . Obviously there are many quant strategies where only a few of these elements are chosen (ex: transaction costs in to the alpha model itself). There are strategies where the flow could be recursive. However the above schema helps one to have a discrete map of various components of a quant system. Alpha model is designed to predict the future of those instruments that the quant wants to consider trading , in order to generate returns. Risk models are designed to help limit the amount of exposure the quant has , to those factors that are unlikely to generate returns but could drive losses. The Transaction cost model is used to help determine the cost of whatever trades are needed to migrate from the current portfolio to whatever new portfolio is desirable to the portfolio construction model.The alpha, risk and transaction cost models then feed in to a portfolio construction model, which balances the tradeoffs presented by the pursuit of profits, the limiting of risk, and the costs associated with both, thereby determining the best portfolio to hold. Based on the portfolio construction model, the new trades are then sent through the execution model. The whole system’s life line is Data + Research. Without these two elements the black box is a deadbox!.

Part II – Inside the Black Box

This part of the book explains each of the blocks of the above schema. A chapter is dedicated to each of the components of the schema.

**Alpha Models

**The output from Alpha model is either a return forecast or direction forecast.The book starts off by explaining the core difference between the vast numbers of the alpha models. Either they belong to theory driven type or empirical type. In the former one, a quant starts off with a theoretical relationship and vets the data to calibrate the parameters of the model. The advantage with this is that the model can be easily communicated to people. However just because you can communicate the theory behind a model does not mean that the model will make money. There is another school of thought, i.e empirical type where you allow the data to speak for itself and you build/ trade accordingly. Personally , the latter type is far more appealing to me as you don’t have to carry theoretical baggage while building the model. Yes, there is a risk of data mining. So , the approach depends on the time horizon of the strategy. If you are dealing high freq data , I guess the best thing is to work on empirical model building. Most of the people whom I have seen building models in the high freq give a damn to theories. They crunch the data and trade on the pattern. Their belief I guess is ,”At such a frequency, Who has valid theories ?” In a way their opinion is right. Micro Market Structure studies is still at a nascent stage and researchers / academicians have not made a great amount of literature public. Most often than not, if a professor cracks an algo at a high frequency level, he is likely to trade it in a bank/hedge fund. Classic case that I know of is Dr.Robert Almgren from NYU who has written fantastic stuff on execution algos at high frequency scale and has started his own firm, Quantitative Brokers to capitalize on the algos. So , in a way all these theory laden quant models are suited for may be medium term to long term investment strategies. At a high frequency scale, I think empirical models are the flavour at the moment.

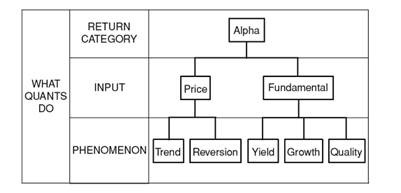

Anyways coming back to this book, the author expands on the Alpha block in the following manner:

The theory driven alpha models are explored from two perspectives, price based models and fundamental analysis based models. From whatever I have seen or read till date, quants primarily using price /volume/ etc to churn out models. Fundamental Analysis based quant models , I think are actually fraud models. My professor used to say that you must build a model that makes money, and once all alpha is gone, you can bring in some fundamental attributes and give a spin to the model so that the model is publication ready in some journal. Strange things happen when you mix academia and hedge funds! .I have started to believe that this fundamental attributes based quant model is bogus. For example, I have seen a few factor models which are based on part statistics, part fundamental analysis. They make fantastic back testing results and sadly perform pathetic in production. Most of them are often flawed as there is not enough data to test their statistical significance. For quants who actually take the pains to test such factor models using random matrix theory or equivalent theory , I think they trade away the signal asap rather than making in to a sales pitch to buy side.

The chapter then delves in the implementation aspects of any such alpha model. These details include Time Horizon, Bet structure, Instrument type, Run Frequency of the trading model. One inevitable conclusion that a reader draws from this book is that, there are only a few alpha seeking strategies but the implementation attributes are so diverse that it can potentially give rise a ton of trading strategies.

**Risk Models

**The book states at the very beginning that risk management function from a quant perspective is not about reducing risk , but it is primarily about selecting sizing the risk exposure. Post that , the quant can decide whether it makes sense to go ahead with the strategy. For sizing the risk exposure, one can simulate and statistically formulate risk exposure bands or apply heuristics to size the exposure. The other aspect to be dealt with is leverage. The author makes a passing remark about Kelly’s criterion and its use for optimal sizing of exposure.

The author makes the same type of distinction in risk models , i.e theory driven risk model and empirical risk model. Stat arb world seems to like empirical risk model as they bring out the risk factors from the data. However the downside is that there could be risk factors which have characteristics that cannot be hedged away in the real world.May be there are no instruments in the market you are working , that can be used to hedge risk factors. If you are working in emerging factors where things are still developing, you might as well take cognizance of the fact that your position is unhedged and hence you don’t have a choice but to reduce risk by tweaking the size your exposure. That’s the best you can do. If you do not have control on risk exposure type, at least you can control the size of risk exposure. So, a quant has to strike a balance between theory laden risk modelling approach and empirical approach. In any case, he/she can embed the risk model in the alpha model itself or can use it as an external component. It all depends on the strategy I guess.

**Transaction Cost Models

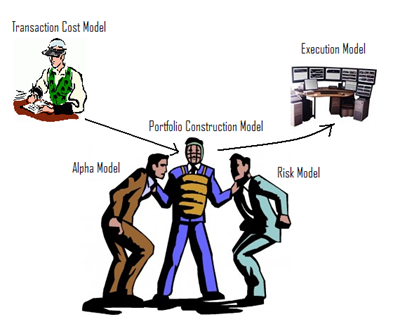

**The three key elements of transaction cost models are Commissions & Fees, Slippage Costs and Market impact costs , with increasing order of difficulty in building a model. Commission& Fees is the easiest to incorporate as they are mostly fixed hurdle costs for a trade. Slippage is difficult to model as it depends on the strategy being adopted. Slippage cuts in to Trend following strategies whereas it aids mean reverting strategies. The most difficult one to model is the Market impact and the book mentions the four common models used for Market impact, i.e Flat, linear, piece-wise linear and quadratic. The takeaway from this note is that transaction cost model’s purpose is to simply advice the portfolio construction model how much it might cost to transact. Its job is not to minimize the cost of trading.A nice analogy given about the three components described is as follows: The alpha model plays the role of the starry eyed optimist, and the risk model plays the role of the nervous worrier, and transaction cost models act as frugal accountants.

Portfolio Construction Model

Portfolio construction model acts as an arbitrator between Alpha, Risk and Transaction Cost Models. Given that alpha model is an eternal optimist , Risk Model is an eternal pessimist and Cost Model being the guy who reminds of the trading costs, the portfolio construction model balances the output from these models and tries to construct a portfolio based on some objective function. There are basically two types of Portfolio construction models. First are the Rule based construction models like equal weights, equal vols, decision tree methods etc. These are heuristic by definition and hence will appear as adhoc than quantish models. However it is still a debatable issue among finance literature whether equal weight model beats all the fancy optimizers out there. Second type of portfolio construction models are optimization based. There is an objective function, there are constraints on the size of holding and type of holdings and you basically optimize the function. Here the book mentions a laundry list of techniques like plain vanilla unconstrained optimization, constrained optimization, Black Litterman model, Grinold and Kahn’s factor portfolio approach, Michaud’s resampling approach(which is far more appealing to me from stats perspective) and Data mining approach. Given the arbitrator’s role played by the construction model, this is one area which can come close to being termed as “Black Box” as there are tons of variations that a quant can choose based on statistical tests and market conditions. The author mentions an interesting observation that quants who build Rule based construction models typically take intrinsic alpha approach(meaning they rely on individual security forecasts), while quants who build Optimization based portfolios take a relative value alpha approach.

**Execution Model

**This is one of the toughest and exciting area for any quant. Probably that is one of the reasons for sparse academic literature and trading strategy documentation. Recently I came across a flyer about a high frequency trading shop that is going to be conducted in Singapore / Mumbai in April 2011 that costs a couple of thousand dollars!!. Are the strategies so secretive that a two day workshop costs ~ $3000? I guess this execution world is more like a social video game. The guy who has a better strategy in a video game wins. This chapter talks about various technology options for executing a trade and talks about DMA, high frequency trading platform, that are very much a reality in developed markets. These are useful in markets like US where getting alpha from medium term to long term strategies is difficult. So, I guess Execution Model is the new Alpha Model in all such markets.

Data & Research

The concluding sections talk about data and research components of the black box. Data is the starting point for quant’s work and the book merely scratches the surface about data by giving an overview of data procurement, data treatment and data storage issues. The section on research talks about sources of idea generation for a quant strategy and research issues( more from a back testing perspective)

**

Part III – A practical guide for investors in Quantitative Strategies

**

The book talks about a couple of inherent risks in any quant strategy that an investor should be aware of, they being , Model Risk, Model Mis-specification Risk , Regime change risk, Exogenous shock risk , Contagion or common investor risk. Most of these terms are pretty self explanatory. The author narrates Aug 07 quant crisis to highlight the crowding phenomenon of quant strategies.

The author gives his opinion on some of criticisms of quant trading that one gets to hear such as

-

Trading is an art and not a science. Quant trading is of no use.

- No”, says the author, though the argument is little weak as he focuses on all the successful quant firms. Taleb’s “silent evidence” makes the argument weak.

-

Quants cause more market volatility by underestimating risk

- “No “ , says the author with a few numbers based arguments

-

Quants cannot handle unusual events

- “Valid criticism” says the author.

-

Quants are all the same

- “No “, says the author by giving two arguments. First the components of black box described has so many levels of combining that quant has a very large degree of freedom. Second reason being numbers based. He cites his own firm where he gives an estimate of 30% of quant trades in opposite directions. He also shows correlation between quant long short funds to be very close to 0, vis-à-vis a relative high hedge funds return correlation

-

Only a few large Quants can thrive in the long run

- “No”, says the author citing about half a dozen reasons. Some of them are compelling and make the case that a boutique shop is as appealing as a large quant fund for an investor

-

Quants are guilty of data mining

- “Not a fair claim “, says as it is often use interchangeably with “curve fitting” which obviously is useless.

The last section of the book talks about evaluating quants and quant strategies. It talks about the ways to interview quants, what sort of questions to ask quants , how to understand what quants are doing and finally the way to incorporate quant traders in to your overall portfolio strategy. I found the last chapter of the book particularly interesting as it mainly flows from the author’s experience in hiring and managing quants.

Takeaway:

Takeaway:

The schema described in the book is very appealing and can serve as a good framework for all the quant strategies that one comes across. So, in that sense, the book does indeed demystifies black box trading by showing various components of the black box and the interdependencies.