The High-Frequency Game Changer : Summary

The book starts off with a discussing ‘What’ and ‘Who’ aspects of High Frequency trading systems.

What is High Frequency Trading :

With the advent of electronic trading , the human market maker has been replaced by electronic market maker. The back end is a programmed strategy that does the market making. HFT’s DNA comprises two elements.First element is the trading strategy that is typically liquidity provision or intra day arb extraction. Second element of its DNA is the holding time that is usually a fraction of a second.

Who are High Frequency traders:

HFT firms can be typically categorized in to four types

-

Regulated Market Makers : Leading wholesalers like Citadel, Knight fall in this category. These firms have employed technology to enhance the overall operations of a traditional market marking role

-

Statistical Arbitrage Hedge funds : Statarb typically connotes a strategy with a holding period of a few days. But in the recent years, variant of Statarb techniques are being employed intra-day, for example, Pairs. When Pairs was first used at Morgan Stanley, the holding period was a few days from the entry date. Now the same co-integration based strategies are employed on intra-day data. The fact that they are being used does not mean that there is definite alpha in them. Intra day is characterized by far more noise than inter-day data. So, there is always a risk of coming up with nonsense estimates using intra-day data.

-

Low-Latency brokers : These firms are the Lime Brokerages of the world whose strength is technology. Using very strong technology infra, they deploy strategies to do incredible volumes on the stock exchange

-

Clearing firms catering to HFT needs

The common attributes amongst the above firms is that they focus on having low-latency, resilient, scalable technology, and their trading strategy is their bread and butter and they forever keep tweaking them. Lastly they all keep a low-profile.

The chapter goes on to list the impact of HFT firms on the markets.

-

Tech has become the critical component in HFT strategy. Hence there have been lot of successful startups providing very niche services.

-

Post HFT, spreads have become tight

-

60% of the volume on NYSE is HFT driven

-

Expansion of the maker-taker model : Island is an example here, that has become the de factor pricing model of today’s US equities market. By offering a rebate for providing liquidity and charging for taking liquidity, Island created an ideal transaction model to attract HFT firms.

-

Active investor in market structure : Most trading venues have attracted investments from HFT firms, thus improving the market structure

-

HFT has moved beyond equities in to options, futures , FX and other assets

So, pretty much whether someone likes it or not, HFT is a reality that is not going to go away. With out HFT, i.e Stock exchange transactions would look completely different.

Market Structure

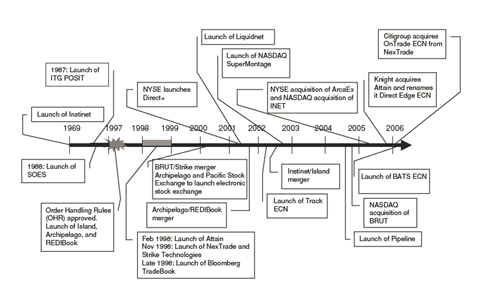

This section talks about the evolution of the market structure since the time Order Handing rules were introduced in 1997. The following visual best summarizes the evolution:

1997 was a landmark event in the market structure evolution as ECNs came in to existence. They were the main outlet for unwanted limit orders from market makers. Large buy-side firms became attracted to ECNs because of their ability to execute orders anonymously and to minimize market impact.

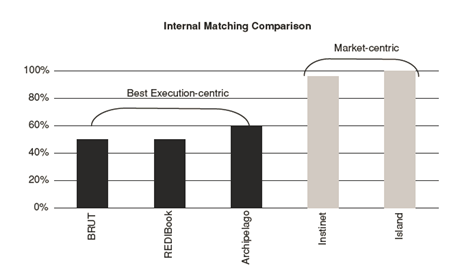

ECNs followed mainly two business models.

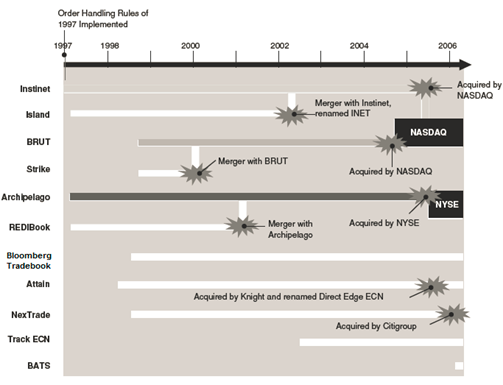

The first category is the best execution centric ECNs where they were efficient order routers; the second category was Market-centric where ECNs matched the orders internally and then routed if they failed to match it internally. Slowly Best Execution centric ECNs lost their uniqueness to DMA . Instinet and Island ECNs became popular with latter taking a larger market share. In June 2006, Instinet acquired Island and thus NASDAQ became a big player in ECN business. Also there were a spate of mergers and acquisitions during 1997 and 2006. By the end of 2006 all the ECNs got consolidated in to NYSE or NASDAQ.

The following visual summarizes the M&A activity in this space :

Then came RegNMS . The future prospects of regional exchanged looked quite bleak. But in the recent years they have made a great comeback. The chapter then goes on to cover one of the most interesting execution avenue in US , the dark pools , that are currently about 40 in number and account for approximately 13 % of the the US equities market. Types of dark-pools and the nature of dark pools are covered in this section. One of the reasons for the rise of dark pools is hedge funds.

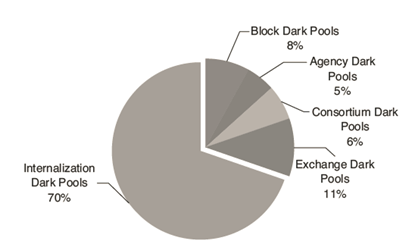

The various types of dark pools described are

- Block Trading Dark pools

- Agency Dark Pools

- Consortium Dark Pools

- Exchange Dark Pools

- Internalization Dark Pools

The estimated market share of dark pools as of Q2 2009 is shown below

Trading Infrastructure

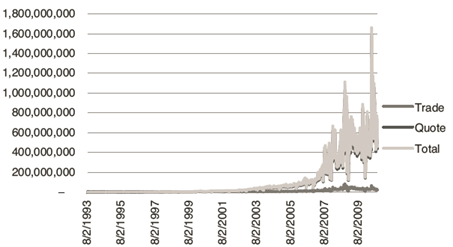

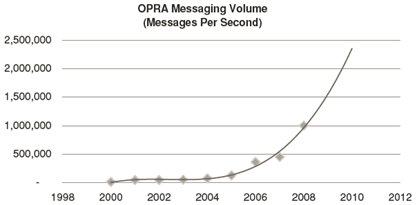

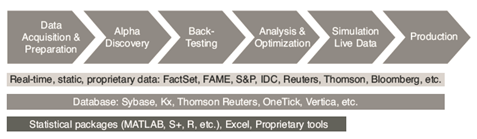

With rapid adoption of electronic trading and algorithmic trading, the messaging volume has seen an exponential rise. Reg NMS and market fragmentation has also given rise to tremendous amount of TAQ data in the recent years. In the equities side, 1.8 Billion messages per day is becoming a norm and in options data, the volumes are mind boggling with 2.5 Million per second. The following illustrations give an idea of the same

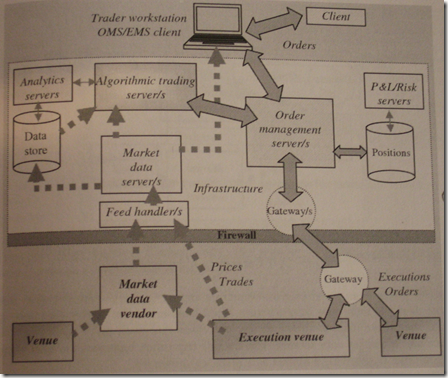

What are the key components of a High frequency trading infrastructure ? It is helpful to have the big picture now and see where the trading infra components fit

**Feed Handler :

**The book says that most of the HFT firms write their own feed handlers and it takes about 2-3 full time dedicated engineers to take care of this task.

**Ticker Plant :

**Tier-one firms pay around 7 Million USD per year in license and maintenance for these tasks. Add to that the FTEs needed to support and maintain the ticker plant cost easily adds to 10 Million USD. So, the firms need to generate that much money in trading to support this high cost operation.

**Messaging Middle ware :

**This is another big area where technology plays a crucial role. If one looks at the various communication messages that occur between the entities in trading, the low latency messaging infra is key for trading algos.

**Storage :

**Depending on the size of operation, firms pay any where between $10,000 to $2 Million for storage.

**Colocation :

**This is the first thing that any HFT set up wants in place. It costs around $1,500 to $10,000 per month. In INR terms it costs about 9 to 60 lakh per year.

**Sponsored Access :

**This accounts for 50% of the overall daily trading volume in the US equities market. Out of this 38% belongs to unfiltered sponsored access and 12% belongs to filtered sponsored access. The former involves no pre-risk management from the broker’s end whereas latter involves some kind of risk management checks. The biggest advantage via a sponsored access it the low-latency that a firm gets. For a DMA , the level of latency is about 4 to 8 milliseconds whereas for co-located unfiltered/filtered access it is 300/650 micro seconds . Thus sponsored access is a big business for all the brokers in US. The following illustration gives an idea of the latency for sponsored access trading.

**Liquidity

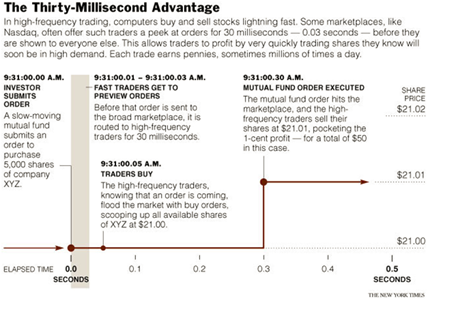

**This section describes flash crash that occurred on May 6 2010. Firstly, what’s a flash order ?

Given the above context, the section goes on to describe flash crash at a 10,000 ft view.

**

Trading Strategies**

Trading strategies typically fall in to the following categories

- Market Making

- Statistical arbitrage

- Momentum trading

- Basis trading

- News based trading

A few examples of execution algorithms are mentioned such as VWAP, TWAP, Pegging, Arrival Price are mentioned, following it up with talking about order types. Obviously at this point it is clear that the content in this book is suited to be a report than a book.In fact there is a section where the authors refer to the content in the context of a report. So, clearly this book was some sort of report floated in Aite group that was then converted to a book format.

Expansion in HFT

This is a nice section of the book that gives a bird’s eye view of HFT developments in various places across the world.

US Markets

This section lists a lot of metrics that give a sense of HFT development in various asset classes

-

Futures

-

25% of all the futures volume is derived from professional high frequency traders

-

50% of all orders generated in the futures market were algo model based

-

-

Fixed income

- 35% to 40% of the `on-the-run' treasuries volume is generated by HFT firms

-

FX

-

The industry averaged approximately $4.3 trillion in daily trading volume in 2008 compared to about $4 trillion in 2007.

-

At the end of 2009, electronic trading accounted for approximately 65% of all FX trading

-

In 2001, the global FX market averaged slightly more than 200,000 trades daily.At the end of 2009, the average daily trade figure reached more than 1 million trades a day.

-

Another good indicator of high frequency trading’s impact in the marketplace is the overall trend in average trade size. In addition to the explosive growth in average daily trade number, the FX market has also seen a decline in average trade size. In 2005, the average trade size for spot FX stood at close to $4 million. By the end of 2009, the average trade size had shrunk to US$1.4 million.

-

FX high frequency trading is poised to grow quite rapidly over the next few years, as the first-generation high frequency trading firms are joined by an influx of next-generation equity and futures high frequency trading firms looking to capture uncorrelated alpha in FX. In addition, new high frequency trading firms have emerged in recent months, formed by FX quants and traders who have left large banks looking to capture new opportunities on the other side of the market. At the end of 2009, high frequency trading accounted for approximately 25% of overall trade volume

-

-

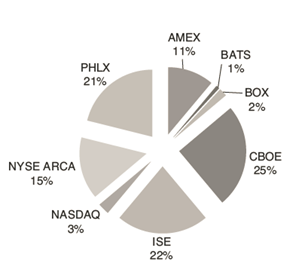

Options - The following are the big eight option exchanges in US

In options, by default HFT makes sense as market making across various strikes and expirations manually is a nightmare. Various stock exchanges where options have traded have adopted different models to attract liquidity providers. Some have adopted maker/taker model while some have their own customized rules for attracting market makers.

European Markets

Like Reg NMS, there has been a trigger in the European markets for rapid market structure changes, called Markets in Financial Instruments Directive(MiFID). MiFID is by far the most ambitious piece of regulatory initiative within the European financial services industry. At the highest level, MiFID is designed to achieve the following goals:

- Provide pan-European harmonization in order to promote investor protection and the leveling of competition across borders.

- Improve market transparency.

- Create an environment for greater market competition for trade execution.

- Create a pan-European mandate to uphold best execution obligation

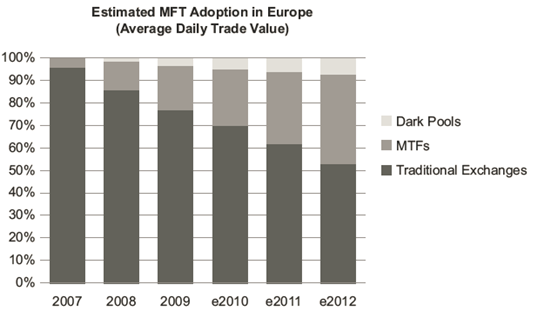

The best execution burden is on the firm . This means that firm has to store historical data to be ready to prove that their execution complied with the regulation. This means opportunity for trading infra providers. Also “Bypassing concentration rules” that are part of MiFID have given rise to Alternative trading venues.Over the last two and a half years, multiple venues have emerged from the dust of MiFID, including MTFs and dark pools. These alternative venues are expected to account for more than 30% of pan-European equities trade volume by end of 2010.

**_Brazilian Markets

_**As early as 1990s there were close to 20 different markets. Now there is one single exchange , Bovespa. Electronic trading has started in futures market since July 2009 and the volumes have picked up a lot

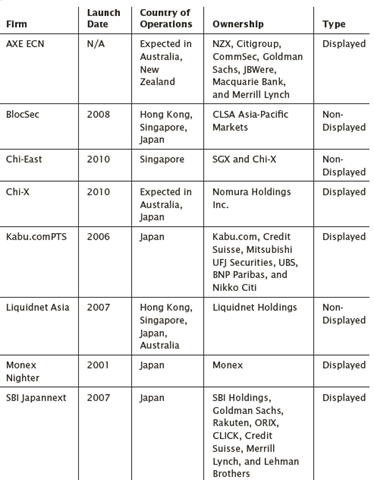

Asian Markets

There are regulatory, IT, business and cultural obstacles that hamper the overall adoption of impending market structure changes. Unlike the US and European counterparts, there is no single pan-Asian capital market. Each major financial center has its own set of regulations and infrastructure, which makes it very tough for smaller players to build a significant presence in Asia.

- ATS - In general most Asian countries discourage off-exchange transactions. This means that ATS will take a long time to develop. Based on regulatory status and changes in market structure and exchange technology upgrades, Japan appears to be the most ready for first generation ATS adoption. This potential has been boosted by the recent launch of Arrowhead, the Tokyo Stock Exchange’s (TSE’s) next generation trading and market data platform. Unlike other Asian markets, Japan’s proprietary trading system (PTS) activity has increased over the last few months.

-

Lack of IT knowledge on the buy-side adds complexity to driving the adoption of advanced trade execution tools, which includes direct market access (DMA), algorithms, and ATSs.

-

Depending on the country, clearing and settlement is another area of concern. In Hong Kong, Australia, and Singapore, the primary exchanges own the clearing and settlement organizations.

-

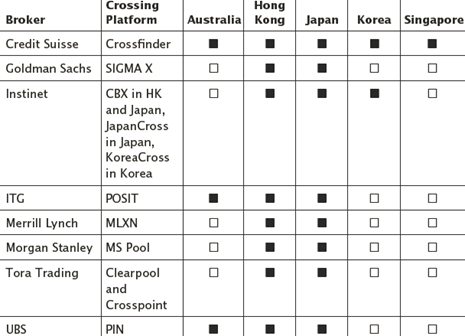

While independent ATSs struggle to begin operations faced with inflexible regulations, most brokers/dealers have operated their own internal crossing platforms for a couple of years now, mainly focused on the Japanese and Hong Kong markets. As the markets become more electronic and major Asian market centers begin to fragment, these internal crossing engines will enable brokers/dealers to provide a wide array of liquidity services to their clients.

The following gives an idea of various crossing platforms in Asia.

- HFT adoption in Asia-Pacific

The overall adoption of high frequency trading in Asia is expected to lag behind Europe by a significant margin driven by the lack of IT infrastructure, complexity in regulation, and lack of attractive market microstructure. However, the presence of high frequency trading firms in most of the major Asian markets confirms that given the right mixture of conditions, the penetration of high frequency trading flow could be significant and quite rapid

Positives and Possibilities

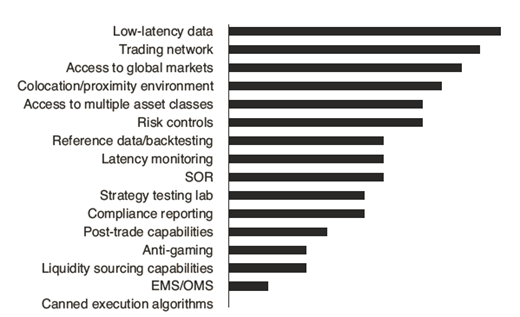

A complete managed solution includes the following components

- Platform

- Colocation

- Network connectivity

- Market data

- Order management

- Risk management

- Algo chassis

- Compliance reporting

- Latency monitoring

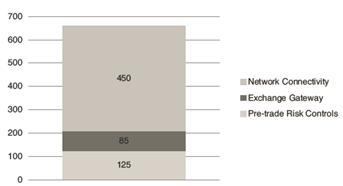

Aite groups claims to have done an interview of 40 odd HFT firms and the following visual summarizes the finding on the key elements of a HFT managed solution

Close to 50% of the technology used in HFT firms is built in-house. The common themes of this in-house development are

-

Colocation : Key requirements include colocation for new markets and asset classes, data center consolidation, and moving additional strategies into existing colocation. Further, firms were waiting for new colocation opportunities to come online from exchanges and other liquidity providers.

-

Market data : Key requirements include acquiring more direct feeds, new data to support expansion, and building historical data repositories for back-testing strategies.

-

Risk management : Speed is the key requirement for risk management. How fast can trades make it through required checks and can the firm make it faster ? Further, many firms are watching regulatory discussions and preparing to incorporate additional risk management requirements.

-

Geographic and asset class expansion : This is a large bucket largely containing the other items in this list, but additional efforts primarily focus on making internal changes to existing systems to support new data types, new fields, new connectivity methods, and is probably the largest bucket of outsourcing opportunity and interest.

-

Network connectivity : Key requirements in this area include upgrades to routers, the addition of network monitoring tools, and fiber upgrades.

-

General Latency: Key requirements include hardware upgrades, exploring hardware acceleration, engineering code for multi-core, and squeezing latency out of existing code.

In the quant analysis infrastructure, databases , especially HPDB( High Performance Databases) play a central role in quantitative trading.

There are two types of dbs used. One is where all the historical tick data is stored and the key is efficient retrieval of data for back testing. Second is the kind of db where the data is stored in memory and it is used for active analysis. The third area that is mushrooming is Complex Event Processing. In the context of dbs,, there are lot of decisions that need to be taken. Should the db be outsourced ? Will the current db infra be sufficient to expand beyond the traditional asset classes? The author seem to say that a HFT firm’s success/failure is critically dependent on the decisions taken about databases

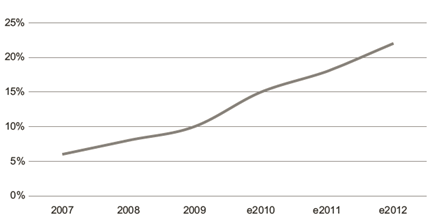

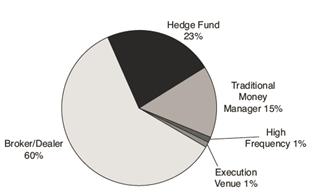

The chapter talks about Smart order routing at length. Smart order routing is predominantly used by Broker/Dealers. The following illustration gives an estimate about the use of SOR by various entities

Market fragmentation and global trading are driving SOR adoption. Of the areas driving growth, Europe is leading the interest in adoption. The following visual gives an estimate of the growth potential of SOR.

Market fragmentation and global trading are driving SOR adoption. Of the areas driving growth, Europe is leading the interest in adoption. The following visual gives an estimate of the growth potential of SOR.

What are the business drivers propelling SOR growth ?

- Dark Liquidity Access

- Liquidity Access in a New Geography.

- Customized Trading Algorithms.

- Small-Firm SOR Adoption

- New Asset Classes.

- Compliance.

I came to know about XBRL from this book and that it has been seen an enthusiastic adoption in Japan.In April 2005, the Securities and Exchange Commission announced an initiative to move financial reporting to an electronic filing system. In the electronic filing process, data is published using eXtensible Business Reporting Language (XBRL) to segregate financial information into structured eXtensible Markup Language (XML) documents that can be read by XBRL document readers and machines. Probably this is the reason why there are hedge funds whose main strategies are news driven.

The authors predict that once low latency solutions are available to anyone, anywhere, there will be a ton of trading startups in a lot of countries.

The chapter ends with these words

Colocation is available. There are managed trading platforms and sponsored access. It would seem that anyone with technical acumen, an understanding of the markets, and some statistical analysis skill could build a strategy and start trading in a low latency environment. Sure, capital is a barrier to entry, but there are firms out there willing to fund people with a good strategy. People in the Ukraine, India, the Philippines, Malaysia, etc. will figure out how to turn their technical acumen and market knowledge into a profitable strategy.

Credit Crisis of 2008:The Blame Game

The book ends with a brief description of various regulatory checks that have been put in place , post subprime crisis. There has been a lot of regulation on hedge funds, prop trading shops, derivative instruments, OTC securities, rating agencies etc that have been put in place and will be imposed on the wall street firms. Hopefully this regulation should make the markets stable in the times to come. But you never know, the next LTCM might happen in a few minutes time.

Takeaway :

Takeaway :

Even though the contents are published in a book form, this is more of a report on HFT. It gives an historical evolution to the current reality of stock exchanges in US , Europe and some Asian countries- High Frequency trading.