Speed Traders : Summary

In the introduction, the author tries to define HFT using the voices of leading HFT players. What are the characteristics of HFT? There is no agreement on a common definition of HFT, but there are some elements that one can at least attribute to HFT. They are

-

Low latency trading.

-

High turnover strategy.

-

Trader goes home `flat' with no open position.

The goal of any HFT firm broadly is to have a set of uncorrrelated trading strategies that has statistically more winners than losers for all the trading positions of the day. The introduction mentions the fundamental market driven factors that gave rise to HFT:

-

RegNMS.

-

Order Handling Rules leading to ECNs and hence a proliferation of venues.

-

Explosion of the universe of instruments; Human market maker is giving way to computerized market maker.

The author ends his intro clarifying terms such as program trading, quant trading, algo trading, automated trading, prop trading, stat arb, ultrahigh frequency trading. I found the explanation of these terms better explained in Barry Johnson’s book ,`Algorithmic trading and DMA'.

**

The Emergence of High-Frequency Trading**

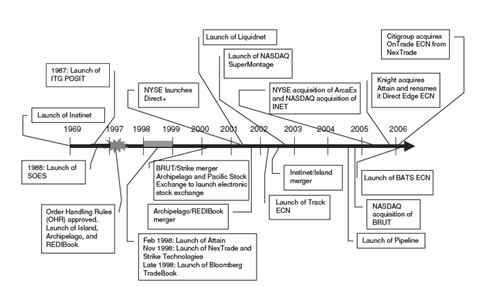

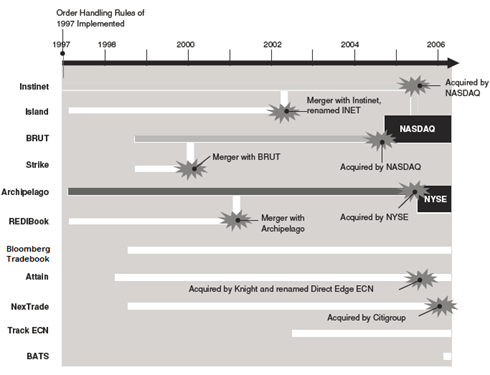

This section lists down the significant events from 1969-2007 that were a precursor to todays' HFT

-

1969 Feb - Instinet Launched.

-

1971 Feb - NASDAQ starts electronic trading in 2500 OTC stocks.

-

1975 May - SEC bans fixed commission rates.

-

1976 May - NYSE introduces DOT.

-

1984 July - NYSE Approves SuperDOT.

-

1987 - Launch of ITG Posit.

-

1994 August - BNP purchases Cooper Neff Options trading firm.

-

1997 - Order Handling rules approved.

-

1998 - Launch of Attain, NexTrade, Strike Technologies, Bloomberg tradebook.

-

1999 April - Regulation ATS becomes effective.

-

1999 July - Goldman buys Hull for $530M.

-

2000 - BRUT/Strike merger, Archipelago and PSX electronic exchange launched.

-

2001- Launch of Liquidnet, Launch of Direct plus, Archipelago/REDI Book merger.

-

2001 April - Decimalization rule hits stock exchanges.

-

2002 - Launch of NASDAQ Super montage, Instinet - Island merger, Tradebot trades 100 million shares a day for the first time.

-

2004 - Nasdaq acquires BRUT, Launch of Pipeline.

-

2005 - RegNMS comes to force, NASDAQ acquires INET, NYSE acquires Archipelago, Knight acquires Attain and renames to DirectEdge ECN, Citi acquires NexTrade.

-

2006 - NYSE buys Euronext, CME-CBOT merger.

-

2007 - Chi-X Europe launched by Instinet. It becomes largest Multilateral trading facility in Europe. A graphic for the above events should have been there to make the content easier to read and recall. A few visuals like the would have made the chapter more readable:

**

The Path to Growth**

This chapter traces the developments through the period 2007-2010 June.

-

2007 April - General Atlantic invests $300M in GETCO.

-

2007 May - NASDAQ announces its plans for acquiring Nordic Stock exchange.

-

2007 July - Citi buys Automated Trading desk for $680M.

-

2007 Oct - NASDAQ buys Boston Stock exchange.

-

2007 Nov - MiFID goes live in Europe , NYSE announces its plans for a data center Mahwah, NJ.

-

2008 June - `Flow traders' receives funding.

-

2008 June - GS Sigma X and Credit Suisse ATS platform log in record volumes of 406M and 210M shares respectively.

-

2008 Nov - BATS becomes an exchange with its USP as speed with maker-taker model. As of today, BATS logs in 12% of the daily US equity trading volume.

-

2008 - Citadel’s Tactical Trading fund earns $1.19B in 2009 with a team of 55 people!

-

2009 Mar - GSET launches Sigma-X in Hongkong. It soon becomes a big hit.

-

2009 June - NASDAQ introduces two types of flash orders , BATS introduces flash orders.

**

High Frequency Trading Goes Mainstream

**

This chapter traces the developments during 2009-2011 , the time frame when HFT entered the parlance of media, journalists, politicians, economists etc. It all began with a NYTimes article by Charles Duhigg on July 24, 2009 on HFT. That was the first time when HFT became known to wider audience and most importantly lead to false notion amongst people that flash orders were used to manipulate market.Click here to read the full article that was published in NY Times.

Soon after this article got published, NASDAQ and BATS stopped offering flash orders. Amidst the falling economy, HFT was making money and this was met with harsh reactions from everyone. Meanwhile BATS and DirectEdge were eating in to the market share of NASDAQ and NYSE. So, to stay competitive in the game, NASDAQ launched INET in late 2009, an HFT enabled platform. NASDAQ also asked SEC to look in to various data centers that were mushrooming in the country. These data centers were heavily used by hedge funds and HFT shops. Meanwhile Chi-X was launched in Europe and Asia. Chi-X was very successful in both the venues. In Japan, it was launched under the name, `Arrow Head' and the latest numbers from Arrow Head - 100 Million shares a day - shows that it is a massive success. There is another market development mentioned here, i.e the ban on naked access. Naked access goes under various names, ‘Sponsored Access’, ‘Unfiltered Access’, etc. All those names boil down to one type of access - Allowing hedge funds to participate in the market using broker’s market participant Id. The broker does not put any kind of controls to the orders and merely offers the platform to the clients to trade with broker’s participant Id. According to Aite group, 38% of the equities volume is from naked access. Banning this was a big jolt to all the broker-dealers.

The chapter also features the success story of GETCO, an options trading firm started by 2 floor traders in 1999, that went on to become one of the biggest success stories from Chicago. There are some interesting facts about the GETCO’s story like , it hired skilled video gamers from Illinois Institute of technology for its trading team. Well, to think of it, HFT is a kind of video game played with sophisticated technology. In Feb 2011, GETCO became a NYSE designated market maker along with the biggies like Goldman, Kellogg group, Bank Am and Barclays.The success of GETCO is also an indication of what a powerful financial and technology hotbed Chicago had become.

**

The Technology Race in HFT**

Based on a few interviews with HFT shops, the author lists some basic requirements for a HFT shop to get going

-

A reliable and sufficiently fast data input source.

-

A robust and sufficiently fast market access.

-

Low enough transaction, clearing and processing costs as well as sufficiently effective and efficient processing and verification capability.

-

Strategy monitoring tools.

Well, if these things appear obvious, Kumiega and Ben Van Vliet of Illionois Institute of technology have developed a step-by-step methodology( using machine control theory) that addresses the needs of institutional trading and hedge fund industries for development, presentation and evaluation of high-speed trading and investment systems. They call it methodology and it says that the following stages of development should serve as a road map for running HFT shop.

-

Before even firms even start building, they should ask themselves how they are going to monitor a successful algo.

-

Build a customized database of historical data and purchase or build a tool for proper back testing of a strategy.

-

Data cleaning methods are a key component. Writing your own scrub methods is better as it gives control over the data.Procure dirty data and see whether your system works.

-

When algos go out of range,let’s say 3-4 stdev , stop the strategy and fix it, just like a plant shuts off a machine if it goes 3 stdev from the normal.

-

Backtesting is critical. However there are certain aspects you can’t back test and be sure. Latency, Market data and timing are always going to be things that are difficult to check in backtesting.

-

Fully define the functionalities and performance requirements of the trading/investment system and develop a system. Don’t tradeoff robustness for the sake of speed.

-

Put in place a reporting mechanism to capture relevant metrics for the HFT strategies.

The chapter ends with saying that, low latency is essential, but it is the strategy that needs to be robust. This is a very different view from what I heard from one of my friends last week. He is of the opinion that there are less than 10 strategies that are basically used in all the HFT shops and the speed is the ONLY thing matters. This book and other people mentioned in the book says `otherwise'. May be both matter equally!.

**

The Real Story Behind the “Flash Crash”**

I found this chapter to be most interesting in the entire book as it goes behind the events that lead to NY Times article in July 2009 . It was in June 2009 that NASDAQ and BATS introduced flash orders to compete against DirectEdge. DirectEdge had given its participants a special order type called Indication of Interest , that helped DirectEdge add 10% to its existing market share. So, this tactic by NASDAQ was to make SEC ban such orders on the entire US market including CBOE that had roaring flash order business. SEC did not make regulatory changes as far as options are concerned. But it did make changes and subsequently flash orders were completely removed from the market.

One typically associates flash crash with some kind of HFT trading gone bad. But this chapter makes it very clear that HFT traders hate flash orders as the only entities that are profitable in a flash order are the exchanges and the guy putting the order. Infact reading this chapter makes one realize that flash crash actually goes on to show why HFT firms are needed in the first place becoz most of the HFT firms shut off their computers during the flash crash. Since there was no liquidity from HFT firms,volatility increased so much that Dow tanked 600 points and bounced back. Liquidity and Volatility have an inverse relationship and thus ‘HFT firms providing liquidity lessen the volatility’ is the argument provided `for' HFT case. When SEC report came out investigating flash crash, it was clear that a massive market sell order of $4 Billion E-Mini contract was the tipping point for the crash in the already nervous market. Why would a trader put in such a big order as a market order and not a limit order is surprising ? Somehow the press has been flogging HFT for the flash crash , when infact, there were firms who were providing liquidity even during the flash crash. Rumor is that there is a firm in Chicago which made $100M in one day. Now given that HFT profits are close to $2B-$3B, that’s a huge amount of money.

Will there be more flash crash type of events in the future ? Certainly says the book and it says this has got nothing to do with HFT strategies.

**

Life after the “Flash Crash”**

This section describes the various events post May 2010 flash crash

-

May 12, 2010 - Talk of HFT tax as they were falsely blamed for flash crash

-

May 14, 2010 - The first piece of investigation revealed that it was a traditional money manager who placed a $4B sell trade with out price limit, that triggered the crash

-

May 24, 2010 - Talk of eliminating stub quotes

-

May 26, 2010 - Goldman launches DMA in Latin American markets

-

June 4, 2010 - SGX announces $250M “Reach Initiative”, the fastest platform in the world that has a 90 microsecond door to door speed. NASDAQ has a door to door metric of 177 micro seconds. This proposed platform at SGX is 100 times faster than the existing infra

-

June 10, 2010 - SEC approves rules that require exchanges to stop trading in specific stocks if the price goes up by 10% or more in 5 min interval.

-

June 11, 2010 - Revolving door practice is seen at GETCO. GETCO hires Elizabeth King, a personnel from SEC. This practice of hiring people from regulatory bodies is called ‘Revolving door practice’

-

June 22, 2010 - GETCO launches its dark pool

-

July 21 2010 - DirectEdge launches two platforms, one for blackbox stat arb guys and second for passive agency order guys

-

Aug 24 2010 - Chi-X receives a takeover enquiry from BATS. Chi-X becomes the second largest trading venue after London Stock exchange in Europe

-

Sep 1, 2010 - BATS and NASDAQ stop flash orders. DirectEdge continues with Indication of Interest orders, a flash order in disguise. From the flash crash to the Waddell & Reed trade that started it all, from the discussion about stub quotes to circuit breakers, from the launch of new exchanges in the United States to GETCO’s dark pool in Europe, by November 2010, high frequency trading was on the minds of everyone in the financial world.

The Future of HFT

This sections lists the events that have happened in 2010.

-

Oct 21, 2010 - Chi-X Global announces that it will start operating in Australia by Mar 2011

-

Oct 21, 2010 - SGX makes GETCO a trading member in its securities operations

-

Oct 25, 2011 - SGX makes a $8.3 B takeover offer for the operator of Australian Bourse

-

Nov 3, 2010 - SEC voted to bar brokers from granting HFT unfiltered access to an exchange, a move aimed at imposing safeguards meant to prevent bad trades

-

Nov 8, 2010 - SEC decides to ban `stub quotes'

-

Nov 11, 2010 - Chi-East, a joint venture between Chi-X Global and SGX was launched and this became the first pan-Asian independent dark pool to be backed by a regional exchange.Chi-East is widely regarded as a landmark in the development of Asian Equities

-

Nov 24, 2010 - DirectEdge announces that it was changing the way it handles flash orders. It also indicated that it will slowly phase out flash orders

-

Dec 1, 2010 - Equiduct Systems Ltd, announced that it traded more than 1 billion euros in Nov 2010 for the first time as ATS aimed at retail brokers gathered momentum. Equiduct is an MTF operated by Berlin bourse.

-

Dec 6, 2010 - ASX that was selling itself to SGX said that the decision to merge with SGX was in the best interests of Australia’s market micro structure development. Collectively the combined SGX - ASX entity would list companies worth $1.9T, fourth in Asia behind Tokyo, HongKong, and Shanghai.

The book is interspersed with interviews with 6 High frequency traders.

Meet the Speed Trader : John Netto

In this chapter, John Netto , a high frequency trader talks about his trading experiences and HFT in general. Here are some of the aspects he mentions,

-

The creation of HFT strategy was the easy part. Issues such as how one will raise capital and how one will handle dealing with compliance, regulatory, reporting, and developing infrastructure are all questions not asked at first but which will become a critical part of the equation of profitability

-

Low latency is very important for HFT but the degree of importance varies based on strategy.

-

In terms of infra, I would say buy , than build so that you can focus on strategies to make money.

-

Sophisticated systems can be thought of as the assistants to the traders, not replacements to the traders, because after all, strategy, structure and people are key to success.

-

HFT is going to get bigger, stronger and more prevalent. More traditional investment managers will explore HFT in the times to come.

-

Always have a few strategies that you think , make money on paper at least.

-

I work out daily. Fitness and being active are a very important part of success . Trading requires you to be mentally alert and hence you have to be be fit.

Meet the Speed Trader : Aaron Lebovitz

Aaron Lebovitz spent two decades in the industry and then started his own firm, Infinium Capital management, a prop shop in 2003 and made it in to an exceptional force in the industry. Here are some of the aspects he mentions,

-

Hook up with a firm that has a proven track record, and make sure to know how to write code.

-

Integration of formal models in to trading decisions is the kicker you get in applying quant.

-

Started off with pairs as his first high-freq strategy.

-

His mantra is, `Developing new markets, increasing global market liquidity, and driving efficient price discovery'

-

Infinium trades 23.5 hours 6 days a week. It did shut down its machines on the day of flash crash

-

It is not all about speed. Having subtle or good strategies will get you alpha.

-

The future of HFT is still very much in doubt, hinging on an uncertain regulatory environment.

-

I don’t foresee traditional investment managers shifting their focus to becoming market makers or developing statistical arbitrage strategies

Meet the Speed Trader : Peter van Kleef

Peter Van Kleef has spent the last 15 years running automated trading ops. Here are some of the aspects he mentions,

-

It never really crossed my mind why someone would want to trade any other way than HFT. It is just so much more efficient

-

Start writing your own trading strategies and see whether they make money on paper. Think about fancy infra later.

-

Trying to apply solutions from other fields of science and research is also a start when exploring HFT.

-

Whenever possible, I try to balance work with some sort of physical exercise. It is MUST for being a better trader.

-

Low latency is important but is not the be-all and end-all.

-

It is time for people to stop competing for speed and start producing alpha.

-

A lot of the profits that are sustainable usually will come from the strategy and not necessarily from technology.

-

Leverage is the key driver because returns are quite low.

-

The overall profit largely depends only on the number of trades that can be done because the average profit is nearly certain. I don’t know many other strategies that, if run well, consistently range about 50% per year and above. We are not in the business to rate ourselves; high-frequency is very profitable, if done right. That much is sure.

-

Sophisticated retail investors are already running HFT strategies.

-

HFT of the yesteryears is becoming a commodity as you can buy all the infra that is needed.

-

Part of what will determine the future of the industry is what regulatory changes legislators and SEC will introduce.

Meet the Speed Trader : Adam Afshar

Adam Afshar’s views on HFT are little different from the traders covered earlier. He is of the opinion that it is the low latency that is extremely critical. Here are some of the aspects he mentions,

-

HFT is a method or a tool. It is not a strategy. HFT methods are applied to three types of strategies - Market Making, Stat arb and Algorithmic execution.

-

My HFT shop uses models where there is absolutely no human intervention in the execution. I believe this should be the way, as human order execution does not allow you to collect data and you can’t back test. If you use an algo for execution, one can collect all types of data and then improve it. Your reliance of specific individuals is also less

-

High-speed data management is the linchpin of a success HFT shop.

-

You can’t avoid latency issue. Its a prerequisite for whatever you do in HFT world.

-

The biggest revenue generating idea in my shop is , one that scours 110 million news items and takes positions intra-day

-

HFT popularity will slowly fade away. It will soon become a commodity once tech makes the landscape flat.

-

My advice to students is to take science and liberal arts subjects as they teach how to think. You can figure what you want to do later.

Meet the Speed Trader : Stuart Theakston

Stuart Theakston runs GLC, an HFT firm. Here are some of the aspects he mentions,

-

High frequency traders simply replace specialist/jobbers in providing liquidity in a much more competitive framework.

-

HFT traders are not getting a free lunch by installing heavy duty infra. Infact all they are doing is eat each other’s lunches.

-

An unfortunate way in which flash crash was handled by the exchanges : Some of the trades were canceled. This gives all the more a reason for HFT traders to be away from the market during crisis.

-

I spend 70% of the time with quants, traders and programmers and 30% of the time watching market and doing research myself. I read a lot of academic papers and journals, etc.for they provide valuable source of ideas.

-

Most of the people in the media, political circles, policy makers are clueless about the function of HFT. Volatility reduction demands Liquidity and HFT guys play a crucial role here. The policy makers have the potential to kill this entire HFT crowd if they don’t understand issues properly.

-

Order-anticipation and cross-venue arb are sensitive to latency, liquidity provision is less so.

-

Prop trading firms can spend 99 cents on infra to make 1 dollar. Hedge funds can only spend 19 cents of the dollar given the structure. So these participants cannot compete in the same space

-

HFT is nearing the bottom in terms of competition to be the fastest. The opportunities are outside equity asset classes like Forex, Exchange traded CDS and developed markets.

-

Suppliers will spring up who try to sell HFT trading in a box to the masses. But the retail users won’t make any money, at least on a properly risk-adjusted basis

-

Most of the development in HFT have already happened in developed-market equity and equity derivative markets, and these are approaching maturity. These markets are likely to be the domain of increasingly specialist outfits. The low hanging fruit has been picked. The next wave is likely to be in emerging markets and esoteric ETFs. This is where people developing their careers in this space should focus.

Meet the Speed Trader : Manoj Narang

Manoj Narang started his firm in 1999 that was in to providing financial toolbox. In the last few years or so, he has transformed his firm in to a profitable HFT firm.Here are some of the aspects he mentions,

-

Its the law of large numbers at play in HFT. If you have a strategy that works 55 percent of the times, you can’t do a few trades. You have to do a ton of trading to translate that edge in to sustainable profits.

-

We generally are buyers of hardware and builders of software and systems.

-

We have never had a a losing week since we started in the business.

-

A successful high frequency strategy will have a Sharpe ratio higher than 4 and a successful HFT operation that runs multiple strategies generally will have a double-digit Sharpe ratio. Such high Sharpe ration are unheard of in traditional investment places.

-

Back of the envelope calculation shows that the profitability of the entire HFT industry is around $2B. Not much in relative terms. There are many other corners of the financial industry such as derivative trading, that generate hundreds of times this amount of profit in one year.

-

The main use of outside capital in the world of HFT is to fund research and development, operations, not to actually trade the capital. Very little capital is required for trading purpose.

-

Once you are an electronic market maker, it is skills that become important and not status or power or connections.

-

Market making function in equities is decentralized. It doesn’t mean everyone should be a market maker. Just because everyone needs food, doesn’t mean everyone becomes a grocer. Similarly individuals should seek to be investors and not liquidity providers.

-

Wall street has little to do with HFT.

-

I think the main risk in the financial markets is that the capital is getting increasingly concentrated, which makes herd like behavior even more prevalent. The frequency with which bubbles inflate and exploder is getting more and more rapid as a result because massively capitalized investors jump from one asset class to another asset class, leaving devastation in their wake

-

HFT does not connote systemic risk.The only systemic risks to the market are the ones posed by herd-like behavior.

-

Tradeworkx started HFT in 2009 and this 50 member shop account for 3% of overall volume in SPDR ETF.

-

One must keep in mind that modeling systemic correlations is VASTLY different from modeling structural correlations.

-

How do I see our fund in five to ten years? I have no idea; five or ten years are an eternity when you are immersed in a world where microseconds matter.

Takeaway :

Takeaway :

If you take all the events that have happened relating to HFT world and list them in a chronological order, spice it up with some HFT trader stories and viewpoints, what you get is, this book.