Singapore FinTech Festival 2022 Notes

Contents

Singapore FinTech Festival is a great festival to attend and get an understanding of various aspects of the intersection of Finance and Technology space. The festival is a great learning experience for anyone, as it brings together some of the best people and the best companies in the world, all at once place. This year, it was an in person event with 324 talks, panel discussions, industry initiatives. product announcements, demos, workshops. The fact that there were 324 scheduled events over 3 days meant that it was physically impossible to digest everything. I have managed to attend a few talks and events and this blogpost will summarize some of the points from the talks. In these summaries, I have also added fantastic visual summaries created by thoth.art

8 Global Economy Insights

Speaker

- Taimur Baig Chief Economist, Managing Director

Notes

- We are in an era of polycrisis, a term that means to connote simultaneous crisis events happening across several domains.

- Unless China manages its Pandemic, it is a challenge for everyone. Ultimately the China’s inability to recover in the short term will have massive ripple effects on everyone

- We are realizing that demand side tools being solving supply side problem isn’t working

- Massive debt causes policy errors. We are going to see a policy volatility

- The protectionist walls that are being put up various countries is going to be harmful

- Green transition seems to be politically untenable

- There is a massive peer pressure among the nations and companies to work towards carbon neutrality. This means that massive amount of money is going to flow in this direction. The flip side to this is that other important aspects that plague our world will not get as much attention as they are needed

- Massive power struggle between many countries

- Our dear earth is hit by a shock, but it bounces back, as if it’s on a trampoline. We must build systems that are resilient, that have enough buffer and can bounce back as shocks are a given to our world

Reflections

Reminds me of Taleb’s thoughts on shocks and antifragility. We need to build enough buffer in our system so that they are resilient to shocks. This buffer might appear inefficient if you measure based on the traditional tools. However these buffers and system designs that make the system resilient. That begs the question, how does one build a buffer or make the system resilient to political and policy decisions that seem to be completely unpredictable? What buffer would Europe had built in to their systems to avert the energy crisis from the Ukraine war ? What buffer could UK have built to stay resilient to political uncertainty ?

May be it should be bottom up. If majority of the actors in the respective personal and professional lives work towards creating systems with buffer, systems that are designed to take shocks, then as a nation, we can be resilient to shocks ? I think Taleb has a set of recommendations on the way to go about doing this, though it might be provocative to the current mindset carried by most people.

Visual Summary by thoth.art

Opening Address

Speaker

- Lawrence Wong, Deputy Prime Minister and Minister for Finance

Notes

- 5Es that one can view the FinTech world and its trends

- Enhance

- Enhance the payments systems within Singapore and across nations

- Purpose bound digital currency backed by Singapore dollar

- PayNow and PromptPay - Payment connectivity between Singapore and Thailand

- Empower

- SME focus

- SGFinDex: World’s first public digital infrastructure to use a national digital identity and centrally managed online consent system. It enables individuals access to their financial information held across different government agencies and financial institutions.

- Envision

- Opportunities and risks

- Embrace underlying technology but stay away from speculation

- Innovative projects

- Project Guardian that explores asset tokenization

- Cross currency transaction trials

- Environment

- ESG FinTech landscape is nascent

- Measure carbon emissions for SFF 2022 festival

- Encourage

- 100 Million grant funding for 500 projects

- MAS third tranche - 150 million funding for the next three years

- Engage

- Share of cheques - 32% in 2016 to 7% in 2022

- Eliminate corporate cheques by 2025

Visual Summary by thoth.art

The Undiscussable : Why is Tech Cost Rising? – Exploring the Optimal Path to Transformation

Speakers/Participants

- Joanne Hannaford Chief Technology & Operations Officer Credit Suisse Group AG

- Andrew Lang Chief Technology Officer JPMorgan Chase

- David Brear

Notes

- Cloud and Developer productivity is the key

- Cloud is an end state

- Return on investment on cloud has become prohibitive

- How many applications on the cloud - is a wrong metric?

- How do you leverage platforms ? One needs to think of Several personas - data analyst, data scientist and software engineer

- There needs to be more open discussions across several types of personas

- JP Morgan

- Omni platform for getting data, munging data and build models

- Onyx platform

- Don’t see the desire to see the change. Many firms are still focused on quarterly results.

- Most firms seem to be agile in specs and not agile in deployment

- AI, Blockchain , Cloud, Quantum computing - make sure that you are experimenting and understand how one can leverage these

- Learning sprints as a part of development life cycle

Reflections

Financial firms are going with multi-cloud strategy and making sure that the tech infra is used by different set of personas.

Visual Summary by thoth.art

Stick, Twist or Fold

Speakers/Participants

- Kristo Käärmann Co-founder & CEO Wise

- Julian Teicke Founder & CEO wefox

- Manisha Tank

Notes

- Wise Founder

- Raising money is a terrible distraction

- 80 billion euros a year

- 3% of the global money transfer

- Focus on financial discipline

- most managers are going to be between 24-30

- wise connects to local systems

- 400 people working in Singapore

- Haven’t found a use case of Blockchain to use in their current work

- Banking has always been bottom up and tech companies have always been about scale

- Uses a lot of ML in various teams

- Fraudulent transactions

- Managing treasury

- Right currency at the right time

- Where the money needs to be in the next two hours

- How do you re-imagine the banking world ?

- Link to payment systems directly

- If aliens landed, how do they want systems to be - is a good analogy

- wefox - uncool kids on the block and helping agents

- no negative selection as the brokers fronts the process

- financial profile is much more resilient

- valuations - 80 times the revenue in 2021 . Now it is much closer to incumbent. Trading 8 to 10 times the revenue

- wefox

- distribution business

- have to disrupt my business in order to survive

- buy an offline broker and help them increase their productivity using our technology

- how responsible tech companies can work together with the regulator in order to protect the consumer ?

- Data can lead to paradigm shift in insurance.

- In today’s world, at least 15 devices connected to internet

- Contextualize

- Know about bad things before the bad thing are going to happen

- words of wisdom from wefox founder - I am not the same person as two weeks ago.

- Become a new person over and over again

Reflections

Interesting to see that a FinTech does the uncool thing turns out to be a great success

Visual Summary by thoth.art

Navigating the Winds of Change in Digital Finance

Speakers/Participants

- Kamal Quadir Founder & CEO bKash Limited

- Martha Sazon President & CEO GCash

- Forest Lin Head of Tencent Financial Technology Tencent

- Ari Sarker President, Asia Pacific Mastercard

- Haslinda Amin

Notes

- Bottom up economic story

- Gcash 69 million subscribers ties up with the stock exchange to expand its services

- changed the game in savings

- helped govt in banking penetration

- financial inclusion is 70%

- bKash

- Bangladesh fintech

- Crisis and opportunity have the same representation in Chinese

- 12 years journey

- 5 financial institutions working with bKash

- Digital KYC

- Account is opened with the institution

- 25000 new customers every day

- Mastercard

- Farm Pass program

- Small time payments high frequency digital platforms

- move a few dollars at a fraction of a cost

- Use of NFT tokens as payment

- Trillions of flows in digital economy

- Digital platforms have no boundary

- Focus on things you can control. Environment will play in whatever

- APAC decade

- Productivity and create value

- Focus on the customers and let them be your north star - Now more than ever customers need us

Reflections

bKash founder’s story was very inspirational. The way he pieced together a few anecdotes from being a practitioner was very interesting.

Visual Summary by thoth.art

SFF Dialogue with Nobel Laureate

Speakers/Participants

- Mr Kailash Satyarthi

- Mary Ellen Iskenderian

Notes

- 110,000 children rescued

- Are empathy and compassion same thing ?

- Sympathy

- Empathy - Feel the problem of others as yours

- If you cannot make a difference, you are burnt

- Compassion - Feeling others problems and strong drive to solve the problem

- People, Planet, Prosperity and Peace are interwoven

- Three aspects

- Supply chain of gratitude

- Internet of responsibilities

- Algorithms of diversity

- History is always been created by people who have courage to jump in the ring.

- Big dreams for everyone

Reflections

An engineer who turned in to a social activist. There was an amazing sense of calm in the way the Nobel Laureate spoke. It sounded more like as though I was sitting in a satsang rather than a highly overcharged tech conference. At the end of the day, his message was loud and clear. Do not be a mere witness in the world but work with the new technologies in the world and bring about a change.

Visual Summary by thoth.art

The Worlds Greenest Blockchain

Speakers/Participants

- Staci Warden CEO Algorand Foundation

- Jaynti Kanani Co-founder Polygon

- John Lee Managing Director & Global Lead of Digital Assets Accenture

- Gene Hoffman Director, Chief Operating Officer & President Chia Network Inc

- Martin Pickrodt Head of Fixed Income SGX Group

Notes

- FIR on Polygon network

- Covid report verification on Blockchain network

- Charity records being registered on Blockchain network

- Dominant use case - Green as a marketing tool

- Voluntary carbon markets are at an infancy

- How can one audit carbon offsets ?

- Whether offsets has come from Scope 1 or Scope 2 ?

- Is Solidity ready ?

- Many dollars have been lost via Solidity enables solutions

- When one can send a movie from Nigeria to Bangladesh in a few seconds, why can’t one send money ?

- ESG reporting standards - Need to have a network effect

- Using Zero Knowledge Proofs on Polygon

- DAO’s implemented on Polygon

Visual Summary by thoth.art

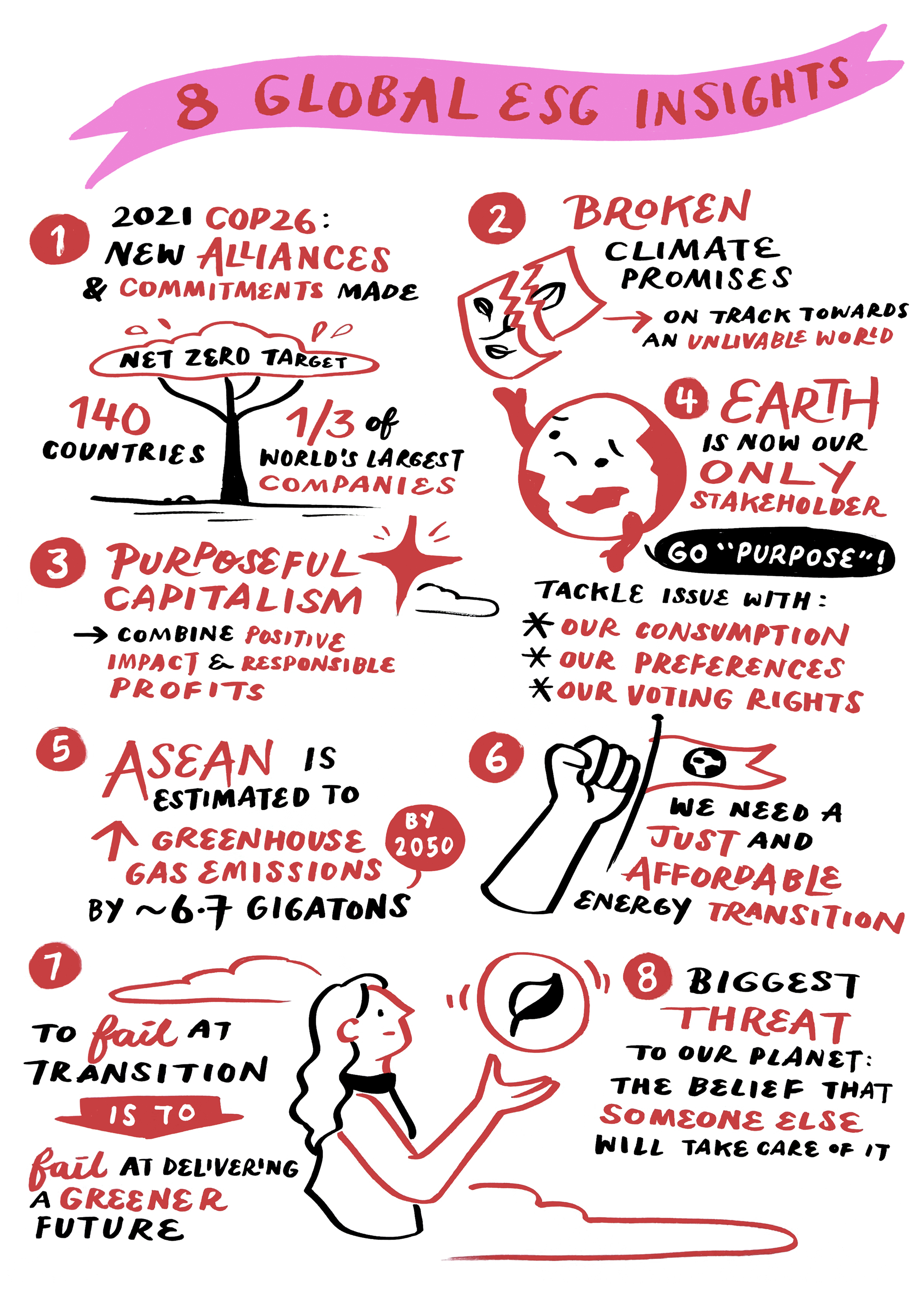

8 Global ESG Insights

Speakers/Participants

- Eric Lim

Notes

- Metrics shown before the keynote speech

- Visual Capitalist heavily references in the slides

- Carbon accounting platforms are popular targets for VCs

- 13 million jobs will be created by 2030, thanks to clean tech

- Net zero is top of mind for US and Eurpoean customers

- 2025 ESG assets estimated to be 1/3 of all assets under AUM

- Global investment in energy transition 600B in 2021

- Share of net flows in sustainable strategies - 50% in EU

- 9.2 Trillion dollars of annual spending to reach net 0

- 140 countries have committed to net zero

- 135 T committed to net 0

- Govt Regulators are going to play a key role

- Private sector 60% of World’s GDP

- Earth is now only our shareholder. Going for purpose

- Purposeful capitalism

- Yvon Chouinard - Founder of Patagonia Yuon

- ASEAN 6.7 gigatons by 2050 without an effective transition plan

- 700 million with #2.5 T GDP ASEAN

- JUST TRANSITION

- To fail at transition means failing at reaching net zero

- Financial companies back companies that are reducing their carbon footprint

Visual Summary by thoth.art

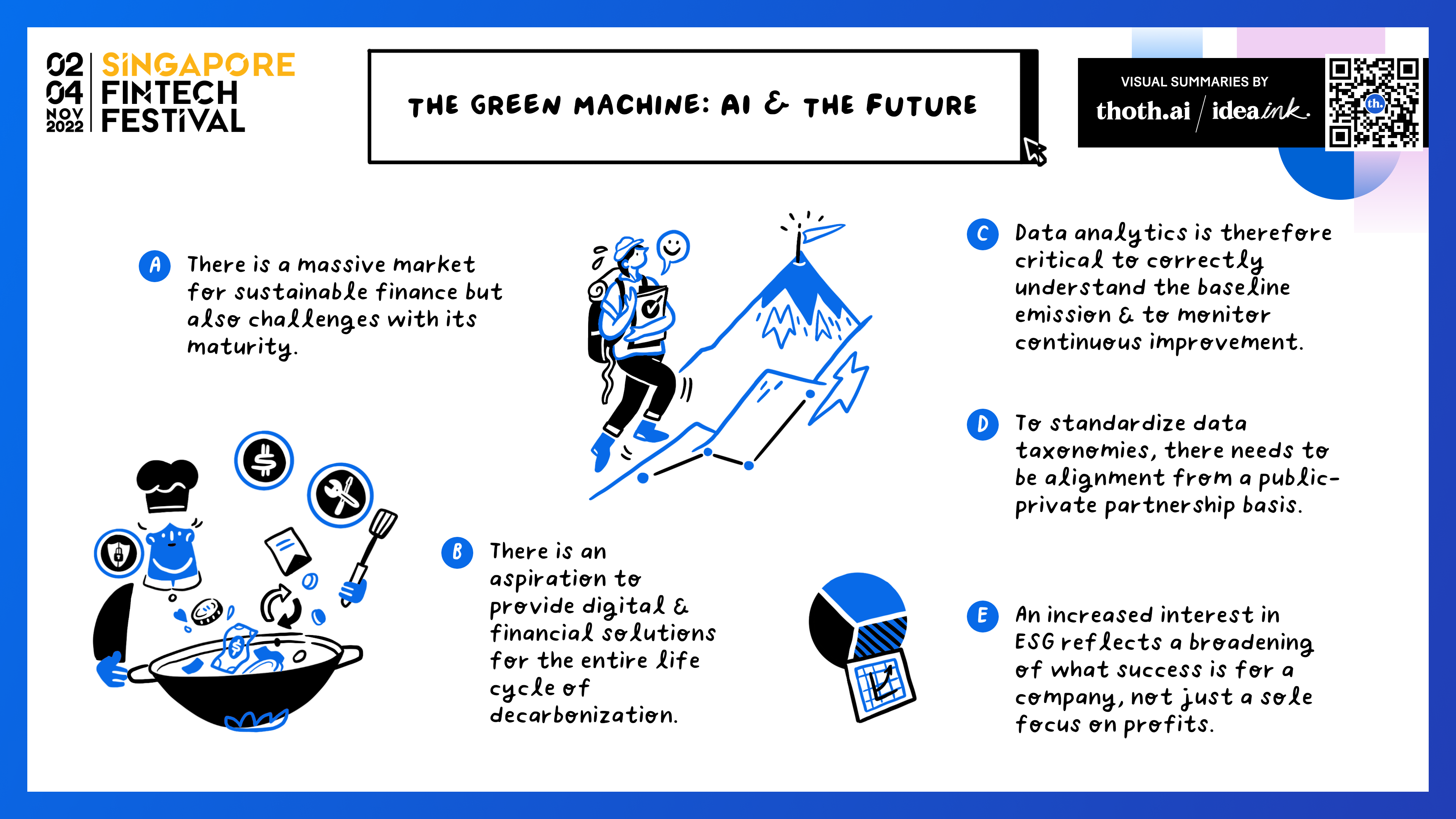

The Green Machine: AI and the Future

Speakers/Participants

- Liu Feng Yuan VP, Business Development Aicadium Singapore Pte Ltd

- Jaclyn Dove Head of Sustainable Finance Strategic Initiatives Standard Chartered Bank

- Tetsuro Imaeda Co-head of Global Banking Unit & Senior Managing Corporate Executive Officer Sumitomo Mitsui Financial Group (SMFG)

- Wu Shiwei Chief Technology Officer Huawei Cloud APAC

Notes

- Inconsistent taxonomy problem

- Accuracy of data is low

- Reliance on proxies to drive models

- Misrepresentation risk

- Alternative data sources to verify commitments

- Get data from utility companies to verify emissions

- Blockchain

- Cannot guarantee that data is genuine but based on the transactions on the Blockchain, one can model green washing

- Sustena tool for SME reporting

- Software and data cannot solve climate chnage problem

- Trusted and Verifiable data ??

Reflections

I was looking forward to this session but somehow was disappointed as the aspect of greenwashing wasn’t discussed much, as advertised in the agenda

Visual Summary by thoth.art

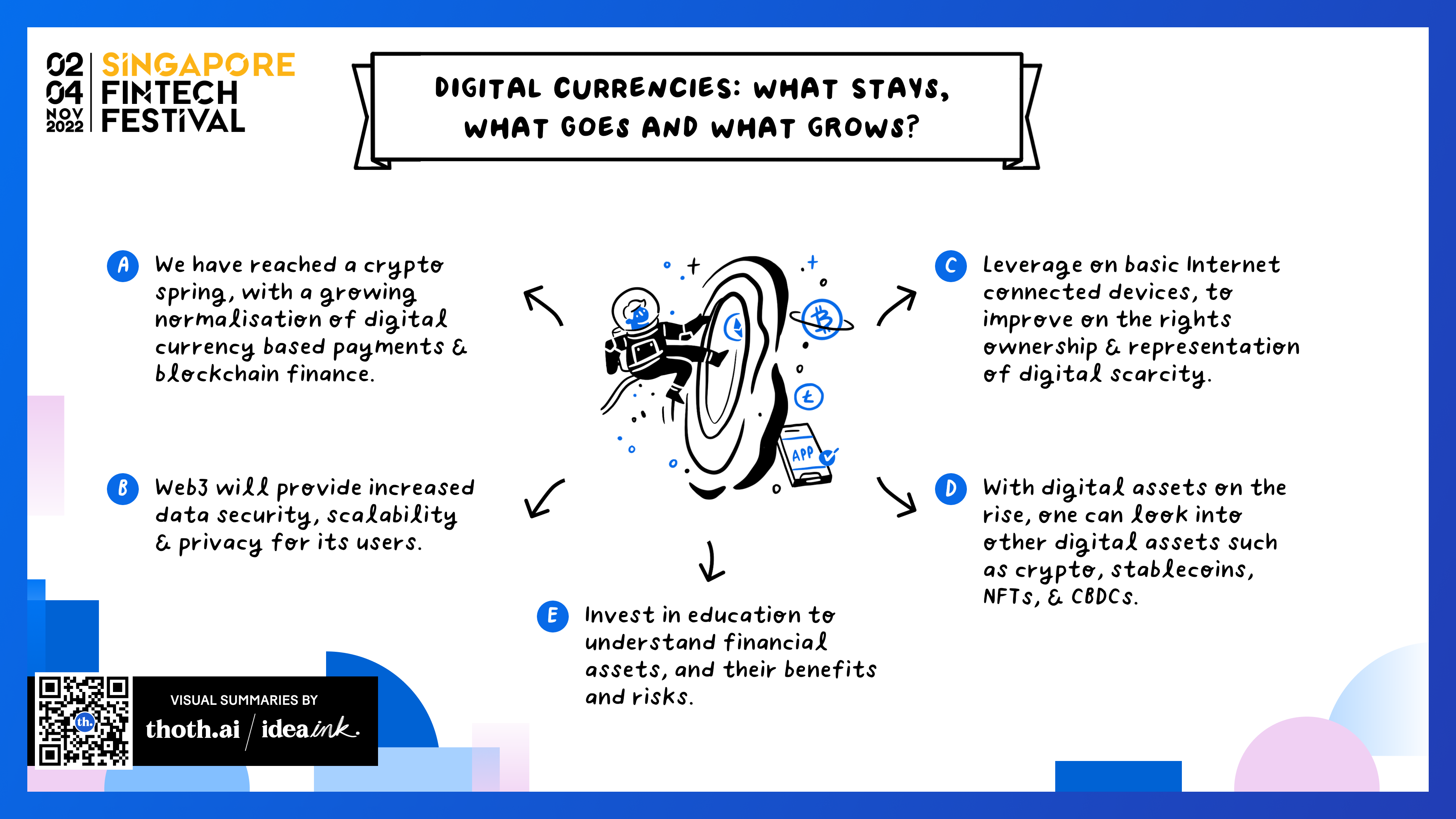

Digital Currencies: What Stays, What Goes and What Grows?

Speakers/Participants

- Eric Anziani Chief Operating Officer Crypto.com

- Dante Disparte Chief Strategy Officer & Head of Global Policy Circle

- Jo Yeo Head, Payments Development & Data Connectivity Monetary Authority of Singapore

Notes

- Google spreadsheet on cloud is not a Blockchain

- USDC is in 190 countries

- Social network via Blockchain usecase

- “Show me the money” as an audit strategy

- CBDC and stablecoins can coexist

Visual Summary by thoth.art

Project Orchid Demo and Technical Sharing

- Let’s say you want to give money to your child so that it is only meant to be spent on certain things. How does one achieve it ? Purpose bound money

- Spent sometime understanding a few use cases and found the usecase very interesting

- Project Orchid Report

MAS Project Guardian Showcase

- What is it about ?

- Interesting demo that showcases regulator and private sector collaboration

- Reverse pricing feeds in to the system to serve as oracles

- Pricing feeds in to AMM to serve as oracles

- Price skew in AMM pricing

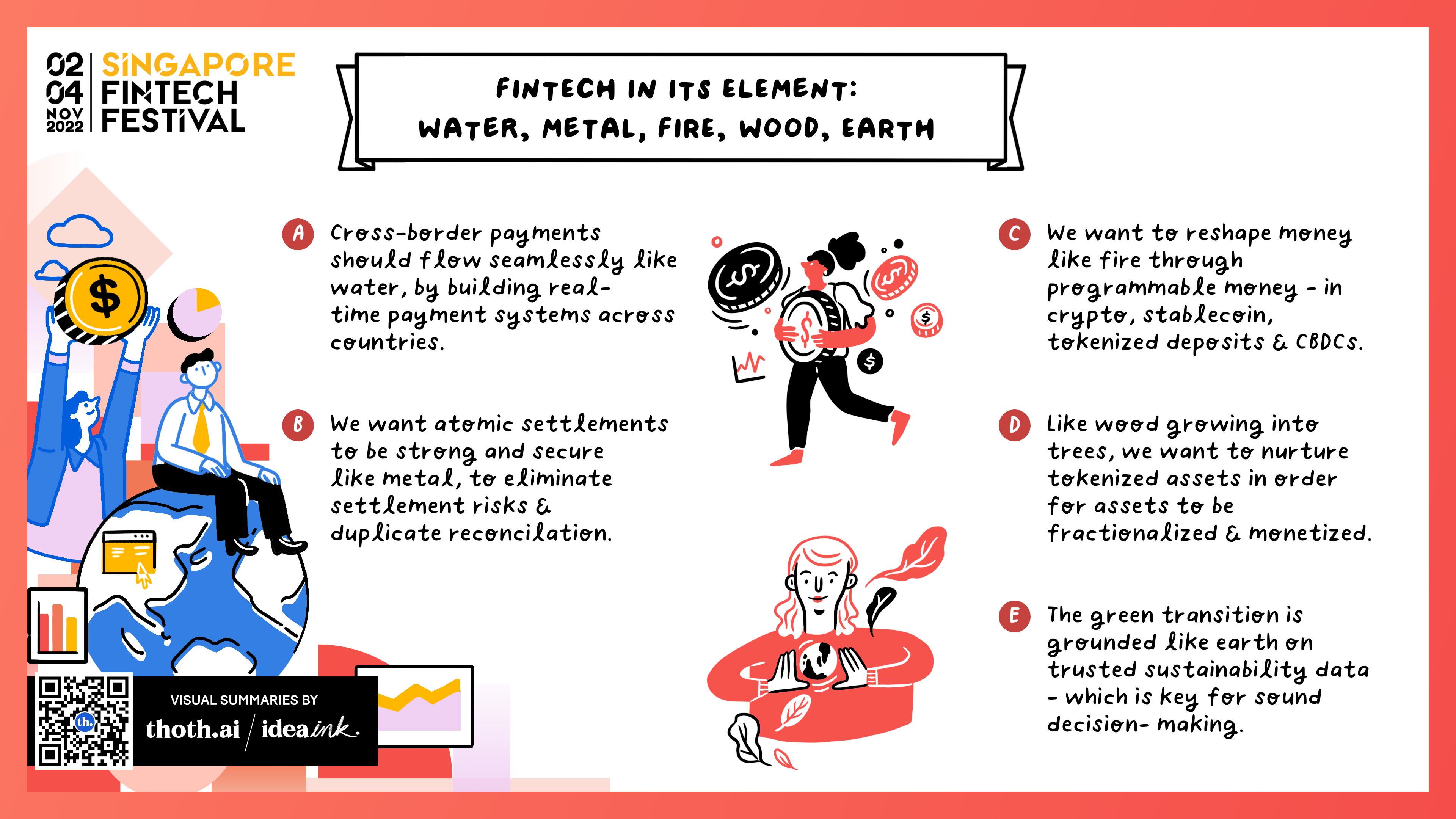

FinTech in its Element: Water, Metal, Fire, Wood, Earth

Speakers/Participants

- Ravi Menon Managing Director Monetary Authority of Singapore

Notes

- Fin tech investments 3.1 Billion dollars

- Five key problems that FinTech in Singapore is trying to solve

- Instance remittance - Water

- Flowing like water

- Cross border payment problem is still an issue

- Relying on archaic network

- Global average cost of sending remittances is hefty

6% - Painful for retailer

- Want cross border payments to flow seamlessly like water

- PayNow connected to Promp Pay and UPI and Doitnwo

- Bilateral linkages take time to implement

- Each implementation accommodates data governance, capital controls, number of required links,

- Project Nexus

- Connect once to the Nexus platform once

- Unified exchange

- Payment transaction is cleared in 60 seconds

- Wider access

- Greater transparency

- Immediate update of the transaction status

- Strong security

- 20 countries in ASEAN connected to Nexus by 2050

- Atomic Settlement - Metal

- Project Nexus solves the clearing problem

- Settlement problem is not solved. Many intermediaries are involved in the process of settlement. It takes anywhere between 2 to 3 days

- Real time settlement like Metal

- Simultaneous exchange in real time

- Removes duplication

- Through tokenized assets on a distributed ledger. Project Ubin demonstrated that part

- Decentralized netting of payments

- Final delivery by tokenizing digital assets

- Partior

- Multi-currency settlement platform

- Dunbar

- Ubin plus

- Global initiative using wholesale CBDCs

- Settlements can be performed atomically

- Atomic settlement across platforms that use distributed ledger

- Policy guidelines

- Wholesale CBDCs with automated market maker - using smart contract

- Partnering with Swift

- Programmable money - Fire

- Digital money accounts for 90%

- Rules are written on smart contracts

- Better assurance that the money reaches the intended recipients

- Program and Purposes in to the money itself

- Programmability comes from tokenizing money and putting it on distributed ledger

- 5 ways

- Cryptocurrencies

- Stable coins are promising

- Tokenized bank deposits

- Digital representation of tokenized deposits

- CBDC - Digital programmable versions of money

- Purpose Bound Money

- MAS is discouraging retail investment in Crypto

- Regulating Stable coins

- Two consultation papers - differentiated approach to digital currencies

- Consumer harm to trading crypto currencies

- Regulatory measures to stable coins

- All stable coins and tokenized deposits should match minimum requirements given out by MAS

- Heat of fire reshapes the money

- Project Orchid

- Purpose bound money

- Programmable contract that can be used with Digital Singapore dollar

- UOB

- DBS

- OCBC

- Grab , Temasek and Fazz

- Govt payouts to people who don’t have bank accounts

- Disbursing grants to training providers

- Skills future will test via smart contracts

- Improve the user experience and strengthen security

- Tokenized assets - Growing like Wood

- While Crypto has been the rage, the real innovation is in tokenization.

- Using a software program, use it as a way to ensure ownership

- Asset tokenization has transformation potential

- High value financial value can be fractionalized and traded without intermediaries

- Can enable DeFi

- Borrowing lending can be done via smart contracts

- DeFi is still in infancy and not without significant risk

- In Tradition finance, supervisors can go after the management. In DeFi world, there is no person in charge. How does one enforce stuff on an algo

- Nurture tokenized assets ecosystem

- Project Guardian

- DBS JP Morgan SBI

- Regulated financial institutions as trust anchors - issue credentials

- Common pool of digital assets

- Establish institutional grade security within the protocol to reduce risk

- Forex and Govt bonds

- Trade Finance - Issuing tokens linked to trade finance

- Tokenizing wealth management products

- Lower issuing costs

- Decrease transaction costs

- Any asset can be fractionalized and monetized

- Trading costs are drastically reduced

- Better accountability

- FinTech regulatory sandbox

- The real value in teh crypto industry comes not from speculation. Tokenizing and putting it on the Blockchain

- Experimenting with Programmable money

- Atomic Settlement

- Tokenizing - reduce risk

- Trading and Speculation for Crypto Hub - NO

- Trusted Sustainability data - Earth

- Good data is foundation

- Corporate disclosure standards and frameworks

- Sectoral transition pathways and plans

- Tack alignment to transition plans

- Close financing gaps for net zero transition

- Green and transition taxonomy

- ASEAN taxonomy

- Green fintech

- Project greenprint

- ESGenome and ESGRegistry

- National Disclosure utility

- National Disclosure Utility partnership ESG

- Cross border interoperability

- Focus on Data Orchestration

- Aggregate data from multiple ESG data providers

- Utility providers

- Sectoral providers

- Financing gaps and technology gaps

- Launch Digital marketplace

- Synergize connectivity

- ESG Registry

- Blockchain based registries

- ESG Data Directory

- Instance remittance - Water

- Collaboration is key between incumbents, fintechs

Visual Summary by thoth.art

The Great Merge: Rearchitecting Ethereum with Vitalik Buterin

Speakers/Participants

- Vitalik Buterin

Notes

- Consensus algo using PoW

- PoS beacon chain running for two years

- Proof of stake comes from the proof of assets that you put in the system

- Road to Merge

- 2014 - “Slasher” blog post

- 2015 - Early versions of Casper

- 2017 - Casper FFG paper

- 2018 - Beacon chain development starts

- 2020 - Beacon chain launch

- 2021- Altair fork

- 2022 Sept 15 - Merge

- 99.95% less electricity consumption

- More powerful consensus design with parallel confirmations

- Easier to make future upgrades

- Remaining Problems

- Scalability

- User experience and security issues

- Privacy

- Argentina - High Crypto adoption

- 30 % inflation every year

- Rollup centric - Layer 2 based scaling

- Danksharding

- Account abstraction - security solution

- Account recovery on Blockchain

- Stabilize Ethereum protocol

- Next couple of years - A lot of stuff is going to change in the protocol

- Zero knowledge proofs - Parallelization - Execution of ideas

- Web 3.0

- One of the big things is the concept of identity

- It can mean lots of things to lot of different people

- Identity

- I am trusted by XYZ

- I am trusted by the data facts mentioned

- ENS like DNS

- Name links to a particular address

- Signin for Ethereum

- Use the Eth account to sign in to various services

- Proof of Human

- Proof of attendance

- Things like Proof of Human and Proof of attendance - Opportunity for an eco system to emerge

Reflections

There are many concepts mentioned in the talk that I was completely clueless about. May be it is time that I spend time understanding and working through various aspects of the ETH protocol.

Visual Summary by thoth.art

A Hard Look at ESG Finance

Speakers/Participants

- Stuart Kirk Financial Commentator

- Julien Vincent Executive Director Market Forces

- Tariq Fancy Founder & CEO The Rumie Initiative

- Manisha Tank Journalist & Broadcaster (seen on CNN, Ex-BBC)

Notes

- Understand things that are based on something real

- Asset Management teams - Incompetent, Apathy, Cowardice

- Real material action is missing

- Three problems with ESG

- Misselling - Selling products and services that do not do what they do

- Erupt in time

- Proportionality - Too focused on looking at various elements of ESG. Perhaps we should have look at various macro factors.

- Cognitive dissonance - How finance looks at ESG - A lot of companies don’t walk the talk

- Misselling - Selling products and services that do not do what they do

- What’s wrong ?

- Does not change incentives

- How many want to invest in fossil fuel ?

- Do you want to most return ? or trade off return ?

- Majority of the capital is invested on behalf of others

- Fiduciary objective - value and not VALUES

- ESG Finance has created a notion that you can do a ton of stuff. We have not changed the incentive system

- Pollute but not paid cost

- Governed by fiduciary duty

- No regulation put in place

- Price segmentation strategy

- In the last 5 years, ESG tools and data have seen improvement but incentives have not changed

- What triggered you ?

- Compare markets to competitive sports - We need referee

- Blog posts by Tariq - Secret diary

- Two issues around communication

- ESG and Sustainable finance

- FinTech is involved in disintermediating

- ESG Ratings are messed up

- By bringing accountability

- Facilitated shareholder proposal

- Shareholder proposal -

- Challenge the institutions about marketing

- Question of scale and intent

- tariffs

- False conversation

- Big players are interested in trading oil and gas

- They want to bleed business lines

- Treat the companies with contempt

- no correlation between trading volume and share price growth

- By forcing companies to change via voting

- By voting your shares

- GFANZ is harmful

- In execution stage, it does not matter

- Waste of time for the crisis

- Skeptic - Why would they actually succeed ?

- ESG PR statements - CSR

- Face shareholders - Political spending

- Voluntary initiatives - they are actually happening when it is slowing down government’s response

- Besides building tools, there needs to be counter narrative

- future generations how humanity messed it up

- more responsible - govt needs to make systemic changes

- speed of laggards - systemic reforms

- Huge amount of room for the govt

- ESG as a drama - meaningless

- Sustainability bonds are crap

- Real change and real solutions that need to be implemented is missing

- Call to Action

- Building solutions - No green washing - Build tools that have real impact

- Have a voice in the debate - Narrative is dominating in the system

- Most of the biz are startups. Not every company can solve each issue. Don’t expect to solve. Make your company as good as you can be. Payments company solves ESG problem. Build the best company you can

- We need to do what we have

- Market place will not have time or patience or support to firms who are pulling wool over eyes

- We need everyone at their bit of the puzzle as hard as they can

Reflections

Julien Vincent was the most vocal of the speakers who sounded more like an activist. Tariq Fancy on the other hand focused on the fundamental problem plaguing the Asset management industry, i.e. the problem of misaligned incentives. Asset manager is focused on delivering value and not necessary values.

Does it make sense to focus on this area ? If you have worked as a quant and have spent some time munging data of various types, ESG looks like an area that where many data vendors can contribute. However this talk made me feel that it will take quite a while for to get feedback on the model that one develops in this area. Many sites are advertising or pitching cleantech to the all the people who have been recently fired by large tech companies. Indeed there are a ton of people from Twitter, Stripe and many other companies who have been fired. May be a sizable percentage of people will find their way in to this space. Looks like there is a lot of money to be made by data providers, consulting companies. But is there something that I can contribute in the short and medium term ?

Visual Summary by thoth.art

Insurance - Key Note

Speakers/Participants

- Varun Mittal

Notes

- Wealth Management to hit 9T by 2028

- $53 T ESG Assets AUM estimated by 2025, 1/3 of all assets

- Demand for new products and from new segments

- Democratization of access and manufacturing

- Distribution by Digital channels and embedded finance

Visual Summary by thoth.art

microPensions: The New $15 Trillion Opportunity

Speakers/Participants

- Dr David Tuesta Former Minister of Finance, Peru

- Kamal Quadir Founder & CEO bKash Limited

- Srinivas Jain Executive Director SBI Funds Management

- Mary Ellen Iskenderian President & CEO Women’s World Banking

- Parul Seth Khanna Co-founder & Director pinBox Solutions

Notes

- Plenty of experiments by the regulator

- Bangladesh has universal ID

- 99% are doing digital KYC

- 65 million people from bCash are already used insurance products

- 30% of the access is by women

- SBI group has 480 million customers

- Education at the last mile

- Work with tech partners who can take us to the last mile

- Investack

- All FinTechs can take SBI stack and make it easier

- 60 SBI’s FinTech partners using the API solution

- Make insurance easily bundled in to whatsapp and make transaction easy

- 10 million savers with as minimum sa 100 INR in a month

- chota save - it never took off as there was too much of operational cost

- today it is history

- friction has disappeared

- Digital micropensions will make

- The day you start savings - that’s when you come out of poverty

- Trust is based on how the system is built - It includes regulatory bodies, tech and all other components

- Unorganized sector - partnering with fintech

- Use the frontend infra - whatsapp

- Build journeys with fintech partners along with state government bodies

Visual Summary by thoth.art

Supercharging the Insurance & Pensions Industry: The Urgent Case for AI

Speakers/Participants

- George Kesselman

- ZhongAn Tech

- Gautam Bhardwaj

- Lee Sarkin

- Dr Mara Balestrini

Notes

- B2B companies reinsuring the insurers

- pensionTech helping govts and companies to expand pension coverage across dozen countries

- Use cases of AI

- Customer experience has a long way to go. The main pain point is the customer onboarding. Fairly invasive data has to be provided to insurers. With the rise of range of software applications, rule driven insurers

- Built up an eco system of data

- Easing the onboarding journey - Issue a policy without further manual underwriting. Underwriting decision is faster

- Risks in using AI for underwriting - No model is perfect.

- What is the model error ? What does it mean for increased future claim ?

- Regulator and Responsible AI

- Pensions land scape

- Most pension schemes were defined benefit.

- World is moving to defined contributions

- Decisions

- when to start

- when to reallocate

- what to invest in ?

- what portfolio to invest ?

- How do you get people to make effective decision ?

- Use tech to do behavioral nudges

- How likely a person to afford good savings ?

- Long term savings behavior - models can be used

- Income interruption during emergency

- Income smoothing loan based on savings behavior

- Nudges

- Automate indexation

- Munich RE

- Earlier stages of the evolution of AI

- Lot more stuff happening in insurance market

- Cyber insurance - top startups

- More tactical to grow penetration - Asian market

- How to bring insurance to the people ?

- Cyber is not the top need in insurance for the markets in Asia

- Why do we need responsible AI ?

- Unintended consequences of using models

- Person put in various categories of risk - If model predicts bad risk but actually good risk

- Responsibility to all stakeholders

- Building the model is also responsible AI

- What is the rigor needed to build a model in the insurance space?

- Create lifecycle products

- Biases

- Regulation has been relaxed as there has been no adverse event in the insurance space

- Less worried about explainability - Area to be cautious is to be on the model

developer before the model is going to production.

- Real time scoring at the point of scale

- Cloud technology

- If you don’t have ML Ops team that can be deployed and maintained on time

- Taking care of scale

- People moving out of sandbox in to production is the key risk

- Biggest obstacles

- Data used for modeling are fairly high level and sitting in silos. Clean enough data is a challenge

- Talent - Most of the people are coming from actuarial background or outside of insurance

- Technology - Need to have a different level of infra to scale it

- Use of AI in underwriting

- Data exists

- Rules engine

- But deep domain knowledge is needed to build good models

- Someone signs off the model

- ML Ops tech - most companies are not there. Risk management to retrain models in production.

- Domain knowledge is a fundamental problem

- We need to have data scientists to have domain knowledge

- Pensions is a longest contract

- Since you need a constant hand-holding, you can make nudges more automated

- Constant interactions can be automated

Visual Summary by thoth.art

A Stocktake – Has AI Failed to Deliver in Banking?

Speakers/Participants

- Manohar Chadalavada

- Dong Shou

- Charmaine Wong

- Lee Joon-Seong

Notes

- HSBC

- Use cases that have been implemented

- Fraud

- predictive diagnostics for tech infra upgrades

- wealth management platform provides recommendation

- faster decision for loans

- NLP and Speech recognition used in building capabilities and services in the Asian countries

- Data quality issues have been improved

- Satellite images deforestation changes - ESG space

- Use cases that have been implemented

- SCB - Six themes that are being used for AI

- Effective risk management

- top line growth from existing customers

- service customers better

- new business models - partnerships - embedded finance

- internal decision making - better forecasting, capacity planning

- traditional operational efficiency

- RPA Models have been implemented in banks. However slightly more complex AI models have not taken off

- Maturity of AI applications is way off

- Challenges - HSBC

- Data

- Manage risks around the data, data governance, bias

- Talent

- Regulatory compliance across jurisdictions

- Balanced adoption

- Data

- Challenges - SCB

- Not enough data

- Lack of trustworthiness

- Talent constraints

- Lack of scalable infra

- Sponsorship to scale POC projects

- Lack of bureau data for most customers in ASEAN countries such as Indonesia

- Alternative Data for Scoring - ADS for credit scoring

- Invisible women - book recommendation

- Challenge in making third party fin tech providers in adopting responsible AI

- lack of mechanisms to identify model risk

- Usage of AI for consumer credit is nascent. Corporate credit is still under discussion

Visual Summary by thoth.art

Stablecoins: The Future that is your Money

Speakers/Participants

- Richmond Teo Co-founder Paxos/BUSD

- Changpeng Zhao Founder & CEO Binance

- Jo Yeo Head, Payments Development & Data Connectivity

Notes

This session has panelists discuss stablecoins and various aspects relating to the cryptocurrency market. The following are some of the points mentioned:

- Marketing pitch on BUSD

- Consumer protection is going to be very important

- It is built right in to BUSD

- Reserves are backed and fully transparent

- Aims to garner greater trust in retail users

- Our larger unregulated competitors have shrunk in size

- Retail cares more about safety and it is of prime importance to the design of the BUSD

- More interest in financial services to use stable coin as a settlement

- BUSD capture retail and corporate use

- Do we need to many stable coins?

- Yes, we need many more coins as there are a ton of use cases that merely a few coins isn’t enough

- binance coin not competing with BUSD

- What next in the stable coin space ?

- We don’t have singapore dollar stable coin. Paxos might want to launch a Singapore based stable coin

- Recent issue on the auto conversion - BUSD. CZ defends it by saying:

- It was done mainly to reduce the varying stable coin pairs that were sucking up liquidity

- By having the auto conversion feature, the presence of one liquidity pool

- retail investors do not have to use different pools

- much simpler user experience

- Stable coins are becoming mainstream, what regulation needs to be made ?

- BUSD - show me the money

- regulators can come in and enforce transparency and consistency

- knowledge consistency

- every one may or might not be aware of what is meant by a backed up reserves

- bankruptcy remote

- What should regulators pay attention to ?

- Audits in reserves

- Show me the money - good attitude

- Retail restriction to crypto

- HK opened up to retail crypto

- India has high tax on crypto transactions and might kill the industry

- Japan is reversing its stance of crypto and taking a more open stance

- There are jurisdictions where Cryptocurrency trading platform providers can deduct money from traditional bank automatically

- How do retail learn by doing ?

- Allocate less than 0.1% of your networth for retail users

- Don’t have too much exposure to crypto - learn about the transaction costs

- Check out Binance education academy whose online material is used by some of the governments to educate its citizens on cryptocurrencies

- Paxos founder advice - Learn everything but everything will be obsolete. Learn it anyway

- Will stablecoins coexist with CDBC ?

- there are fundamental differences between CBDC, stablecoins, and crytocurrencies

- CDBC unlimited supply + permissioned - lot of approval

- Native crytocurrencies - limited supply - very different cases

- Analogy of New Internet service providers will not erase other old internet provider companies

- Security

- Sustainability

- Transparency

- Collaborative with all entities

- Looking forward

- Lot of things are built in crypto winters

- stablecoins will become regular place

- building infrastructure

- building right partnerships and branding

- CZ says he would love to see binance to get more retail access in Singapore

Visual Summary by thoth.art

A Case for a Web 3.0 Impact: Tokenising Multi-billion Dollar Influencer Market – Brought to you by XelebX

Speakers/Participants

- Katherine Ng Managing Director TZ APAC

- Karolina Bielawska Miss World 2021

- Calvin Cheng Co-founder XelebX

Notes

- Influencers not able to monetize their interactions

- 200 Million are users out 4 Billion users

- Celebs can reach out directly to the fans

- collect money for funds

- raise money for charities

- people want to support contestants

- Football fan tokens

- CelebX platform

- Nike NFT of sneakers has raised millions of dollars

- Creator tokenization

- charities

- Money you are donating goes straight to the charity

- 35 events around the festival

- tokens to pay chat

- see live stream

- having a chat of 10 people

- tips to young girls to get in to contest

- couple of people and travel across the world

- Entertainment events

- Tokenized assets

- Voting based on tokens

- great way to vote

- Entertainment, arts, media can be a great way to make crypto go main stream

- More projects that marry web2 tech distribution and web3

- people comment a lot of stuff on contestants

- how to incentivize participants

- bet using prediction markets

- gamified experience for fans

Visual Summary by thoth.art

Welcome to SFF 2022: 8 Global Web3 Insights

Speakers/Participants

- Tascha Che

Notes

- Core benefit on Web 3.0 is not cheaper transaction.

- Adoption rate is not correlated to GDP per capital

- Digital property right and Digital human rights

- Ownership - Leveraging technology to give ownership to the people

- Lowering the cost of ownership

- Participatory and scalable c=op ownership

- Web 3.0 applications will be completely composible

- Active users dropped by only a bit

- Web 3.0 are quite resilient to shocks

- DeFi and NFTs are two important activities of Web 3.0

- Number of active wallets and transactions on NFT platforms has been growing

- Digital art is the only use case that has taken

- Web 3.0 is moving from the hype

- Customer rewards

- Tokenized creator

- Interoperatbel social media

- Tokenization

- Tokenization is the super fuel of the Web 3.0 economy

- Tokenization combine with

- PoS Eth has reduced carbon footprint

- Entire global economy on Blockchain

- Web 3.0 adoption is similar to the internet’s early days

Visual Summary by thoth.art

Satoshi’s Inspiration

Speakers/Participants

- Dr.Stuart Haber

Notes

- Satoshi’s paper was based on 1995

- 1989 Bellcore - Bell labs communications research

- Researcher in cryptography

- Threza Imanishi Kari

- Accused of changing the experimental data

- Physical records vs Digital records

- How to time-stamp a digital document ?

- Long term integrity of all the records

- One way hash function - finger print of a document - a good metaphor

- Fingerprint is a characteristic of the file

- Fingerprint is unique to the file

- Built a Merkle tree based on the set of fingerprints of a set of documents

- The longest running Blockchain started in 1995

- Genesis block of Surety 1991 Oct

- human social legal - context is all

- DAO are hyped

- Smart contracts - many vulnerabilities

- Lot of hard work to be done in the area of smart contracts

- Science has a nasty photoshopping problem

Visual Summary by thoth.art

The Network State

Speakers/Participants

- Balaji Srinivasan

Notes

- Can we start new countries ?

- Starting new countries is possible, preferable and profitable

- Most countries 38 are less than a million size

- 67 countries are from 1-10M people

- 74 countries are from 10-100M

- 14 countries are 100M+

- FiatMarketCap

- Crypto countries rank with fiat countries

- Auditable oracle for network state

- Why is it preferable ?

- powerless people now have an alternative to failed states

- ambitious people nowhere an alternative in frontier societies

- Why is it profitable ?

- ARPU

Visual Summary by thoth.art

The Arc of Blockchain: A Q&A

Speakers/Participants

- Balaji Srinivasan

- Dr Stuart Haber

- Staci Warden

Notes

- CEO of algorand - Staci Warden

- Crypto techniques that makes sure that information does not change as well as the privacy

- NYTimes publishes the longest running Blockchain chain hash every Sunday

- There are crypto analytic algos that run considerably faster

- can break public and private key

- NIST currently running competition to come up with post quantum

- Underlying security is still difficult to crack with quantum computers

- Regulators are monopoly - what can do ?

- Innovate in cryptocurrencies - cooperate with regulators

- Push back against the book

- Where is the military ?

- Reduce the need for violence

- Three years

- Integrity and transparency of records

- Transparency of records with certain properties

- health records for a patient available

- regular practice of a scientist to write data to a Blockchain

- extended version - identify deep fakes

- solve photoshopping of the data

- Web 3.0 new way of backend

- decentralized version of everything

- code and data time stamped on Blockchain

- citations on Blockchain

- decentralized posts on Blockchain

- Blockchain frontier on the OS system on phones

- Financial aspect does no go away

- Applications start to get deeper

Reflections

Visual Summary by thoth.art

Effective Policies for Crypto Assets

Speakers/Participants

- Sigal Mandelker

- Diogo Mónica

- Timothy Adams

Notes

- Should policy makers retrofit ?

- 200 million telegrams were sent in 1930

- Harvey test , Orange Grove test - same test that is used whether something is or not a security

- area codes based on density of the place

- rotory phones

- we have to fundamentally understand the attributes of crypto

- US - No single regulator - talk to all regulators

- Anchorage Digital

- Federal chartered bank

- Clear box

- Clear expectations

- Voluntarily go to the regulator and put one selves in a box

- Govt experiencing with various technologies

- experience with Polygon and Aave

- what happens when there are no centralized parties

- MAS is looking at various initiatives

- We are asking regulators to be consistency across several aspects in crypto space

- Private sector wants clarity and permanency - we have to give it up as regulators gets to grip with dynamic aspects of the sector

- Programtically create

- We are going to see real solutions to systemic problems in the traditional finance

- All docs are sitting in silos

- Develop privacy preserving tools - meeting the current regulatory constraints

- Crypto native solutions in the Blockchain that makes sure that you stick to the regulation

- What should be a partnership look like ?

- US regulator cannot have crypto if you want to regulate or have new rules

- Big problem

- Regulator has a bank account and still regulate financial institutions

- Doesn’t make sense that regulator cannot experiment with technologies

- Have real public private sector collaboration

Visual Summary by thoth.art

Crypto Assets Built to Last*

Speakers/Participants

- Jeremy Allaire

- He Dong

Notes

- Started Circle in 2013

- How do you put Crypto winter in historical perspective

- Arc and development of the Internet

- Many and many different tech cycles have come in

- Periods of capital investment and risk taking

- New infrastructure layer

- whole new apps on trust that was missing on internet

- It is an exciting time and liken it to a dot com bubble

- Infrastructure happening with public Blockchains

- Policy debates happening is at a great space

- What kind of cryptos will survive ?

- Early 2000s - intense competition to create mobile os and mobile phones. Eventually those OS narrowed down to a few

- User experience finally worked

- Many competing Blockchain infrastructures and each has a digital

- I don’t think there will be 20 different Blockchains

- There will be 4 or 5 Blockchain

- There will be Crypto Superapps

- Superapps that billions are using on Blockchain

- Value, Trust

- What is the value behind cryptos ? Is there intrinsic value ?

- It is because of tech innovations

- Real legacy of crypto

- Public Blockchains are a new kind of OS layer of the internet. They are incentivized. These are global public good that no government is responsible for

- These global public goods are designed to allowed people to have tamper resistant data

- tamper resistant code

- layer to the society that is really profound

- digital commodities that are deflationary

- digital commodities - non govt money will grow and will create incentives for society to operate

- Build other protocols for social, protocol to transact fiat currency

- asset backed or asset referenced crypto currency based

- Future - we will see a rapid proliferation of stable coins as particular form of fiat money rails

- With these networks, there is programmability

- intermediate time value of money - all building blocks of economic activity

- More primitives of financial industry will get expressed as digital tokens and operated through the digital network

- global , inter operable, accessible, efficient

- Modern Finance - Trust. How do service providers do to enable trust ?

- Historically regulation of financial systems have been built on tight controls

- Streaming radio banned example

- Streaming voice calls

- Regulatory frameworks break down

- Open financial system

- Policy makers need to recalibrate

- Markets are running in code

- We need to be able to rules around custody, obligations

- Social contract around the ability to know individuals

- Privacy, Security and Individual freedom - Policy

- Market structures that are primarily running in code

- Auditing

- Testing

- Review

- Higher transparency around the projects

- People will route around the regulation that prohibits non govt money

- we are starting to see govt preferences to a certain type of crypto tokens

- CBDC

- Open internet, Open source innovation coexists with private banking

- Pattern will also

- 95% of the money will be in private markets. 5% of the money in public markets

- Strong desire to upgrade the infra to inc

- privately issued crytocurrencies will dominate

Visual Summary by thoth.art

Beyond Bitcoin: The Future of Decentralised Finance and Digital Assets

Speakers/Participants

- Adrienne A. Harris

- Sheila Bair

- Rabi Sankar Tavarna

- Dushyant “D” Shahrawat

Notes

- Highly intermediated system with high levels of leverage

- DLT could be a solution - decentralize risk with good governance

- Traditional regulation is focused on intermediaries

- Since the essential feature of crypto is to remove intermediaries, the older techniques do not work

- Products cannot be clearly defined - they don’t answer to the traditional questions

- In the absence of intermediaries, the cost of transactions could come down

- We will have to basically unlearn the stuff from the past 2 decades

- India is using Blockchain in the CDBC space

- NY regulations on the crypto space can serve as a poster child for other federal states

- Is it Software ? It falls out of the jurisdiction

- Tokenization - How to regulate that go beyond cryptocurrencies

- Move towards more efficiency

- So far Blockchain doesn’t look promising at scale

- Longer term framework on Tokenization

- Indian Digital Rupee

- Digital currency as much as replica as physical rupee

- Not looking to make it a central bank as liability

- CBDC that is exactly like cash

- No interest on CBDC

- We do not know the behavior of the people when they start

- Do not want to introduce wholesale

- We do not want the banking system in phases

- Small pilots

- Expand the scope

- Distinction whether capital account convertibility

- Stable coins linked to dollar not permitted

- Dichotomy in the way you deal with capital account

- Economic rationale of stable coins

- Can use CBDC along with stable coin

- No algorithmically backed stable coin approved by DFS New York

- How regulators think about space?

- Regulators are looking very closely at the technology. But regulators will want to add a bit of caution. Word of caution. But they are excited about technology

- Never surprise your regulator

- Proof of value - Sandbox approach

Visual Summary by thoth.art

The Next 10 Years: Building the Crypto Economy, Scaling Web3 Innovation, and Weathering Storms*

Speakers/Participants

- Brian Armstrong

- Sopnendu Mohanty

Notes

- 100 million users in coinbase

- Tool for economic freedom

- Three phases

- New asset class

- Financial services

- Technology and not related to finance

- 50% of the investors are not about speculation

- Vitally important for retailers to do crypto

- What are the top 3 things ?

- Centralized exchanges - treated equally with other financial regulation

- Software wallets

- Decentralized protocols - never taking custody of funds. They can’t be treated as a financial service

- Regulators should not control DeFi protocols

- Golden age of software innovation

- People who have generated wealth are reinvesting in hard sciences

- Longevity research

- Science and tech is the best way to change the world

- Starting tech companies

- Journey as a founder

- Resilience

Visual Summary by thoth.art

Building Inclusive Infrastructures and Solutions

Speakers/Participants

- Angel Zhao

- Cecilia Skingsley

- Anubrata Biswas

- Katsunori Tanizaki

- Smita Aggarwal

Notes

- Role of central banks in creating public digital infrastructures

- Heart at Fiat money systems

- So many promising technologies

- Building infrastructures that are open

- Alipay covers one billion users. Mom and pop stores accept alipay

- Instead of building a superapp, give out the technology out to others in the other jurisdictions

- 2.5 million merchants via alipay plus

- How airtel has created a successful model ?

- 2013-2018 - billion people got biometric identities , bank account and mobile phone

- UPI payment protocol

- Possible for private players to create solutions - low cost to serve at scale

- 50 million consumers monthly, 27 billion usd

- data wave - next 10 years similar to digital wave that has taken place in the last 10 years

- Ant group and bKash initiative

- Common QR code giving Covid grants

- Airtel 8 billion transactions annually

- Score it and put it in the public private network

- Monetary science fiction

- Nexus - taking all 60+ instant payment settlement systems in to the engine that makes instant payments across countries

- CBDC is important

- Maintaining public trust in fiat currency

- Efficiency - Cash has been an anchor when consumers and merchants pay

- Inclusion - Being the payment provider of default

- Resilience of the payment system

- Some countries will go the CDBC while other won’t

- Wholesale CDBC could be the next possible generation of money facilitating cross border payments

- Innovation that creates the max impact

- Borderless payments

- Data ownership and structures around it , Large amount of second order innovations

Reflections

Visual Summary by thoth.art

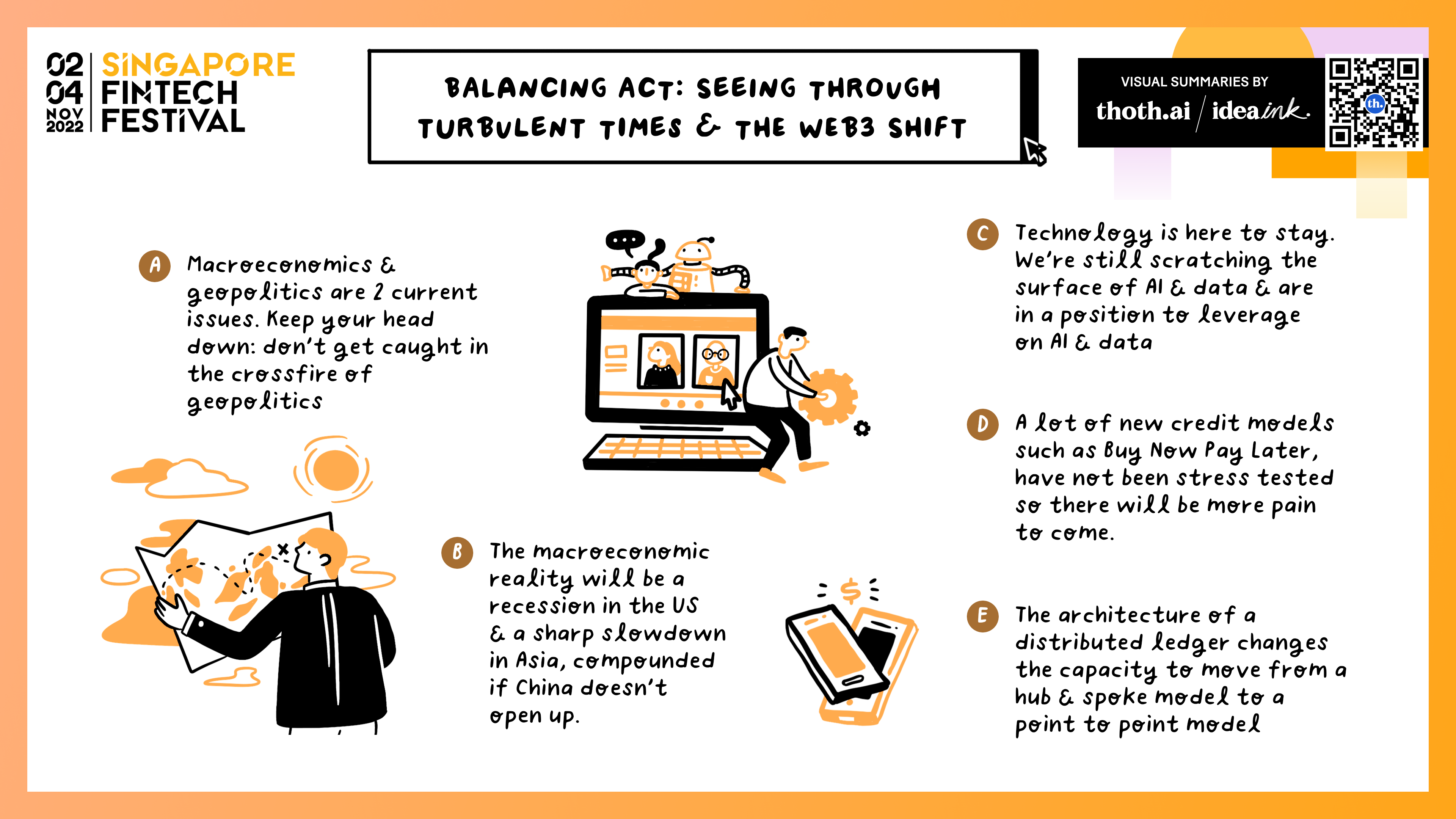

Balancing Act : Seeing through turbulent times and the Web3 shift

Speakers/Participants

- Tan Sri Tony Fernandes

- Piyush Gupta

- Vijay Shekhar Sharma

- Tanvir Gill

Notes

- Air Asia challenge 205 flights in air

- Big Pay

- Ride hailing

- Remittances

- Built some of the new businesses

- Banks are at an advantage with the interest rate rising

- DBS is focusing on AI and data to leverage across various services

- Architecture of DLT is gamechanging

- back office can be transformational

- value transfer

- public money - CBDC, Intermediated (stable coin), private value transfer

- state backed vs non state backed world

- central banks , regulators will not give up

- Tech is immensely powerful

- stable coin

- digitize

- purpose bound money

- ubin - P2P atomic settlement

- Digitizing fiat currencies

- Public vs Quasi public

- Will private money replace public money ? No

- Quasi public money

- Use case of Retail CBDC is very weak

- Cross border space

- UPI is already there? Why Blockchain ?

Visual Summary by thoth.art

Takeaways

- Deriving meaningful analytics and building models in the ESG space is plagued with data issues. The data issues cannot be solved by one single company. To force companies to report the emission data in a way that is not misrepresented, is a big problem cannot be addressed by one single company. This means that whatever AI or ML models that are being built by various teams around the world are going to be faulty, or at worse, specifically targeted towards achieving a certain narrow agenda

- Despite the massive net flows that one is seeing in ESG related assets, the verdict is still open. May be funds are using ESG as price segmentation strategy and nothing else

- Governments all over the world are experimenting with retail and wholesale CBDCs and want to squash stable coins and other cryptocurrencies. Everyone feels that all these coins can coexist together but will they really?

- Developing financial solutions on Solana or Polygon is worth looking in to

- Instead of merely speculating on whether a specific tech stack is going to work or not, it is better to get your hands dirty and create solutions that might or might not succeed. It is a better way to get engaged in the crypto space

- Derivate volumes on cryptocurrencies are nascent but are expected to go up in the years to come

- Purpose bound money demoed by MAS looks very promising.

- Banks will come out very strong in this high interest rate regime and will be able to invest in people, processes and technology than many other firms who will slow down

- Betting one’s career on ESG might be appealing in the short term, but does it really make any sense when all the activity is more or less politically driven, propaganda driven

- Founders peak - most of the speakers emphasized on the importance of having a long term mindset.

- On the one hand MAS is against speculation and risky activities relating to crypto space, while giving out fund management licenses to companies like Hashkey capital. Is there a disconnect ?

- Space for data providers to act as oracles in AMMs built using Blockchain and Web 3.0 concepts

- DeFi is still in a rudimentary phase with many of the algos such as AMM very rough in its implementation

- Tokenization is and will be one of the biggest usecases around which there will be interesting developments

- Water, Metal, Fire, Wood and Earth - a great analogy for FinTech elements