NIFTY Returns Basic Number Crunching

Purpose : Look at NIFTY returns and Slice and dice to get a rough

idea of returns over many years

> library(xts)

> nifty <- read.csv("C:/Cauldron/Benchmark/Interns/nifty.csv",

+ header = T, stringsAsFactors = F)

> nifty$trade.date <- as.Date(nifty[, 1], format = "%d-%b-%y")

> nifty <- xts(nifty[, 2], nifty$trade.date) |

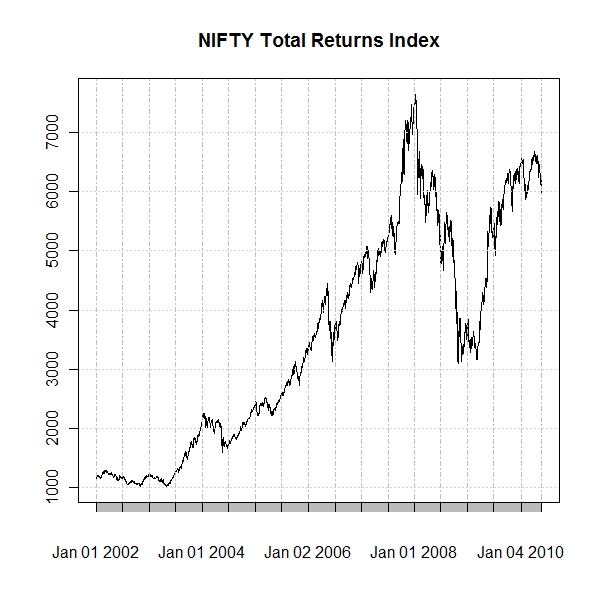

Plot Nifty Total Returns Indes

> plot(nifty, main = "NIFTY Total Returns Index") |

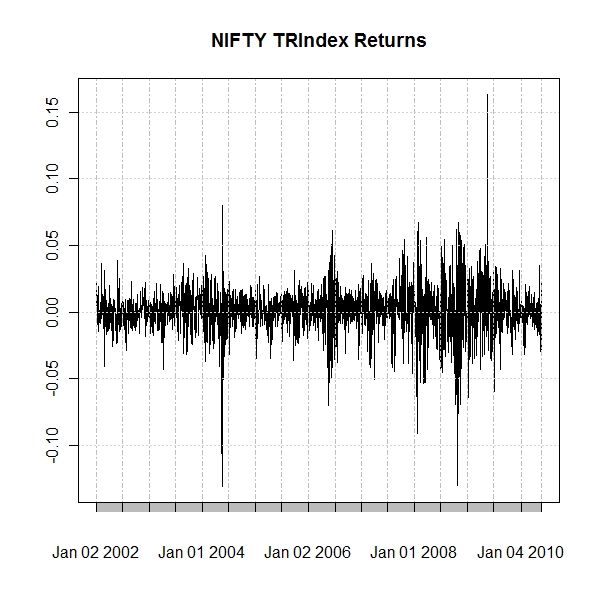

Plot NIFTY Total Ret Index - Daily returns

> nifty.ret <- as.xts(returns(nifty)[-1, ]) > plot(nifty.ret, main = "NIFTY TRIndex Returns", pch = 19, type = "l") |

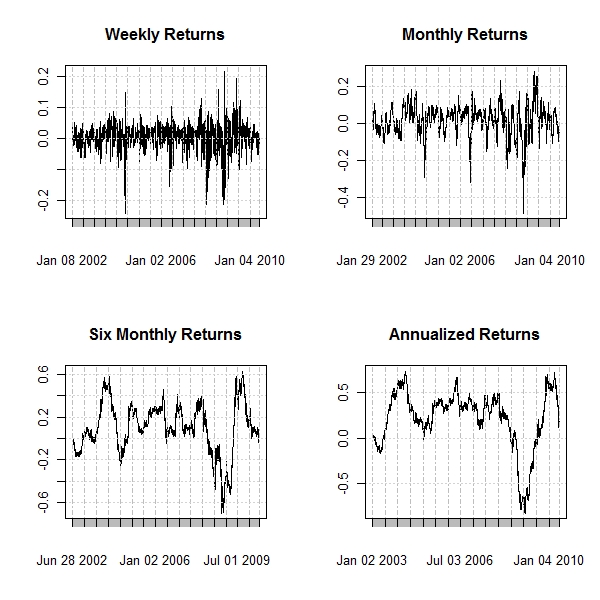

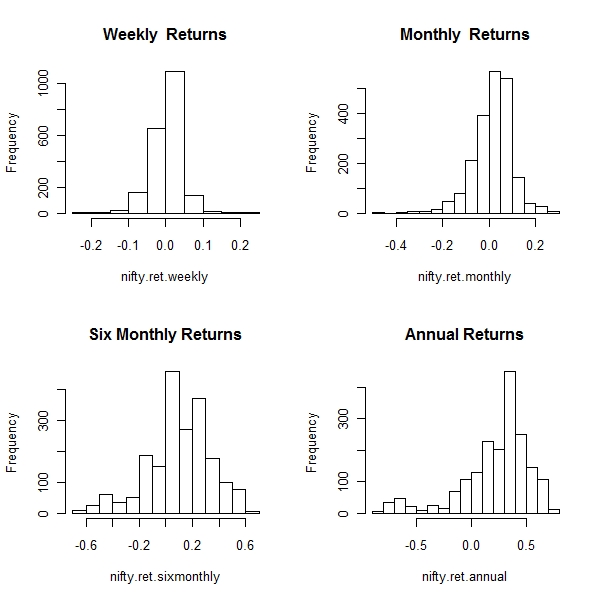

Prepare weekly, monthly, yearly, 2:10 yearly returns

> wid <- 5 > nifty.ret.weekly <- as.xts(rollapply(nifty.ret, width = wid, + sum, align = "right")) > wid <- 20 > nifty.ret.monthly <- as.xts(rollapply(nifty.ret, width = wid, + sum, align = "right")) > wid <- 125 > nifty.ret.sixmonthly <- as.xts(rollapply(nifty.ret, width = wid, + sum, align = "right")) > wid <- 252 > nifty.ret.annual <- as.xts(rollapply(nifty.ret, width = wid, + sum, align = "right")) > par(mfrow = c(2, 2)) > plot(nifty.ret.weekly, main = "Weekly Returns", pch = 19, type = "l") > plot(nifty.ret.monthly, main = "Monthly Returns", pch = 19, type = "l") > plot(nifty.ret.sixmonthly, main = "Six Monthly Returns", pch = 19, + type = "l") > plot(nifty.ret.annual, main = "Annualized Returns", pch = 19, + type = "l") |

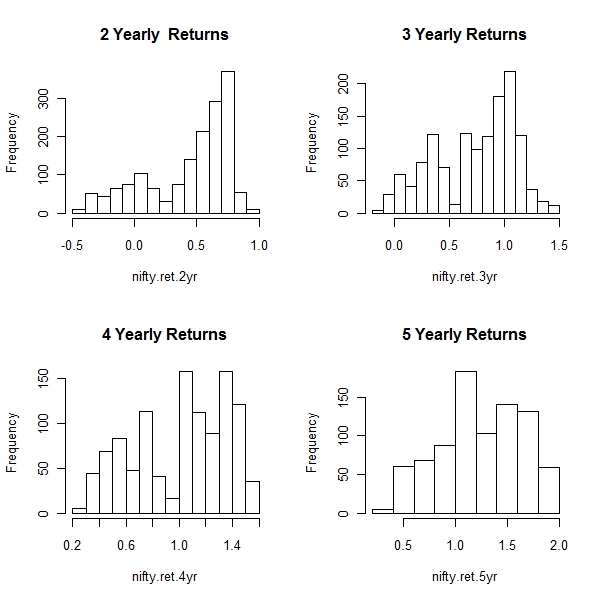

- The more the holding period , the higher the frequency of obtaining higher returns

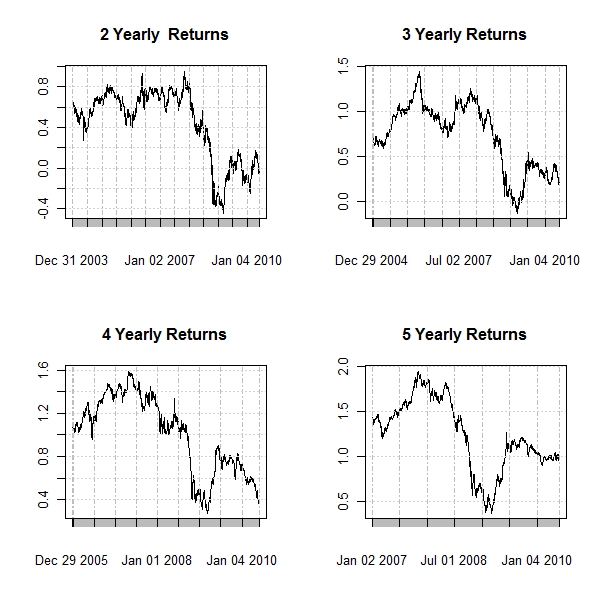

> wid <- 252 * 2 > nifty.ret.2yr <- as.xts(rollapply(nifty.ret, width = wid, sum, + align = "right")) > wid <- 252 * 3 > nifty.ret.3yr <- as.xts(rollapply(nifty.ret, width = wid, sum, + align = "right")) > wid <- 252 * 4 > nifty.ret.4yr <- as.xts(rollapply(nifty.ret, width = wid, sum, + align = "right")) > wid <- 252 * 5 > nifty.ret.5yr <- as.xts(rollapply(nifty.ret, width = wid, sum, + align = "right")) > par(mfrow = c(2, 2)) > plot(nifty.ret.2yr, main = "2 Yearly Returns", pch = 19, type = "l") > plot(nifty.ret.3yr, main = "3 Yearly Returns", pch = 19, type = "l") > plot(nifty.ret.4yr, main = "4 Yearly Returns", pch = 19, type = "l") > plot(nifty.ret.5yr, main = "5 Yearly Returns", pch = 19, type = "l") |

> par(mfrow = c(2, 2)) > hist(nifty.ret.weekly, main = "Weekly Returns") > hist(nifty.ret.monthly, main = "Monthly Returns") > hist(nifty.ret.sixmonthly, main = "Six Monthly Returns") > hist(nifty.ret.annual, main = "Annual Returns") |

> par(mfrow = c(2, 2)) > hist(nifty.ret.2yr, main = "2 Yearly Returns") > hist(nifty.ret.3yr, main = "3 Yearly Returns") > hist(nifty.ret.4yr, main = "4 Yearly Returns") > hist(nifty.ret.5yr, main = "5 Yearly Returns") |

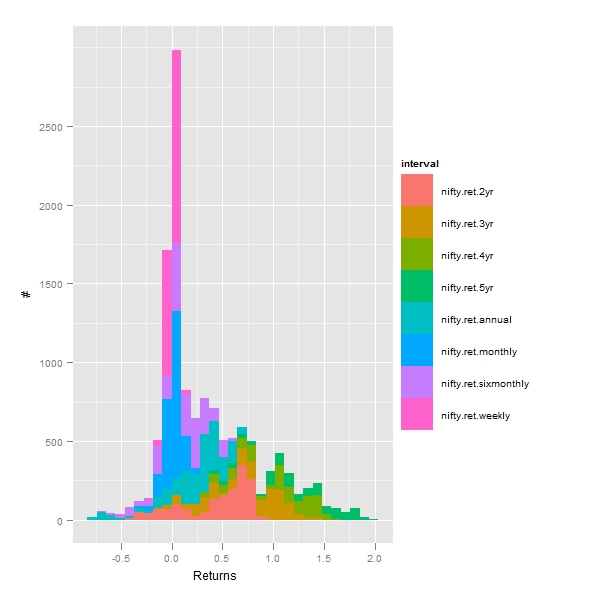

> library(ggplot2)

> z <- merge(nifty.ret.weekly, nifty.ret.monthly, nifty.ret.sixmonthly,

+ nifty.ret.annual, nifty.ret.2yr, nifty.ret.3yr, nifty.ret.4yr,

+ nifty.ret.5yr)

> z1 <- data.frame(coredata(z))

> z2 <- stack(z1)

> colnames(z2) <- c("returns", "interval")

> p <- ggplot(z2, aes(x = returns, fill = interval))

> q <- p + geom_histogram() + scale_x_continuous("Returns")

> q <- q + scale_y_continuous("#")

> print(q) |

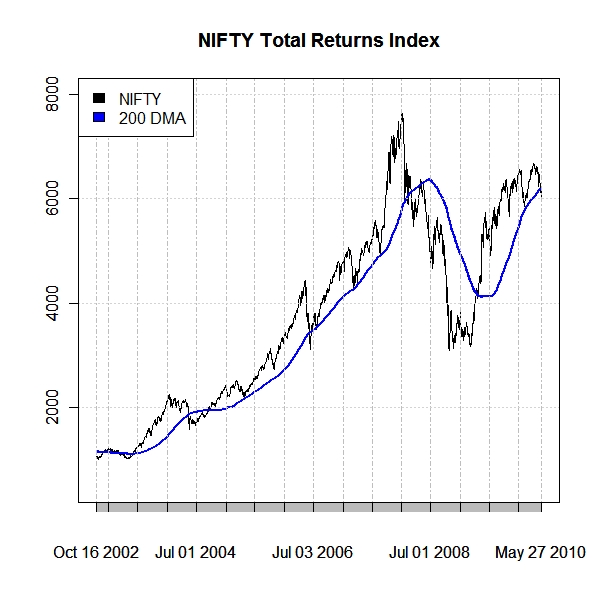

Comparison of 200 day Moving Average of NIFTY and NIFTY

> par(mfrow = c(1, 1))

> wid <- 200

> nifty.ma.200 <- as.xts(rollapply(nifty, width = wid, mean, align = "right"))

> temp <- merge(nifty, nifty.ma.200)

> temp <- temp[(!is.na(temp[, 2])), ]

> plot(temp[, 1], main = "NIFTY Total Returns Index", ylim = c(500,

+ 8000))

> par(new = T)

> plot(temp[, 2], main = "NIFTY Total Returns Index", ylim = c(500,

+ 8000), col = "blue", lwd = 2)

> legend("topleft", legend = c("NIFTY", "200 DMA"), fill = c("black",

+ "blue")) |