Concordance Discordance

Purpose

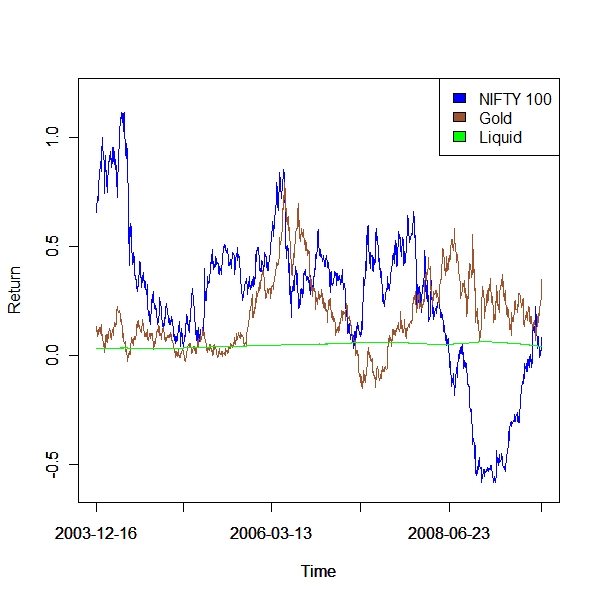

Use Concordance and Discordance to check for any meaning correlation between NIFTY , Gold and Liquid

> start.date <- "2003-01-01"

> end.date <- "2009-08-28"

> library(corpcor)

> library(mnormt)

> library(fields)

> library(fPortfolio)

> library(fPortfolioBacktest)

> library(PerformanceAnalytics)

> library(xts)

> annualized.returns <- function(x) {

+ n <- length(x)

+ (x[n] - x[1])/x[1]

+ }

> nifty.data <- read.csv("C:/Cauldron/Benchmark/PMS/Product/MF/nifty_mar_12.csv",

+ stringsAsFactors = FALSE, header = T)

> nifty.data$trade.date <- as.Date(nifty.data$Date, format = "%d-%m-%Y")

> gold.data <- read.csv("C:/Cauldron/Benchmark/PMS/Product/MF/gold_mar_10.csv",

+ stringsAsFactors = FALSE, header = T)

> gold.data$trade.date <- as.Date(gold.data$Date, format = "%d-%m-%Y")

> liquid.data <- read.csv("C:/Cauldron/Benchmark/PMS/Product/MF/liquid_april_22.csv",

+ stringsAsFactors = FALSE, header = T)

> liquid.data$trade.date <- as.Date(liquid.data$Date, format = "%d-%m-%Y")

> nifty.data$nifty.100 <- as.numeric(nifty.data$nifty.100)

> gold.data$gold <- as.numeric(gold.data$gold)

> liquid.data$liquid <- as.numeric(liquid.data$liquid)

> nifty.ts <- as.timeSeries(nifty.data$nifty.100, timeDate(nifty.data$trade.date))

> rownames(nifty.ts) <- nifty.data$trade.date

> colnames(nifty.ts) <- "nifty.100"

> gold.ts <- as.timeSeries(gold.data$gold, timeDate(gold.data$trade.date))

> rownames(gold.ts) <- gold.data$trade.date

> colnames(gold.ts) <- "gold"

> liquid.ts <- as.timeSeries(liquid.data$liquid, timeDate(liquid.data$trade.date))

> rownames(liquid.ts) <- liquid.data$trade.date

> colnames(liquid.ts) <- "liquid"

> rawdata <- merge(nifty.ts, gold.ts)

> rawdata <- na.locf(rawdata)

> workdata <- window(rawdata, start = start.date, end = end.date)

> dates <- as.Date(rownames(workdata))

> workdata.xts <- xts(workdata[, 1:2], dates)

> workdata.ret.roll.y <- cbind(rollapply(workdata.xts[, 1], width = 252, annualized.returns,

+ align = "right"), rollapply(workdata.xts[, 2], width = 252, annualized.returns,

+ align = "right"))

> colnames(workdata.ret.roll.y) <- c("Nifty100Ret", "GoldRet")

> workdata.ret.master <- workdata.ret.roll.y

> workdata.ret.master <- as.timeSeries(coredata(workdata.ret.master), timeDate(as.Date(index(workdata.ret.master))))

> dates.liquid <- as.Date(rownames(liquid.ts))

> liquiddata.xts <- xts(liquid.ts[, 1], dates.liquid)

> liquiddata.ret.roll.y <- rollapply(liquiddata.xts[, 1], width = 300, annualized.returns,

+ align = "right")

> colnames(liquiddata.ret.roll.y) <- c("Liquid")

> liqworkdata.ret.master <- liquiddata.ret.roll.y

> liqworkdata.ret.master <- as.timeSeries(coredata(liqworkdata.ret.master), timeDate(as.Date(index(liqworkdata.ret.master))))

> all.master <- merge(workdata.ret.master, liqworkdata.ret.master)

> all.master <- window(all.master, start = start.date, end = end.date)

> all.master <- all.master[(!is.na(all.master[, 1])), ]

> all.master <- all.master[(!is.na(all.master[, 2])), ]

> all.master <- all.master[(!is.na(all.master[, 3])), ]

> plot(all.master[, 1], ylim = c(-0.6, 1.2), col = "blue", ylab = "Return", lwd = 1.5)

> par(new = T)

> plot(all.master[, 2], ylim = c(-0.6, 1.2), col = "sienna", ylab = "", lwd = 1.5)

> par(new = T)

> plot(all.master[, 3], ylim = c(-0.6, 1.2), col = "green", ylab = "", lwd = 1.5)

> legend("topright", legend = c("NIFTY 100", "Gold", "Liquid"), fill = c("blue",

+ "sienna", "green")) |

Plain simple correlation

> cor(all.master)

Nifty100Ret GoldRet Liquid

Nifty100Ret 1.0000 -0.1321 -0.4214

GoldRet -0.1321 1.0000 0.2406

Liquid -0.4214 0.2406 1.0000 |

Test of Independence using Kendall’s metric

> n <- dim(all.master)[1]

> sqrt(9 * n/4) * abs(cor(coredata(all.master), method = "kendall"))

Nifty100Ret GoldRet Liquid

Nifty100Ret 57.00 5.980 11.287

GoldRet 5.98 57.000 6.955

Liquid 11.29 6.955 57.000 |

All pairs are dependent as each value is greater than 1.96

Test of Independence using Spearman metric

> n <- dim(all.master)[1]

> sqrt(n) * abs(cor(coredata(all.master), method = "spearman"))

Nifty100Ret GoldRet Liquid

Nifty100Ret 38.000 6.213 10.741

GoldRet 6.213 38.000 8.687

Liquid 10.741 8.687 38.000 |

All pairs are dependent as each value is greater than 1.96