The Lords of Easy Money - Book Review

Contents

This blogpost summarizes some of the main points from the book titled “The Lords of Easy Money”, by Christopher Leonard

I have found this book to be a fascinating read that exposes the working of a Fed without resorting to macro economic jargon. Typically one has to wade through a lot of macro economic terms and understand them, before one can begin to look at Fed. Not with this book. The author has pulled off a Micheal Lewis style narrative that intertwines the stories of specific individuals with the larger context of highlighting the workings of Fed. The characters come in and go out of the narrative in a manner that kept me glued to the book from start to finish.

In this blog post, I have tried summarizing the book in the form of a mindmap for each of the individual chapters

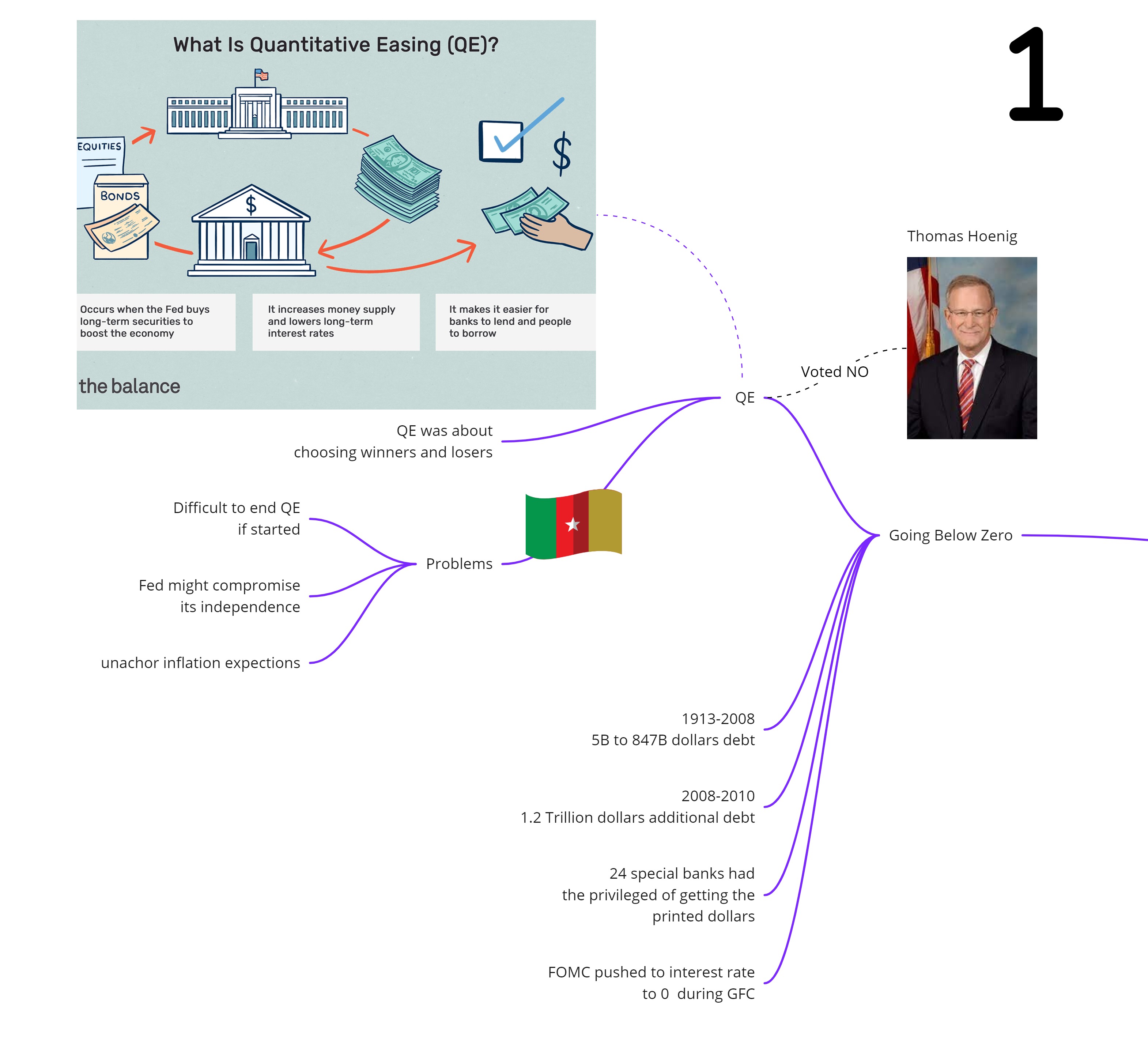

Going Below Zero

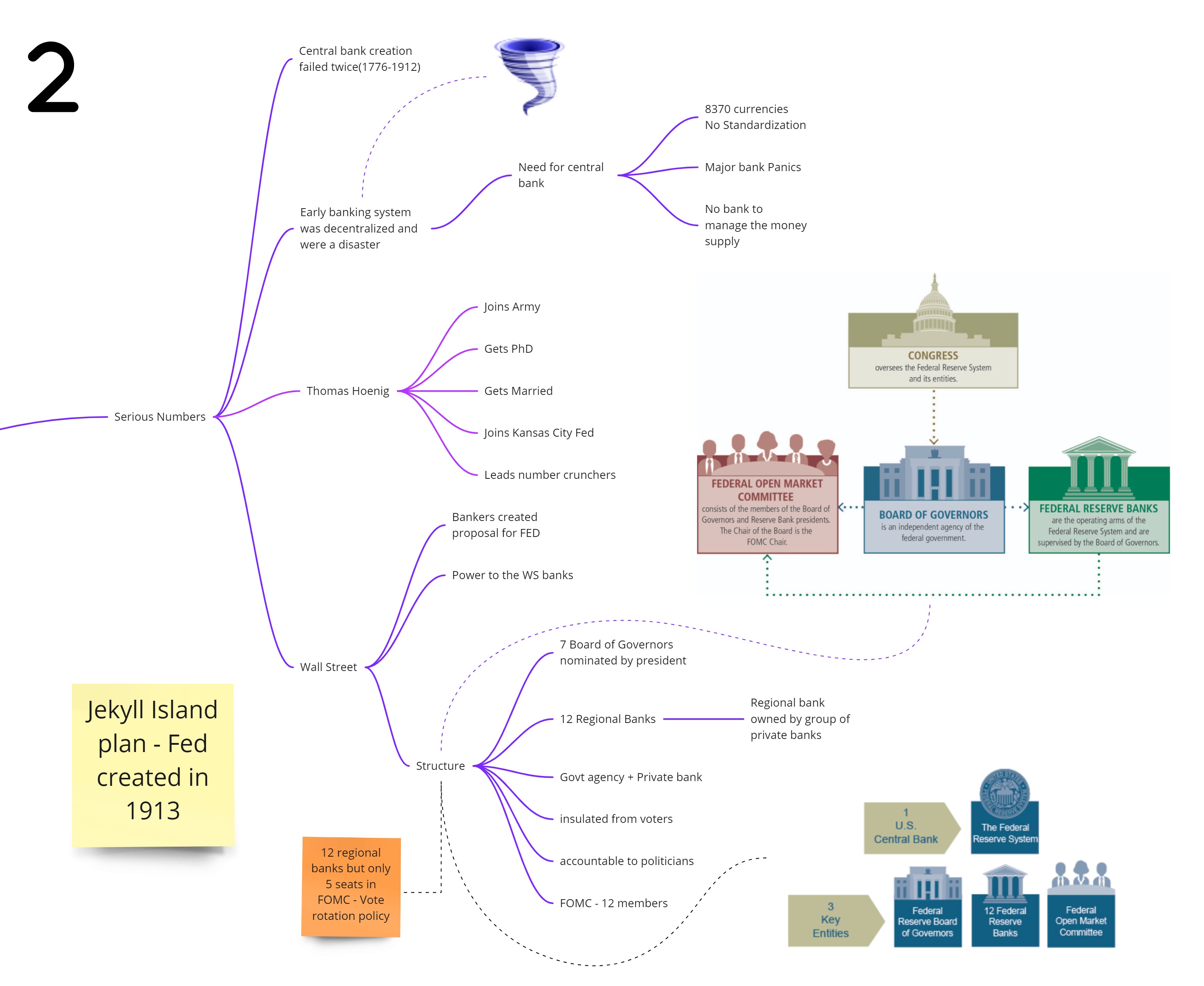

Serious Numbers

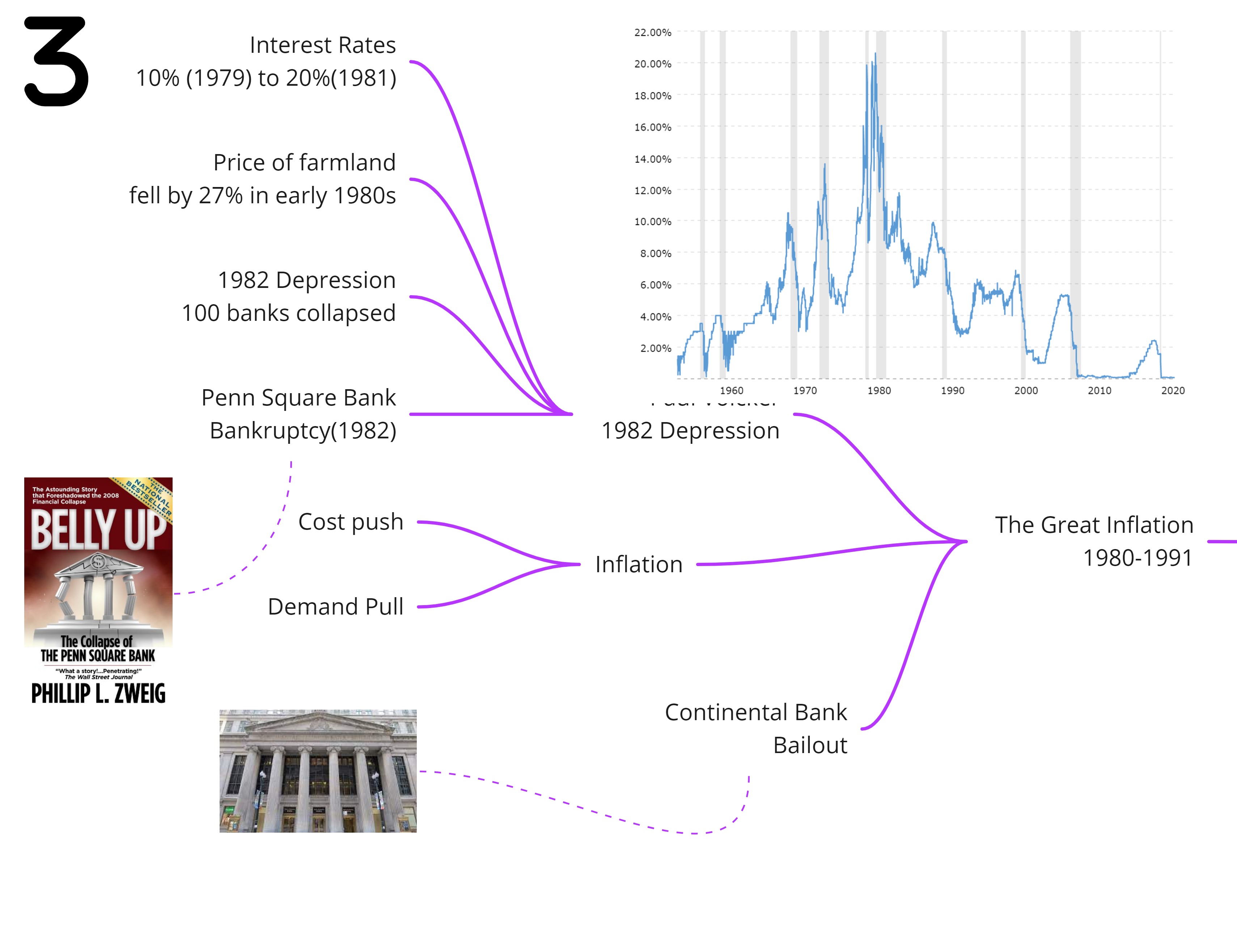

The Green Inflation(s)

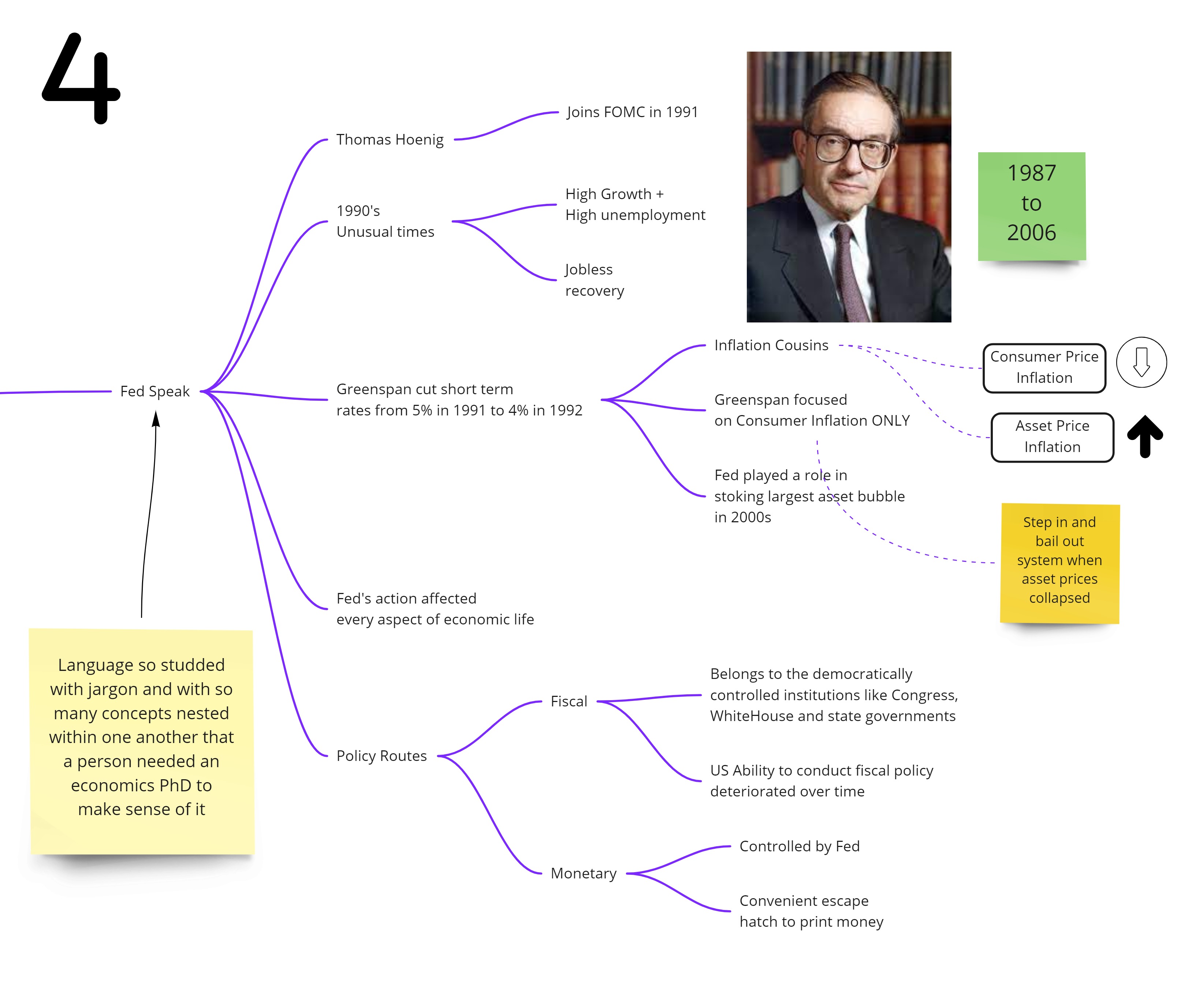

Fedspeak

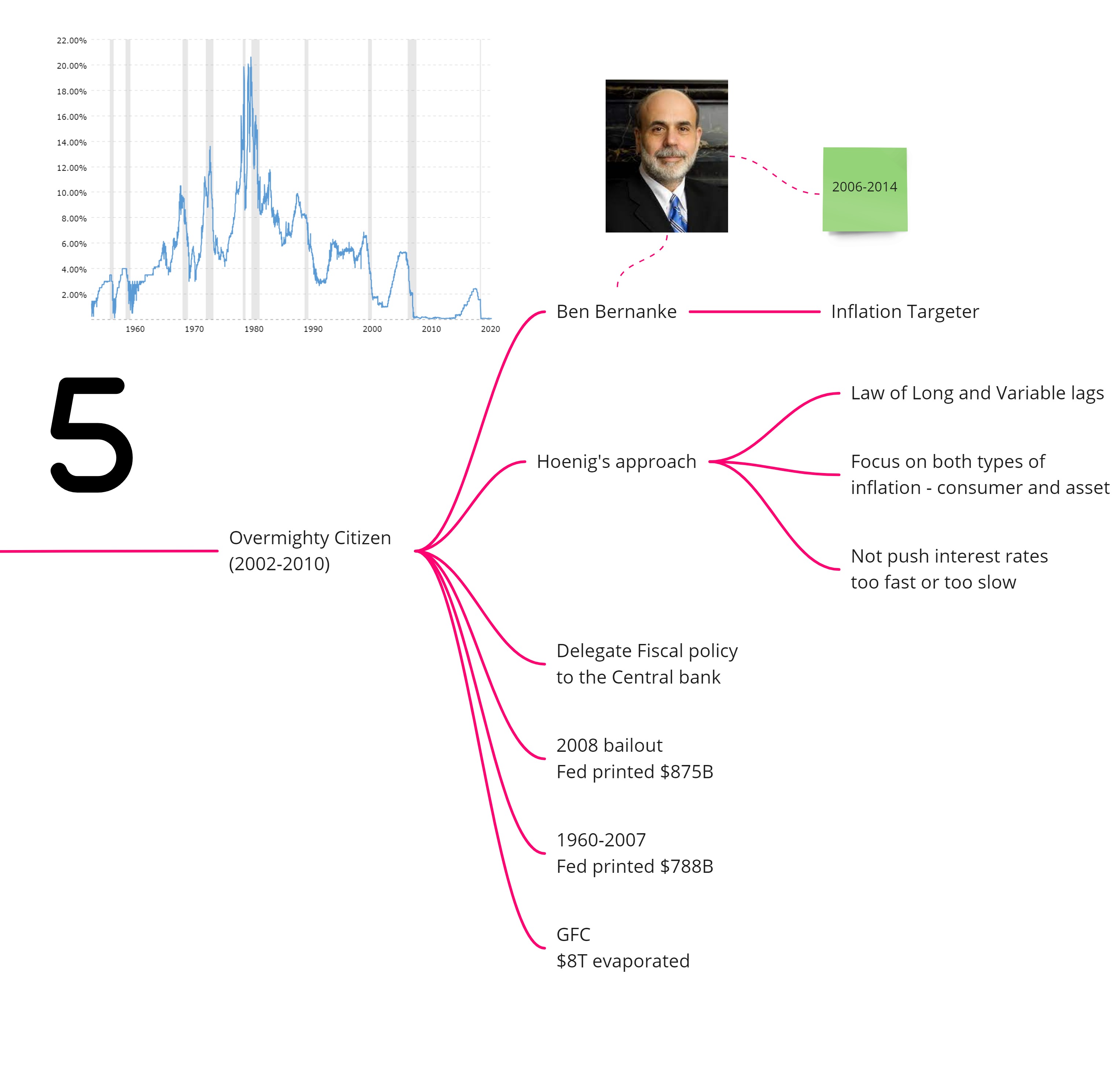

The Overmighty Citizen

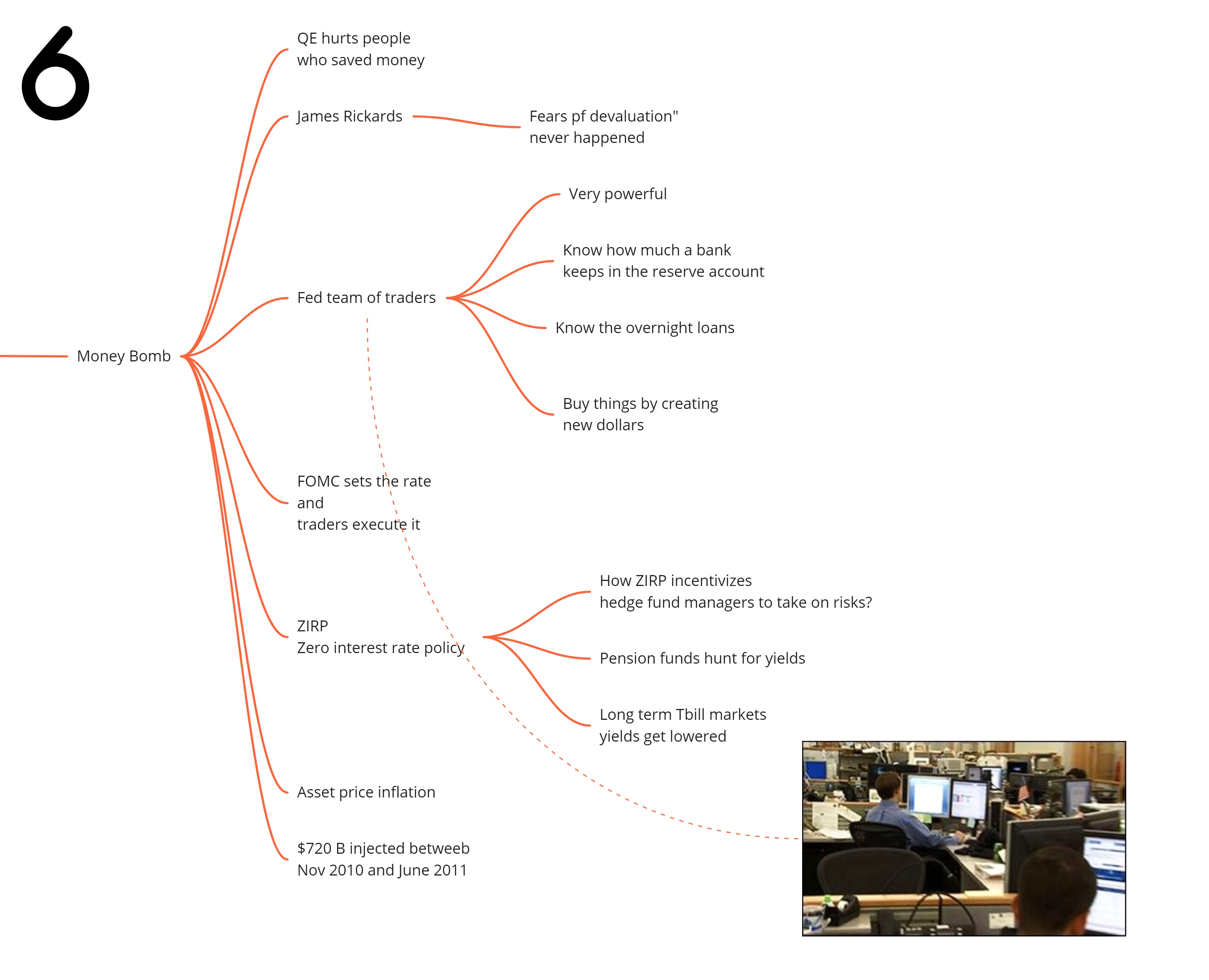

Money Bomb

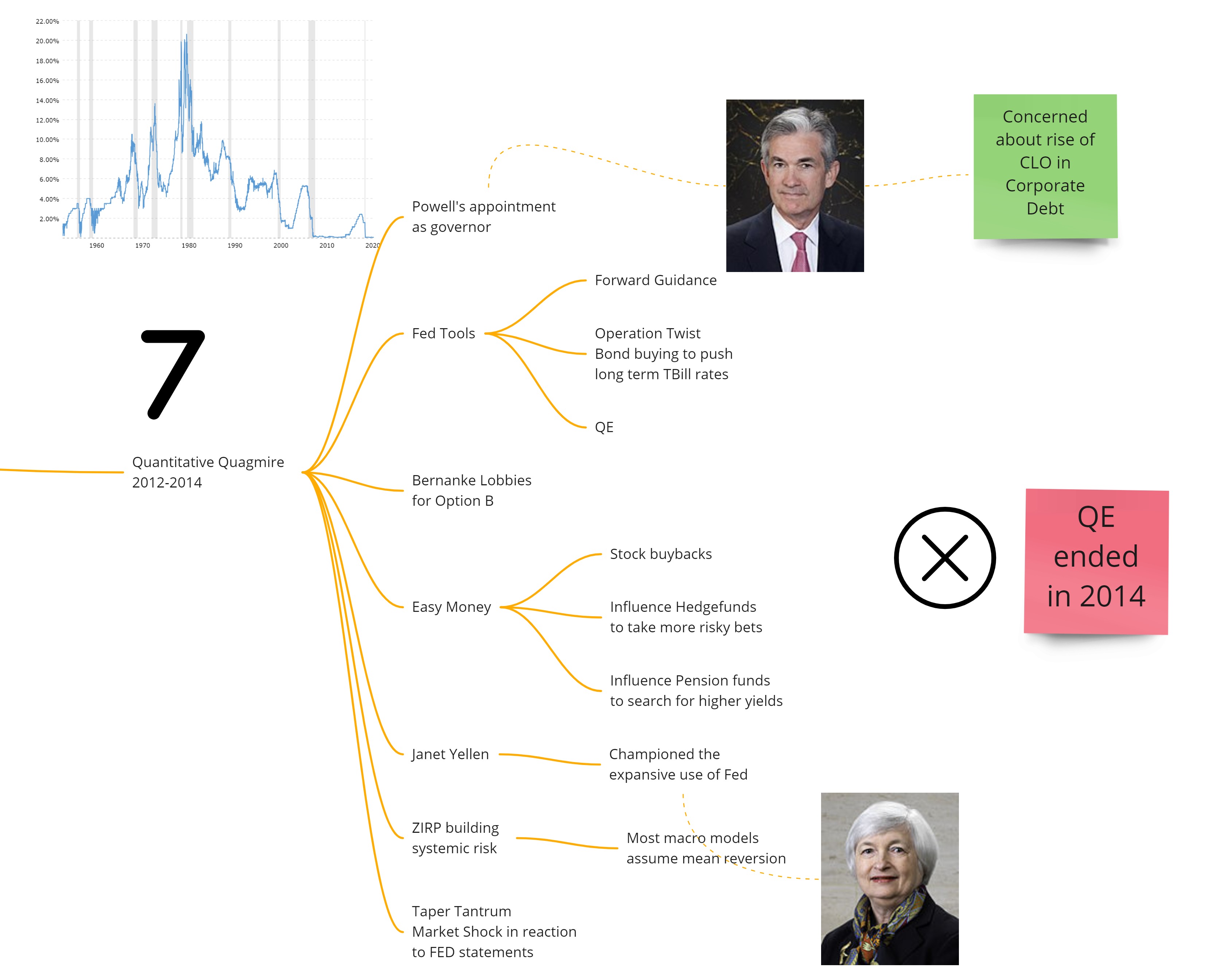

Quantitative Quagmire

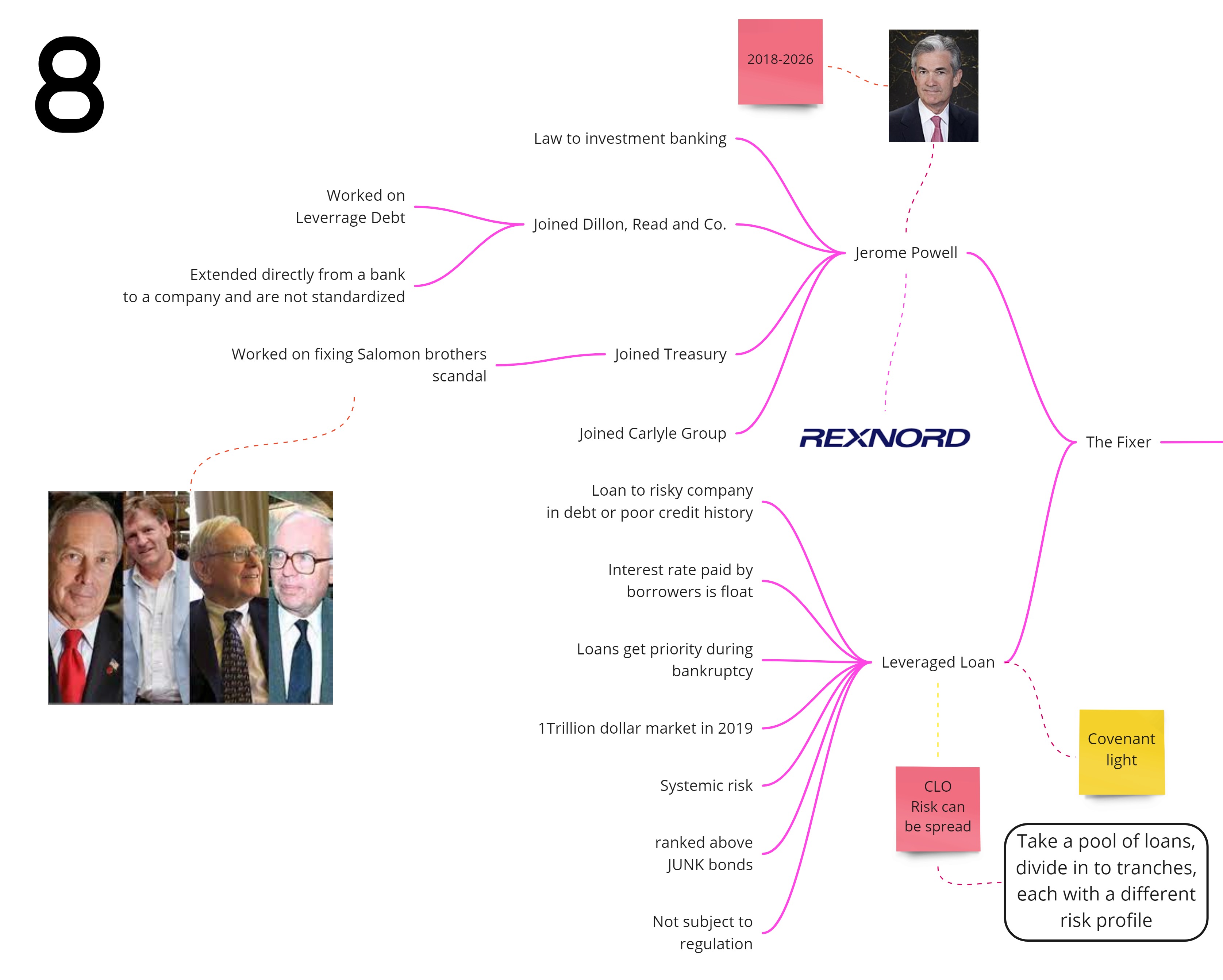

The Fixer

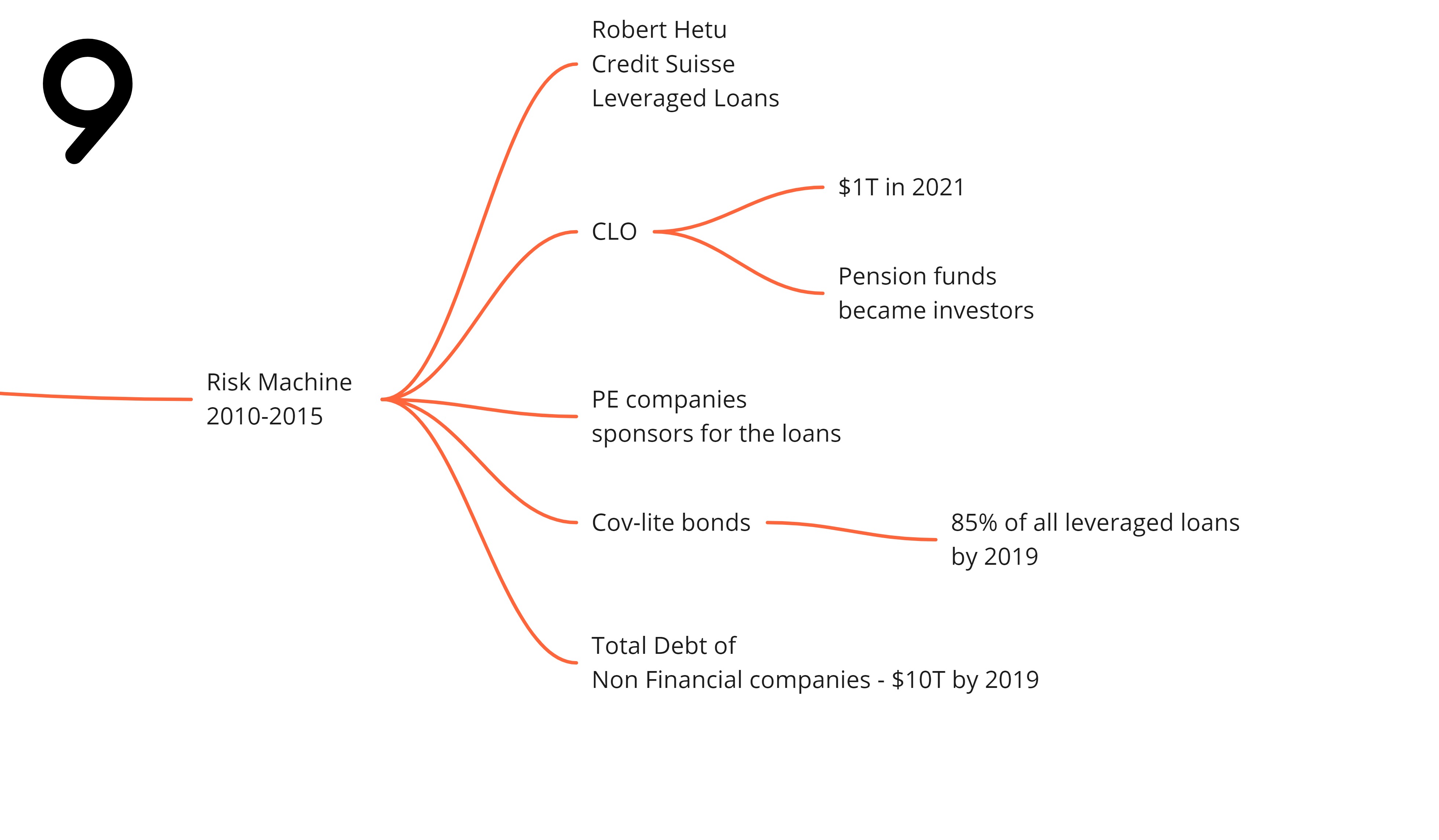

The Risk Machine

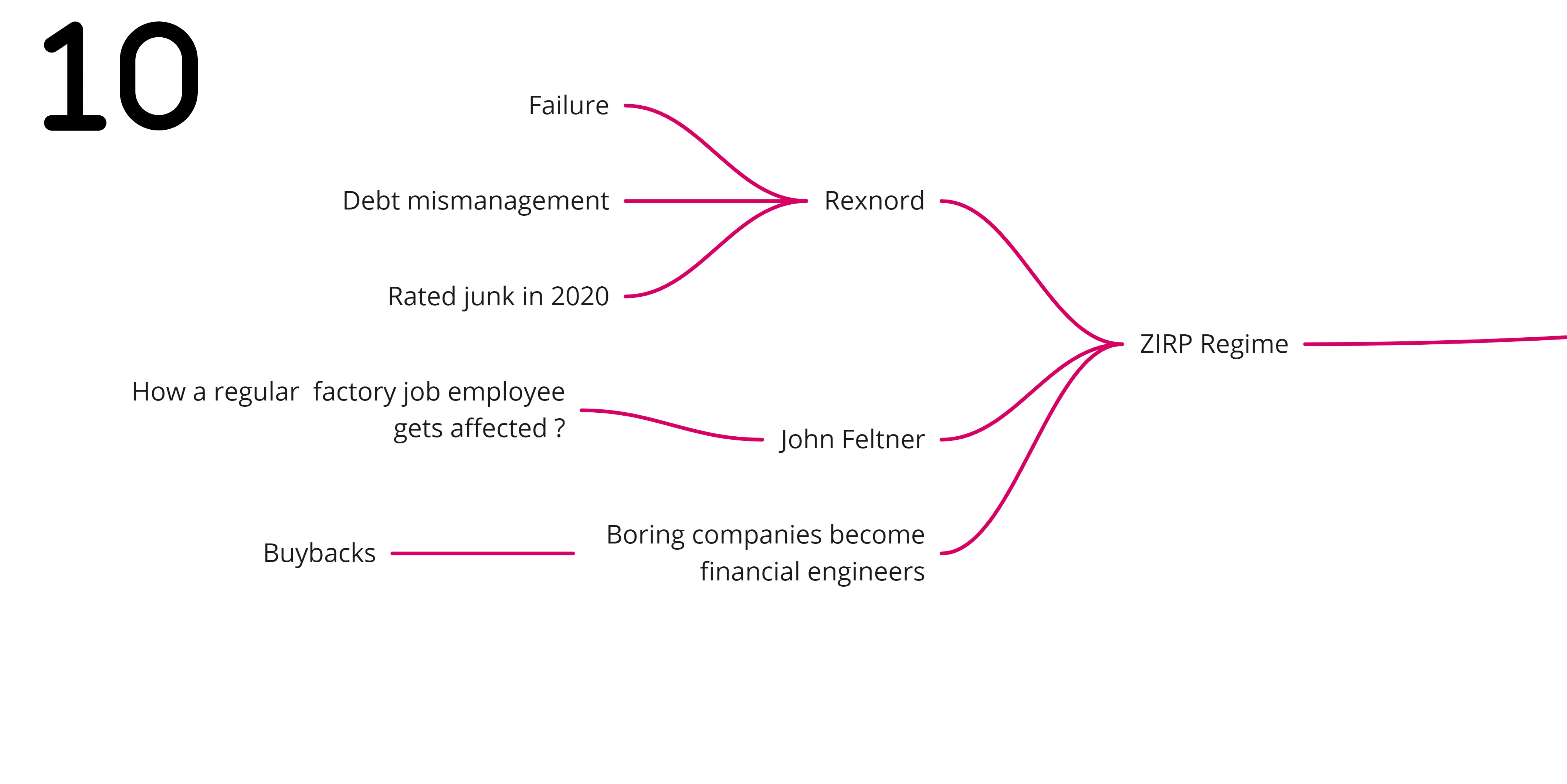

The ZIRP Regime

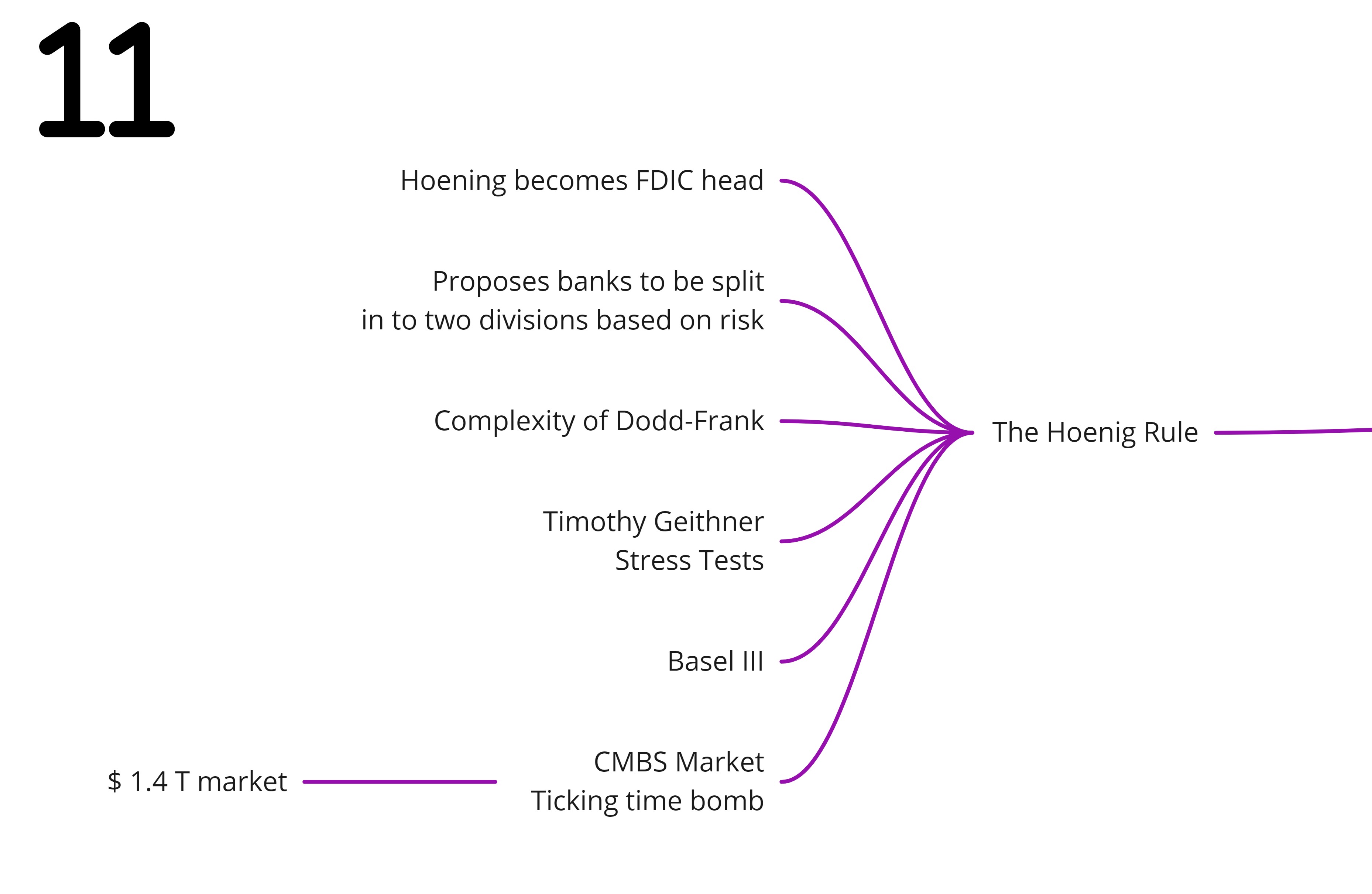

The Hornig Rule

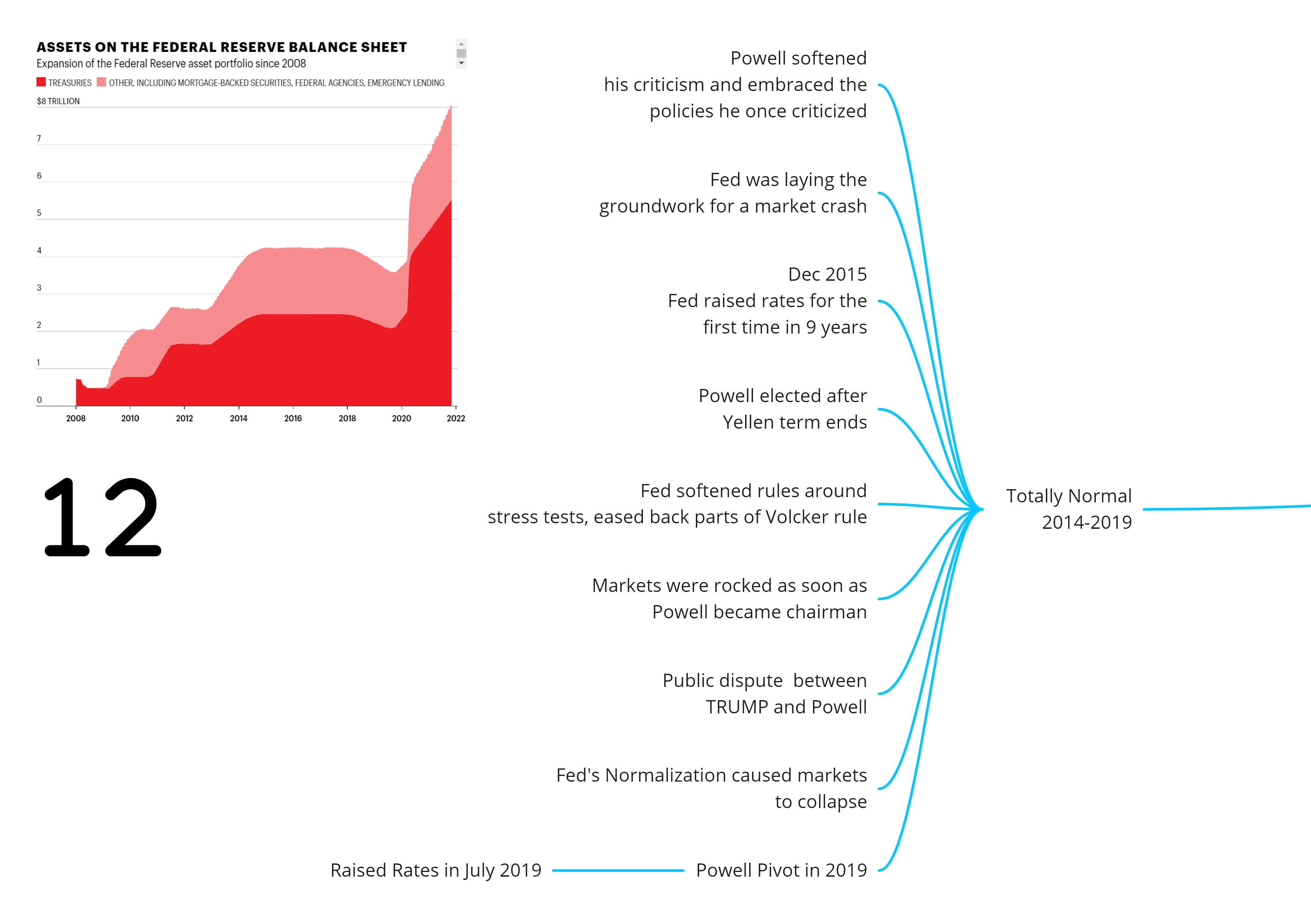

Totally Normal

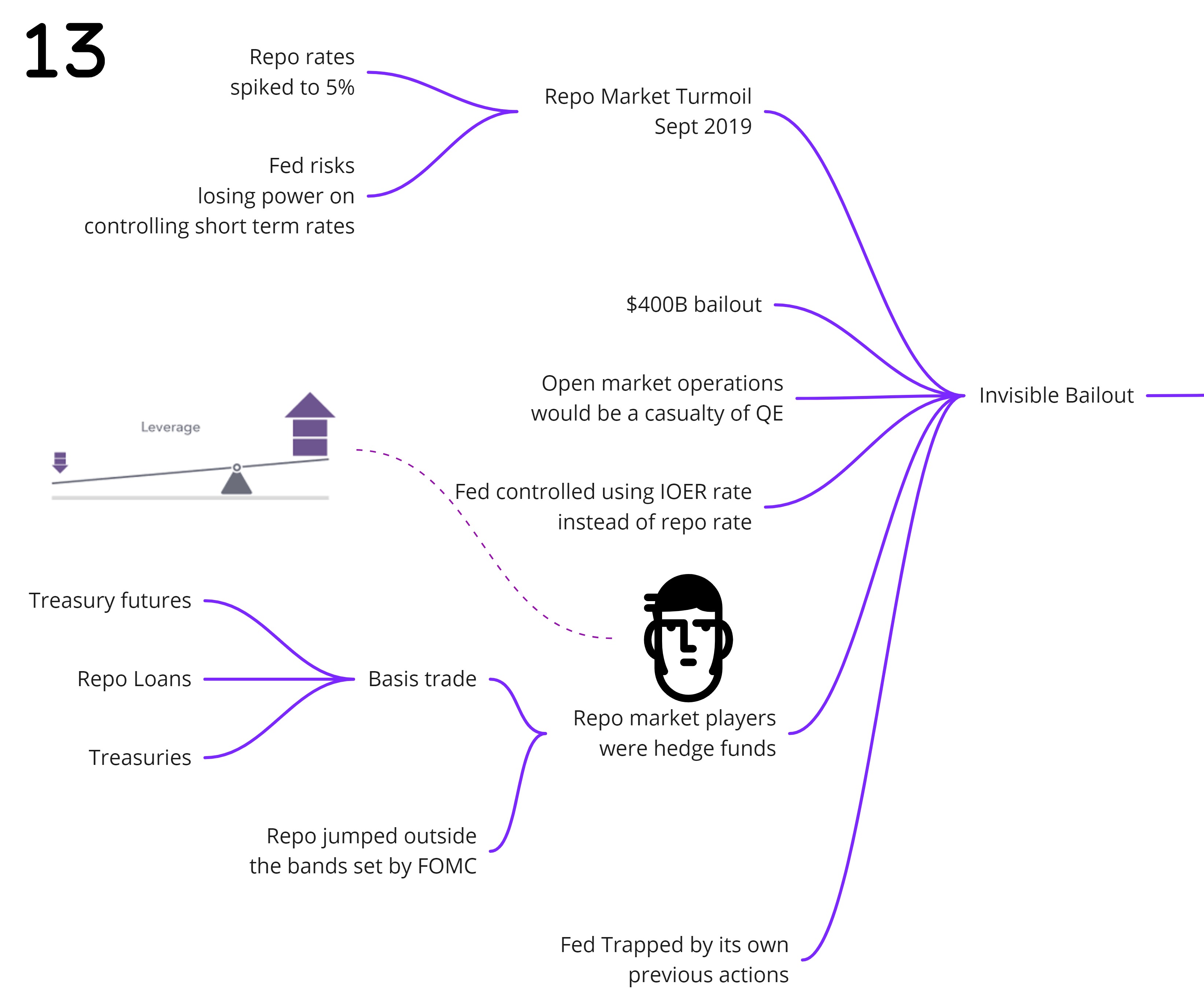

The Invisible Bailout

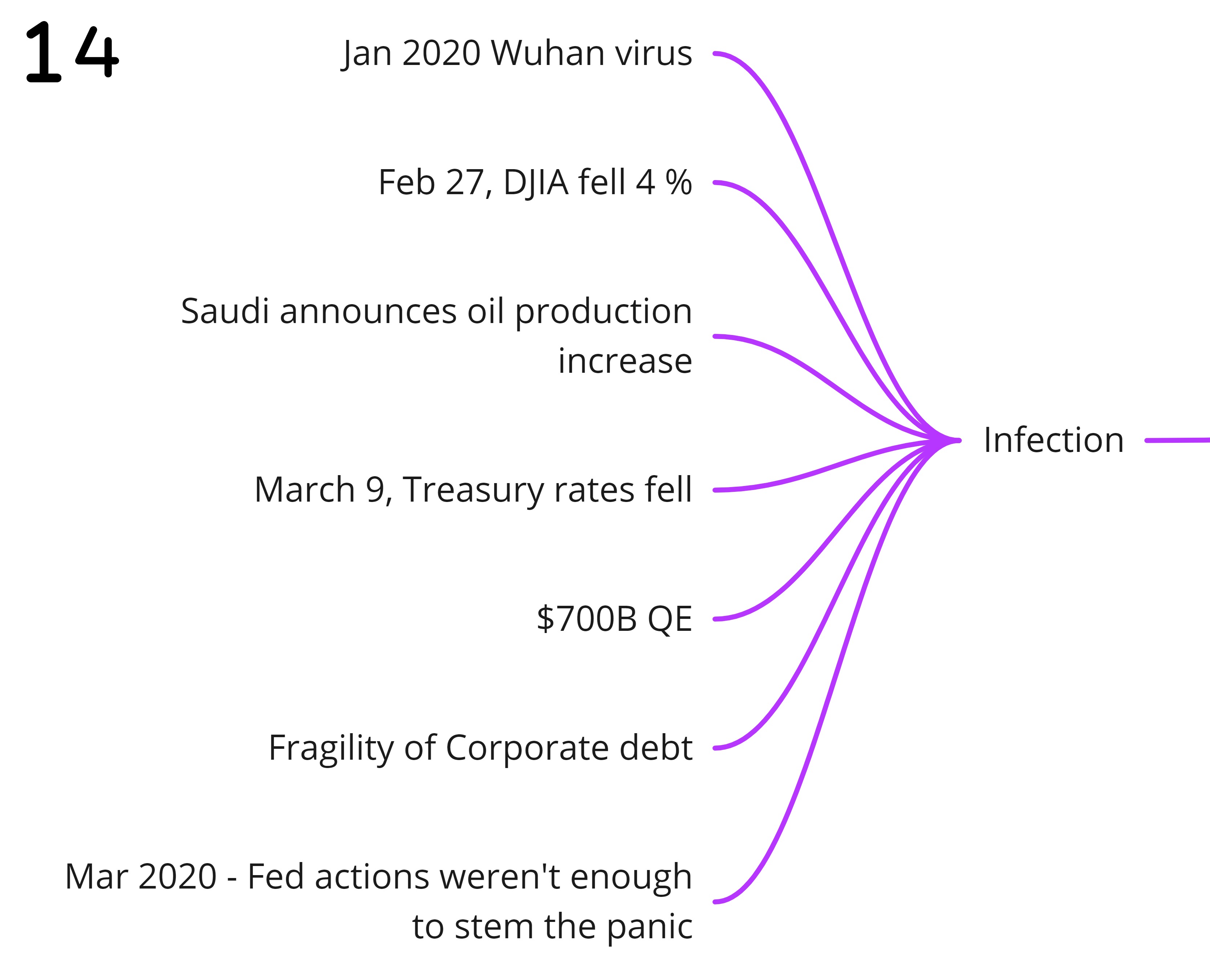

Infection

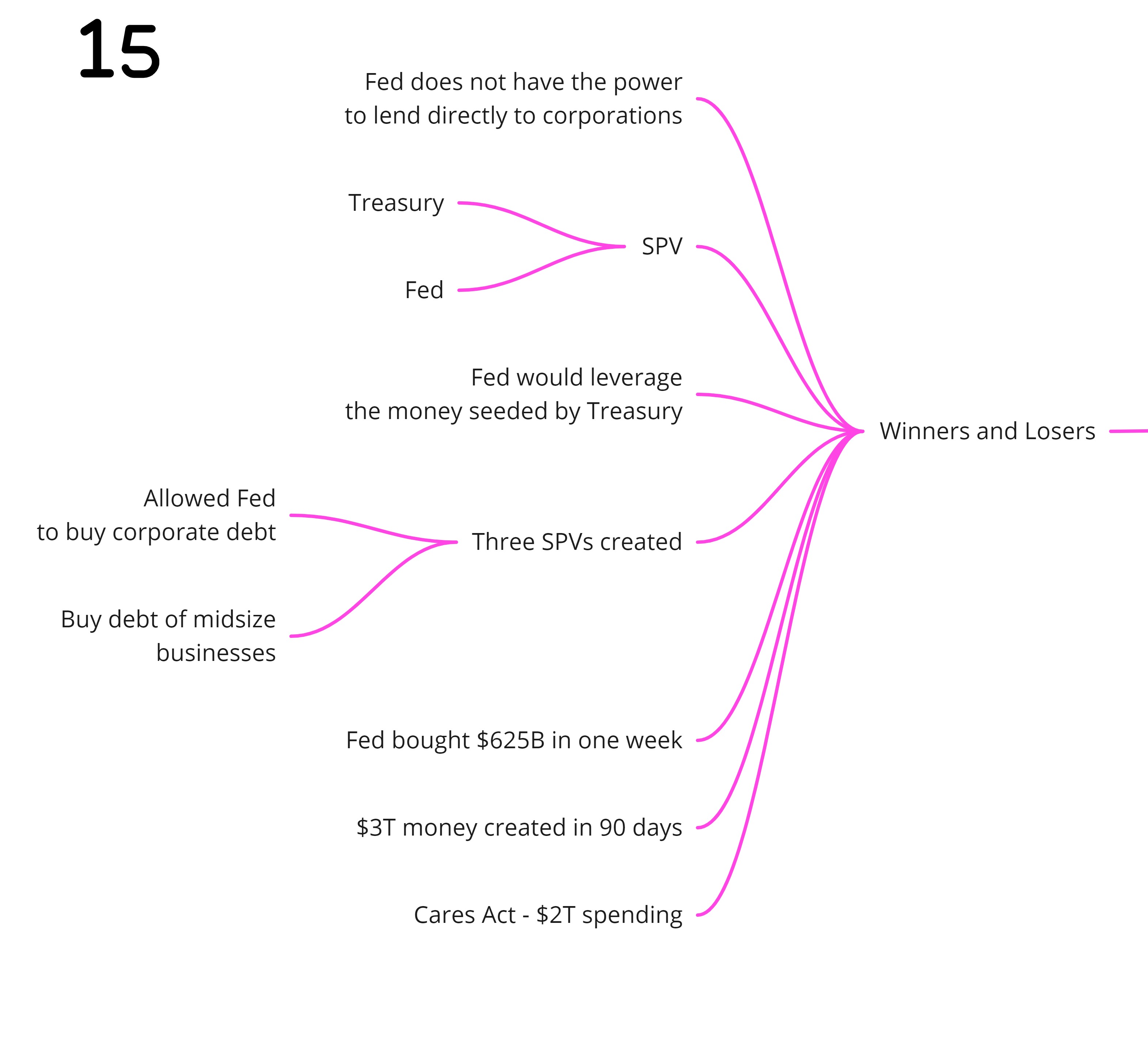

Winners and Losers

The Long Crash

The final chapter takes the reader through the current financial situation of the economy and essentially drives home the message the repercussions of GFC and Fed policy actions have not yet panned out in the economy and the massive asset bubbles that have built in the economy will blow up sooner or later.

Takeaway

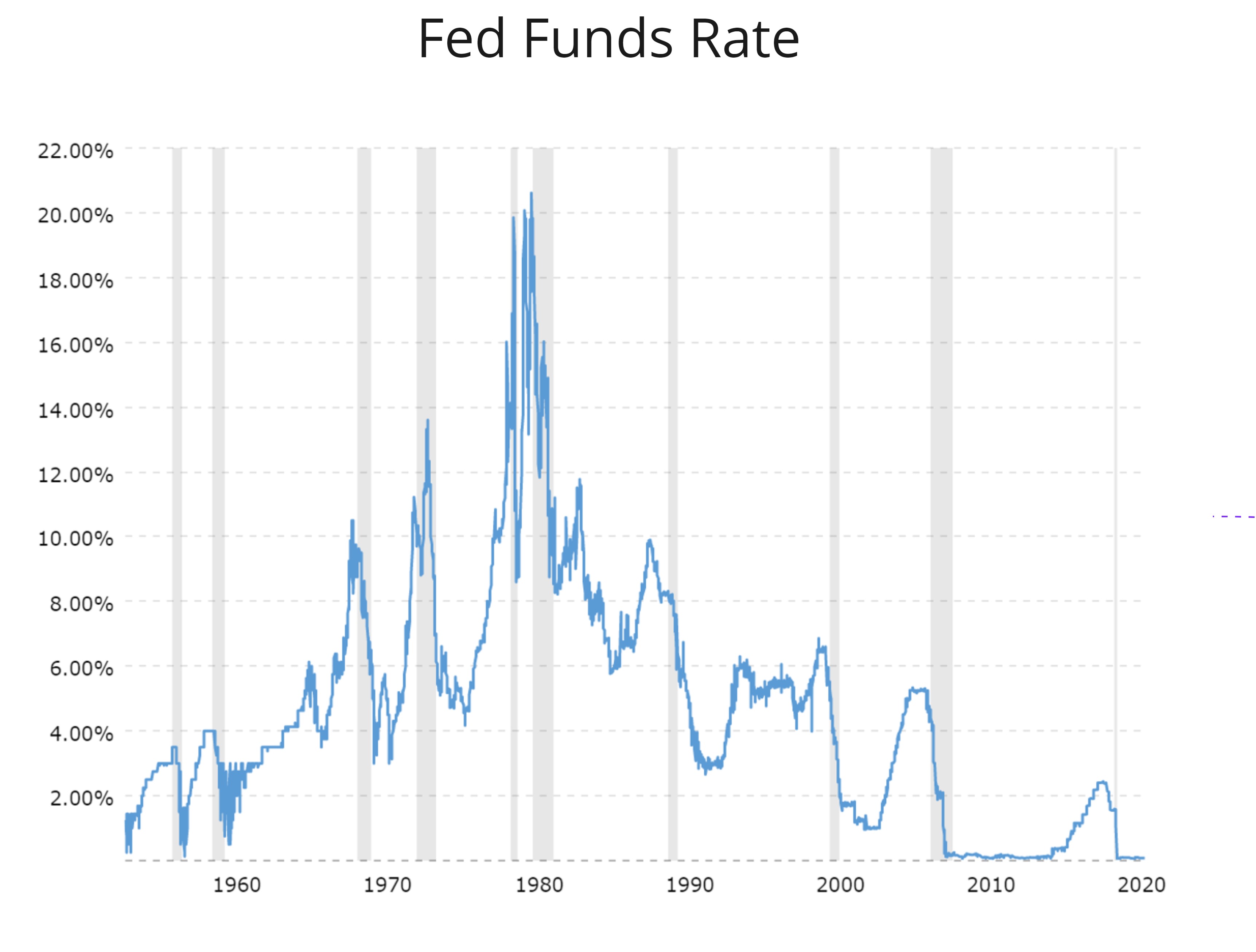

If one wants to understand various Fed activities that we see in the Fed fund rate evolution over decades, this book does a great job of it. Thoroughly enjoyed reading the book