Competing in the age of AI - Book Review

Contents

This blogpost summarizes some of the main points from the book titled “Competing in the age of AI”, written by Marco Iansiti and Karim Lakhani

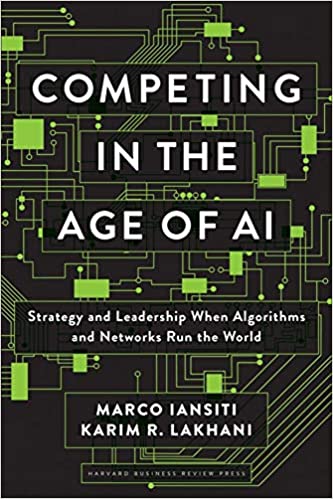

The Age of AI

The chapter starts with an example of an algorithm drawn portrait that deceives all the experts, who conclude that it is a Rembrandt drawing. The example is meant to give a glimpse of what is already happening in many domains as well as what will be happening if the current trajectory continues.

AI is becoming a force in the arts, connecting various disciplines and media and expanding the range of artistic possibilities.

Quoting Satya Nadella,

AI is the “runtime” that is going to shape all of what we do.

The authors say that AI is becoming the universe engine of adoption. The main idea of the chapter is that the businesses are becoming successful with a new operational model with the following traits:

- scale faster

- enlarge the scope of their offerings as they can easily connect with myriad of businesses

- ability to produce opportunities for learning and improvement

Most of the transformation in the learning and improvement area is done via weak AI. We are not talking about AGI. It is weak AI that is already transforming the way companies are operating. The chapters gives examples of WeChat, Tencent, Amazon, Walmart and many others to illustrate the above traits of the new operational model

Rethinking the Firm

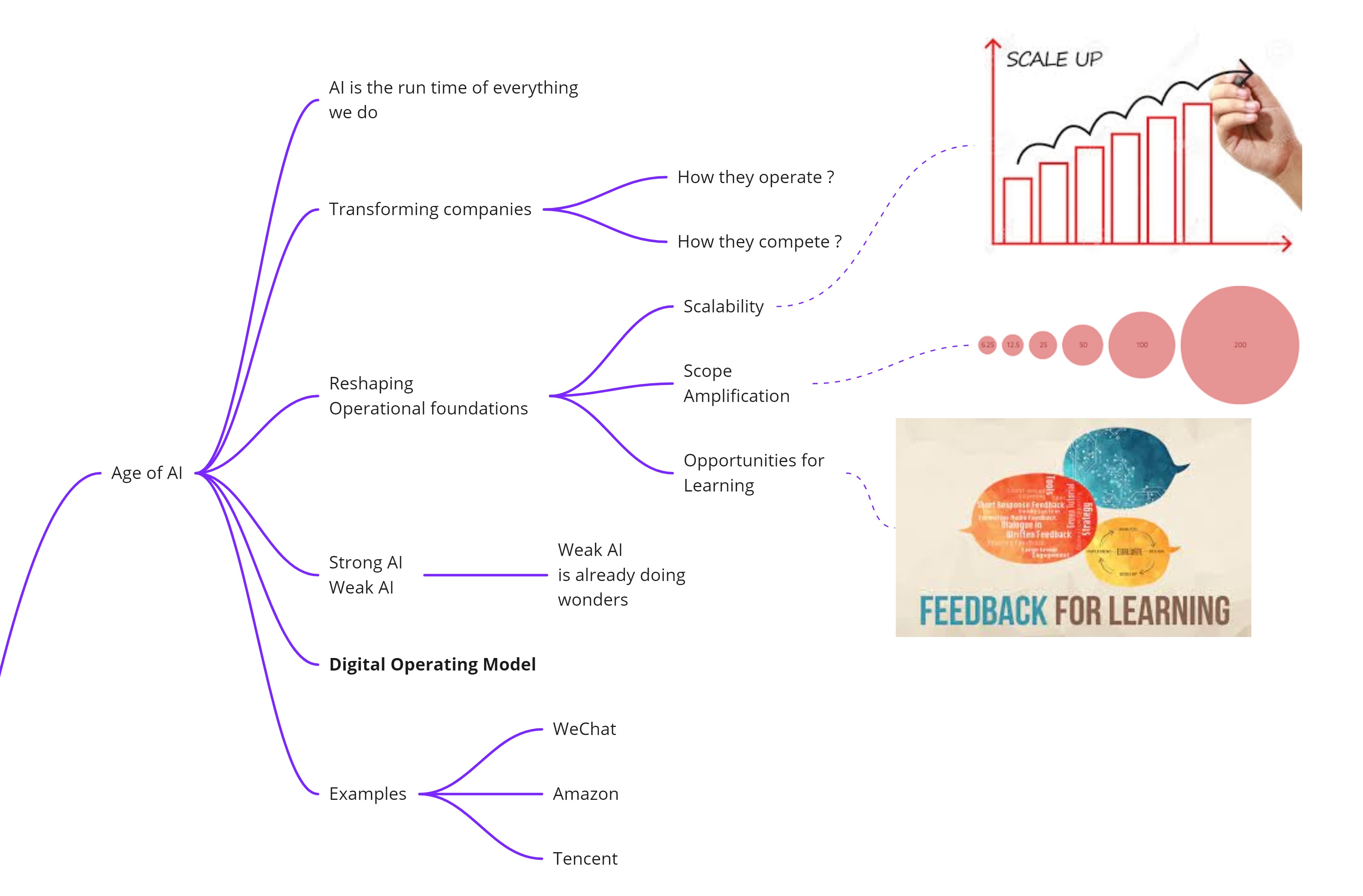

The chapter talks about two critical factors of any firm, the business model and the operating model.

The business model comprises of value creation and value capture. The value creation part answers the question as to why a customer would choose to company’s products and services. Value capture is the part that gives an idea of how much of the value is captured by the firm.

The operating model refers to systems, processes and capabilities that a firm has, in order to deliver the business value.

The chapter talks about three companies that are transforming their business model and operating model to that one is not a constraint on another, for creating a successful firm. Traditionally the alignment of the business and operational models was always the focus area and more often than not, changing one without the other lead to failures

Three case studies are presented that illustrate the ways in which the new unicorns are transforming their operating model and business models so that they can scale better, increase scope and find avenues for learning opportunities.

- Ant Financial

- Started in 2004 as a platform to connect buyers and sellers

- QR code that lets buyers and sellers to transact without any additional hardware

- Value creation is by offering a substitute for trust in the form of an escrow-based financial payment service

- 10,000 people to server 700 million customers

- Yu’e Bao ultra-lightweight investors - allowed users to earn interest on money in their accounts

- Yu’e Bao means leftover treasure

- AUM $120B dollars as of Sept 2021

- Ant Financial and Tencent’s WeChat control 90% of chinese market

- MYBank uses algo for loan approvals

- Zhima credit scores

- Experimentational platform to feedback on rolling new features

- Peleton

- high-quality indoor bicycle with a 21-inch tablet to display fitness programming

- even though this case is profiled as a success story in the book, Bloomberg reported in Mar 2022 that the company was heading towards a disaster

- Ocado

- AI company disguised as a supply chain company

The three examples are meant to illustrate the radical ways in which companies have changed their operational model and have become unicorns

AI Factory

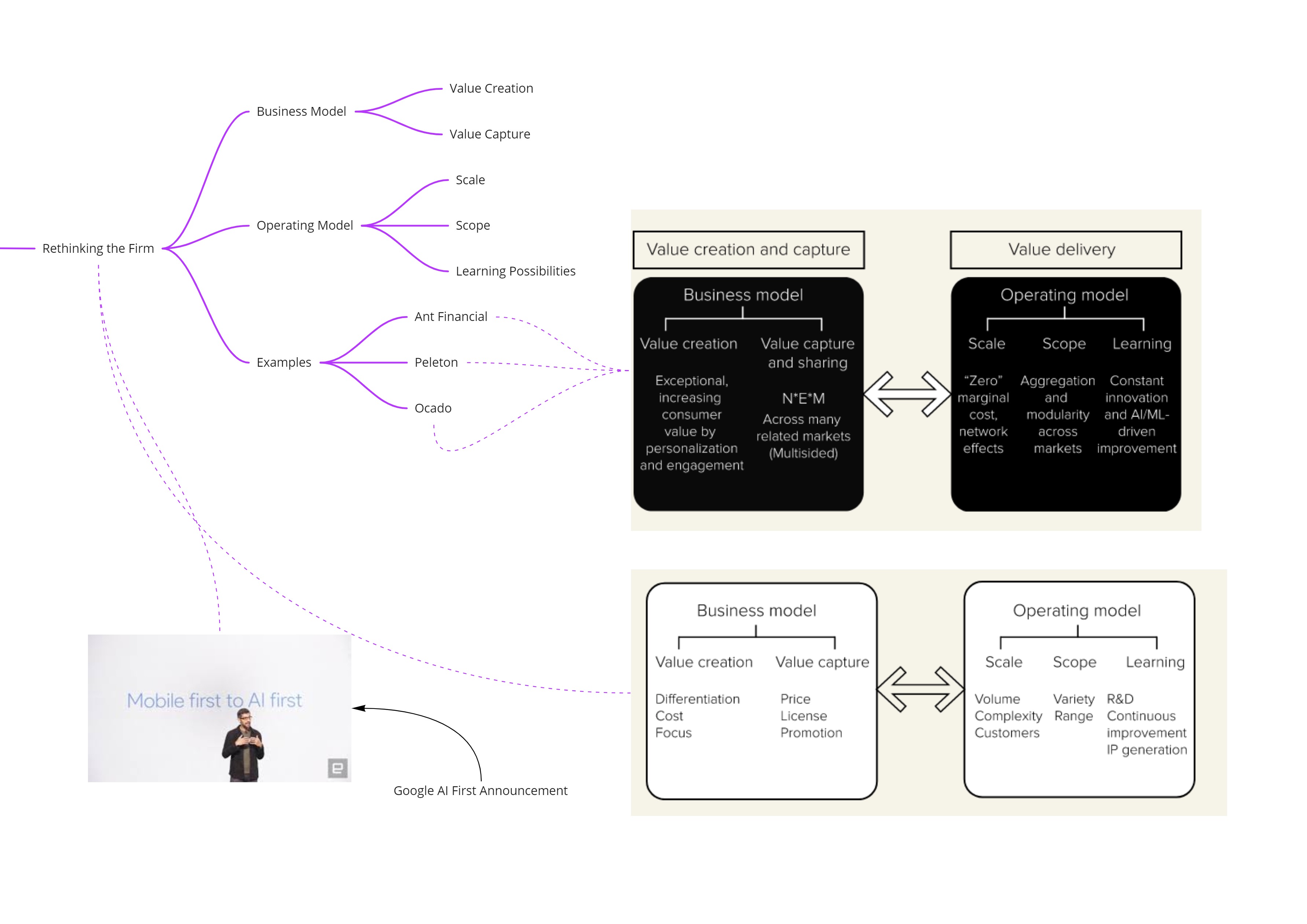

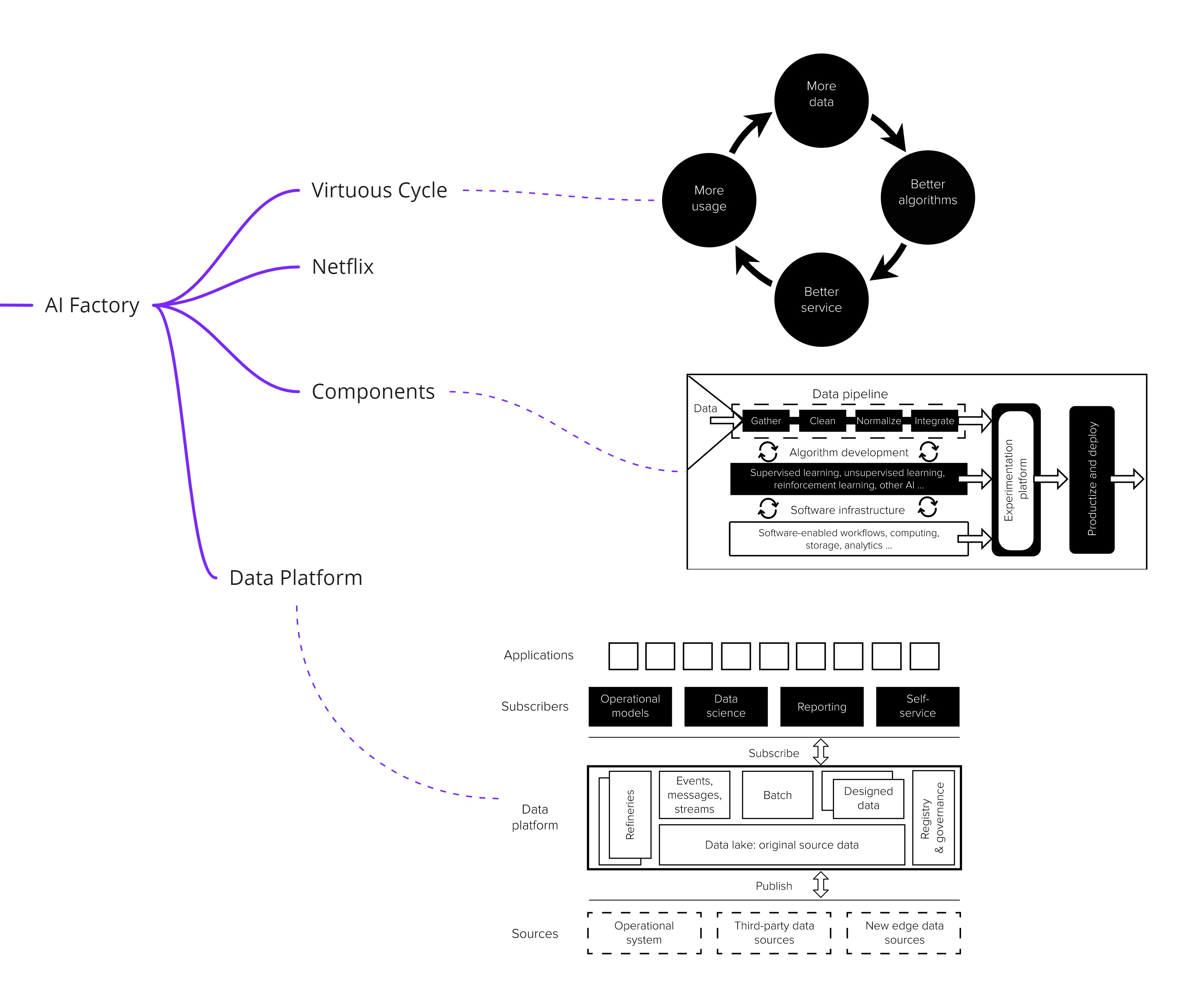

This chapter talks about ways in which firms are redesigning the core using AI and ML based technologies. In doing so, the firm creates a virtuous cycle between user engagement, data collection, algo design, prediction and improvement

The chapter uses Netflix as an example to illustrate the various components of AI factory

- Data pipeline

- Algo development

- Experimentation platform

- Software infrastructure

‘datafication’ of TV entertainment is what Netflix has done. Ofcourse many companies have datafied in diverse fields and have become successful. Imagine any app that takes data about you, the app is datafying.

The chapter gives a brief primer on supervised, unsupervised, and reinforcement learning algorithms. It also talks about components of data platform architecture.

Be it any bank, hedge fund, asset management firm; they are all trying to digitize their operational model around AI and ML. Given the markets are inherently characterized as wicked world problems, the regular use of ML in financial markets is not straightforward. In most of the other fields, the variables are not as stochastic as finance and hence weak AI is good enough.

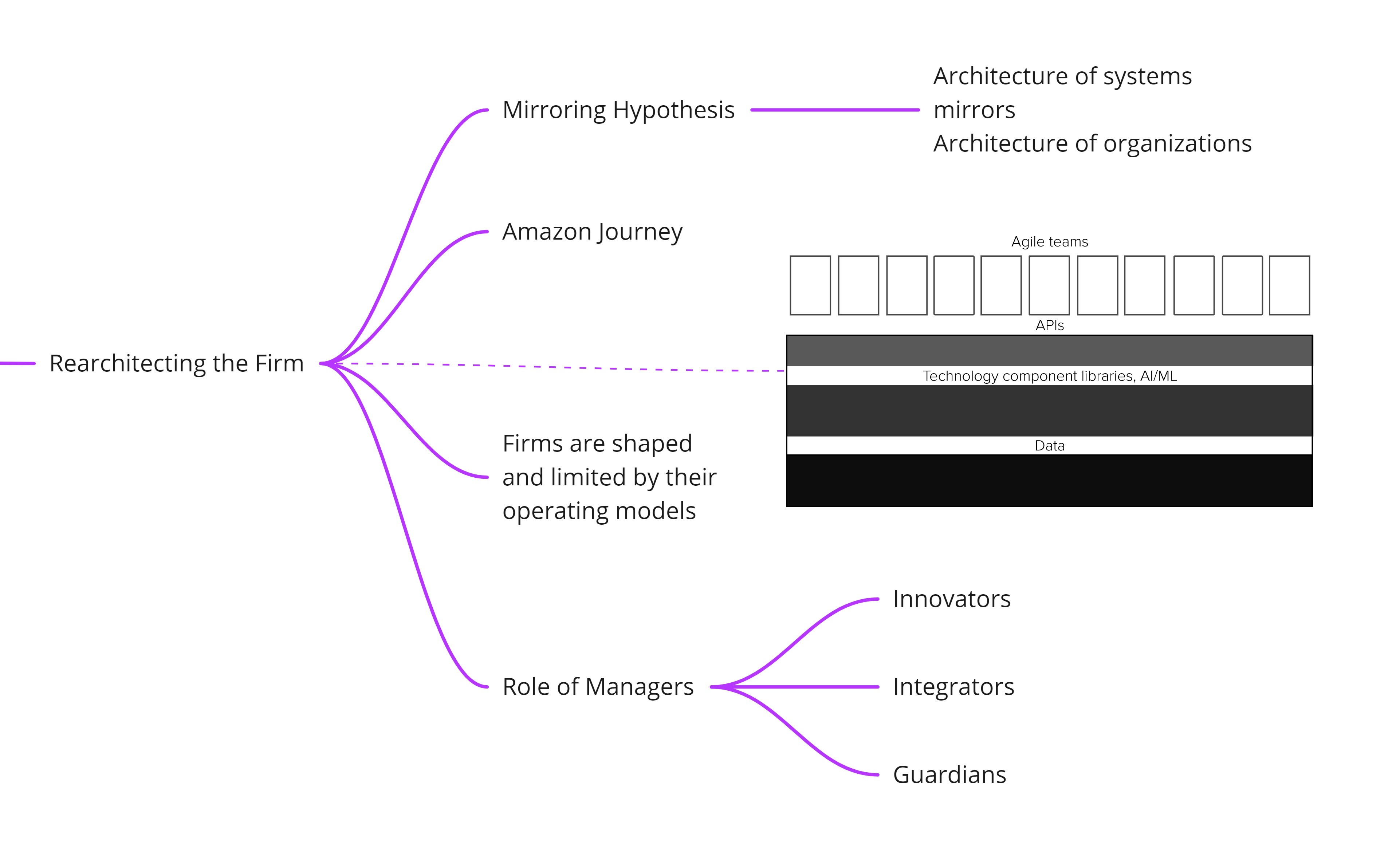

Rearchitecting the Firm

This chapter talks about the limitations of the traditional operational model that are not built for scale, enalarged scope and learning, that a digital operational model demands. Amazon is the running example through the chapter and the authors highlight various transformations that the firm underwent, to become a highly successful organization that it is today. The chapter talks about the various components of architecture of an AI-powered firm such as data, technology component libraries, API driven culture and agile development. Technology by itself is not something new but the crucial aspect is the organization culture that will have to change to make the new architecture work. In the process, the managerial layer in such an organization has a vastly different role as they shift from managing people to managing code Managers become innovators, integrators, guardians of the organization that mirrors the tech stack that is being followed.

The main takeaway from this chapter is that as organizations embrace open architectures for the systems, it is obvious that the organization workflow has to become open and agile that allows for experimentation and learn about new ways of delivering value.

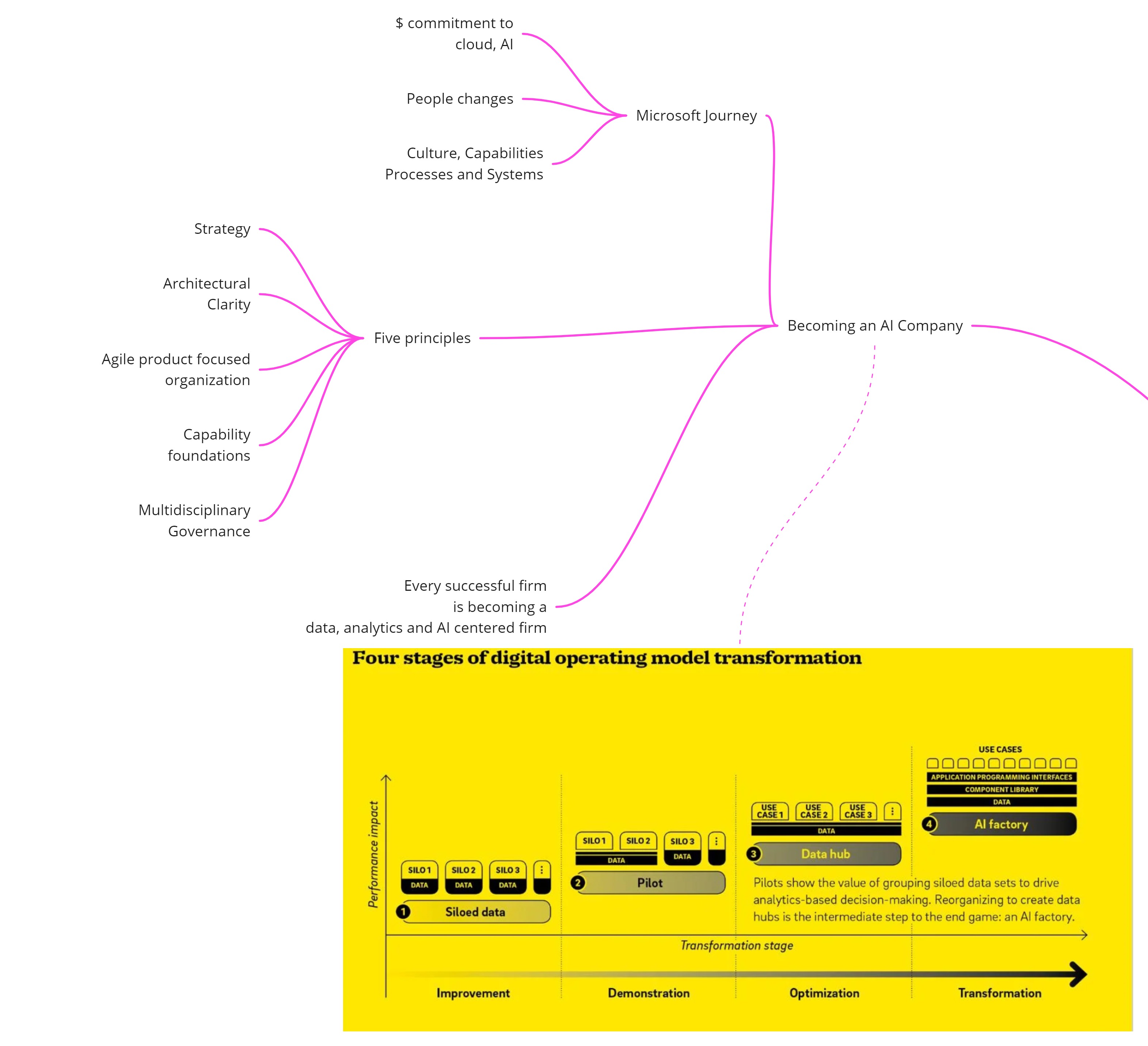

Becoming an AI company

Microsoft is the running example of the chapter and is used to demonstrate the various painful transitions that will have to happen for a traditional firm to become an AI-centric firm. The author lay out 5 step approach based on their experience with dealing many companies that have had transformations to an AI-first company

- Strategy

- Architectural Clarity

- Agile product focused organization

- Capability foundations

- Multidisciplinary Governance

The chapter ends with a case study of Fidelity Investments that embarked on the journey a decade ago and has now rearchitectured the company where data, analytics and AI are at the core of the company’s operating model.

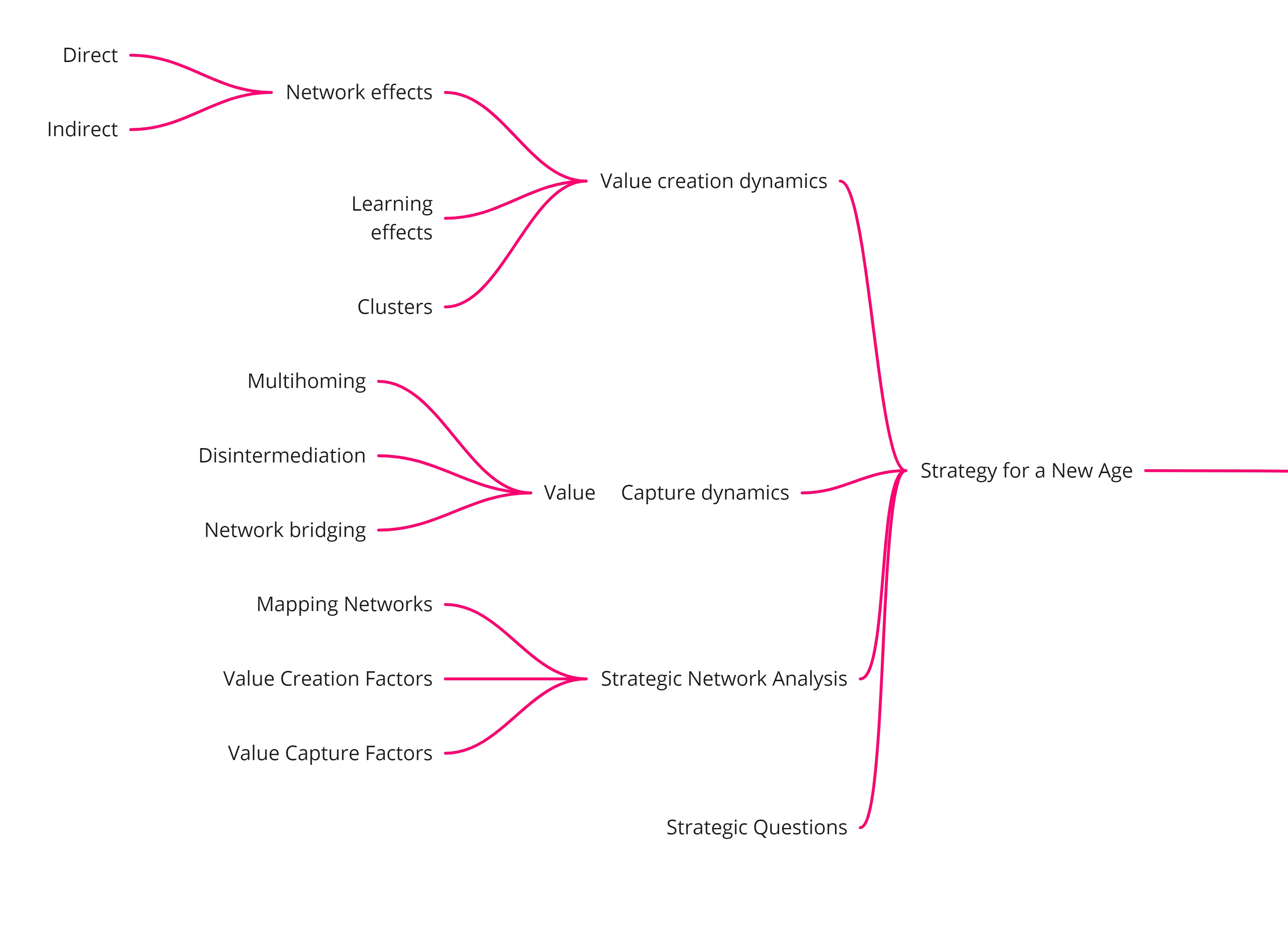

Strategy for a New Age

I found this chapter interesting as the authors provide a framework for thinking about any network based business(which is practically any business in the modern day). One needs to look at specific network characteristics underlying value creation and value capture. The main questions to think about in the analysis are

- What is the core service delivered ?

- What networks are key to providing that service, and what are their characteristics?

- Are there strong learning or network effects ?

- Are the effects clustered ?

- If network and learning effects are weak, how do you strengthen them over time ? How do you increase the value delivered ?

- If the network effects are strong and there is little value delivered until critical mass, how do you get there ?

- What are the important secondary networks ? Can they enable additional network or learning effects?

- Do we have challenges with network clustering, multihoming, disintermediation ?

- What are the best value capture opportunities?

- Are there network bridging opportunities?

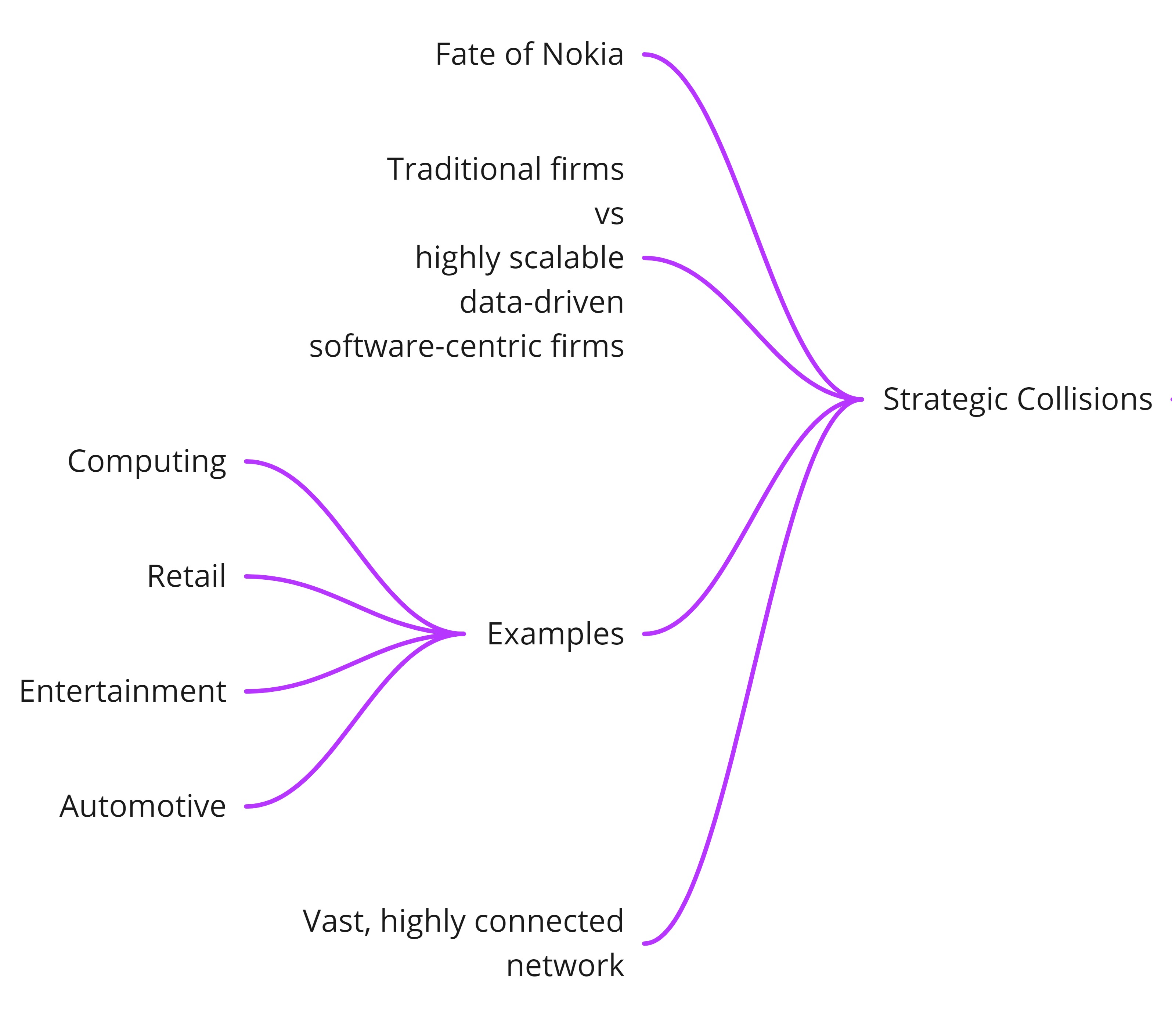

Strategic Collisions

The chapter walks through the failure of Nokia and highlights various aspects behind the collision between traditional firms and modern firms that have a different operational model. There are several examples mentioned across computing, retail, entertainment, automotive domains that highlight the fact that companies with digital operating model with a sound business plan are upending traditional firms everywhere

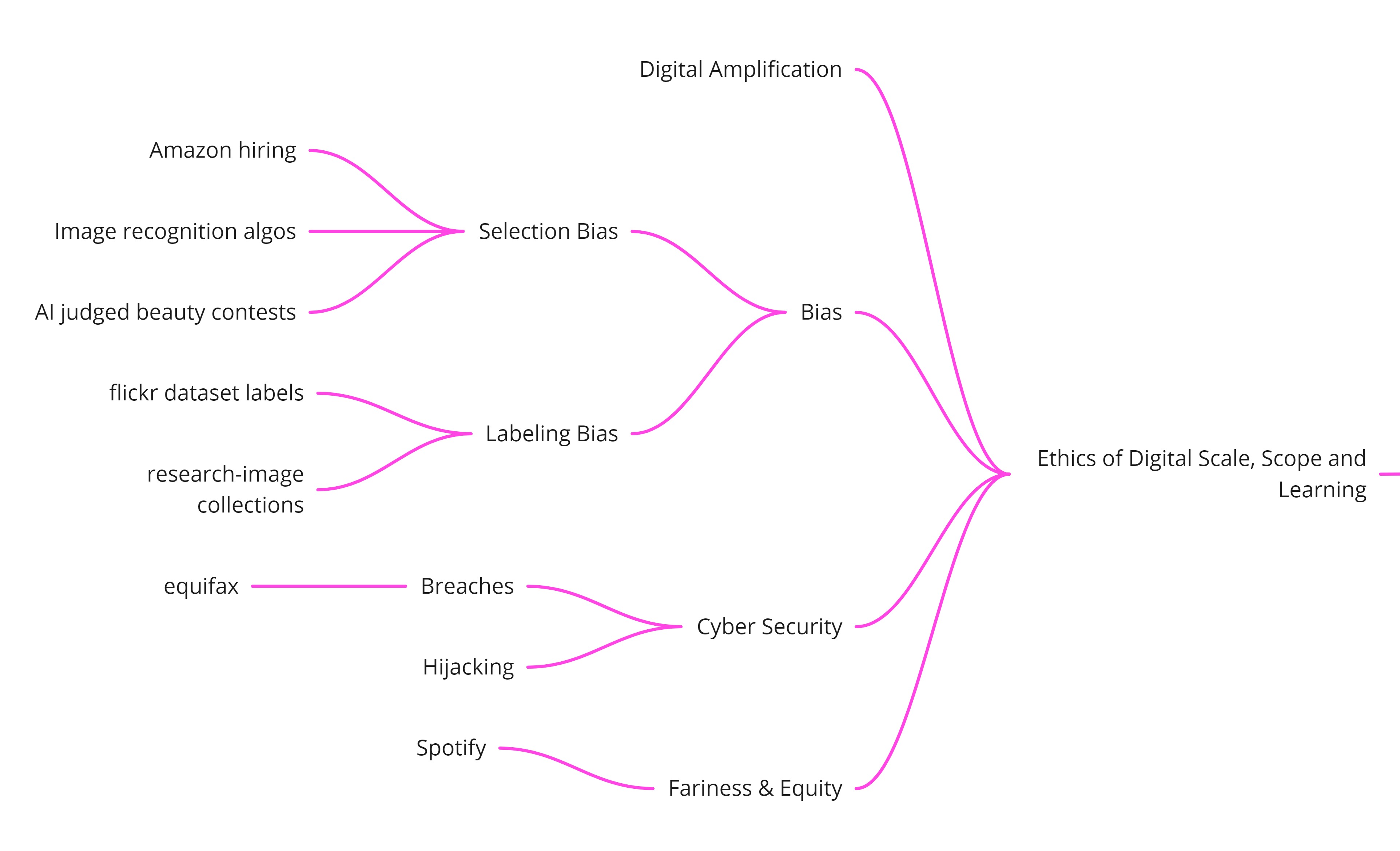

The Ethics of Digital Scale, Scope and Learning

The chapter helps us understand the varying range of ethical issues that arises in creating, managing and sustaining an digital operational model. Ton of examples are provided to highlight algorithmic bias, cybersecurity and AI fairness

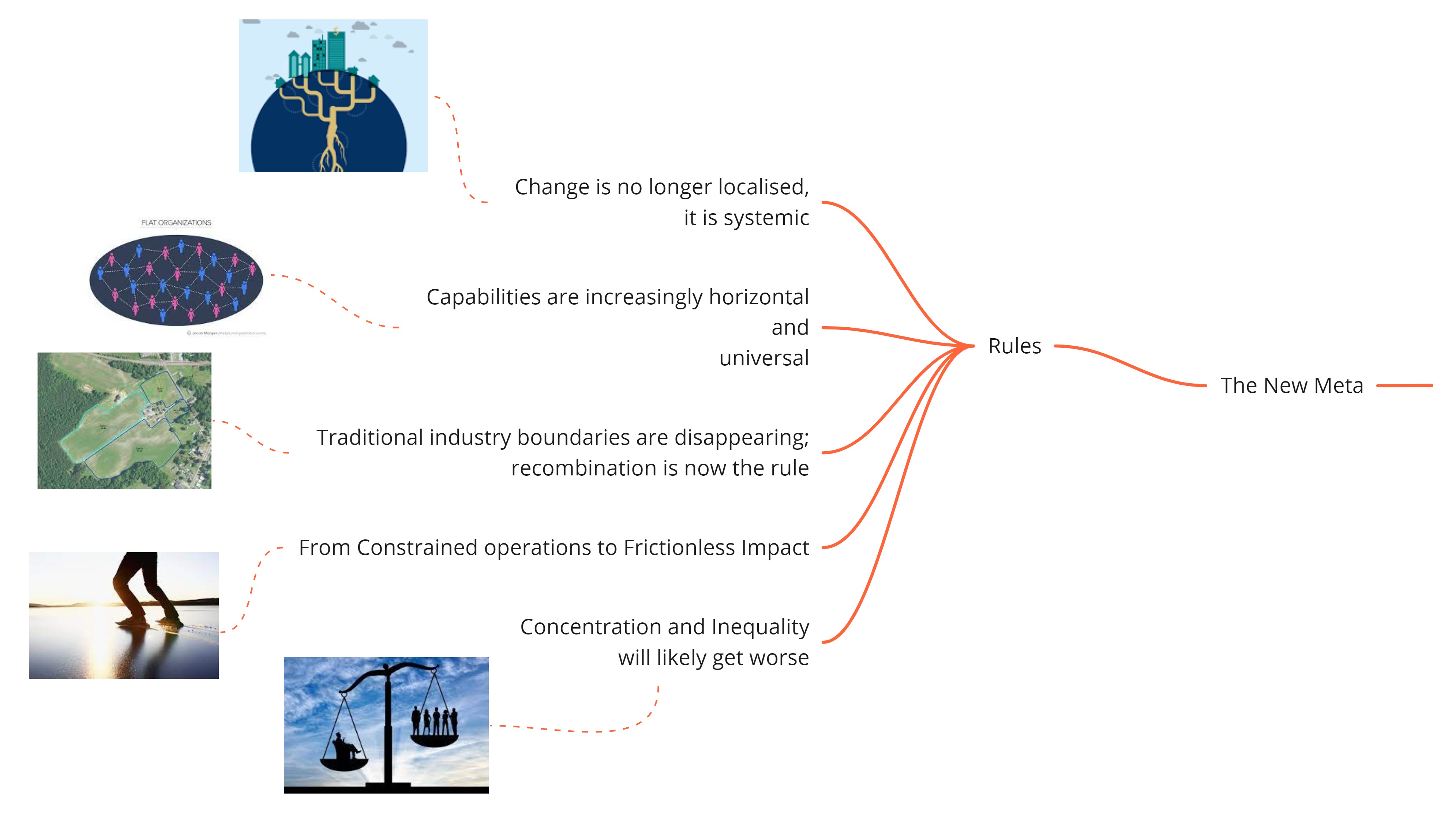

The New Meta

The chapter talks about the emerging rules of the game for all the companies that are competing in the new operating model

- Change is no longer localized, it is systemic

- Capabilities are increasingly horizontal and universal

- Traditional industry boundaries are disappearing; recombination is now the rule

- From Constrained operations to Frictionless Impact

- Concentration and Inequality will likely get worse

Leadership mandate

The chapters says that we must find wiser ways to lead the increasingly digital firm. Four areas are highlighted in this chapter

- transformation

- entrepreneurship

- regulation

- community

There are examples given for each of the above areas so that one can understand the leadership mandate better.

Takeaway

This book is a nice primer to the business environment in the modern world. We see a different set of companies dominating the market place in all domains. The book gives a good framework to understand the digital operational model components, i.e. scale, scope enlargement and learning possibilities. Once you understand the framework, it is but natural that whichever successful company, unicorn, startup that you look at, the common principle of patterns becomes evident