The Bogle Effect - Book Review

Contents

This blogpost is a brief summary of the book titled “The Bogle Effect”, by Eric Balchunas, who is also a co-host “Trillions” podcast.

Introduction

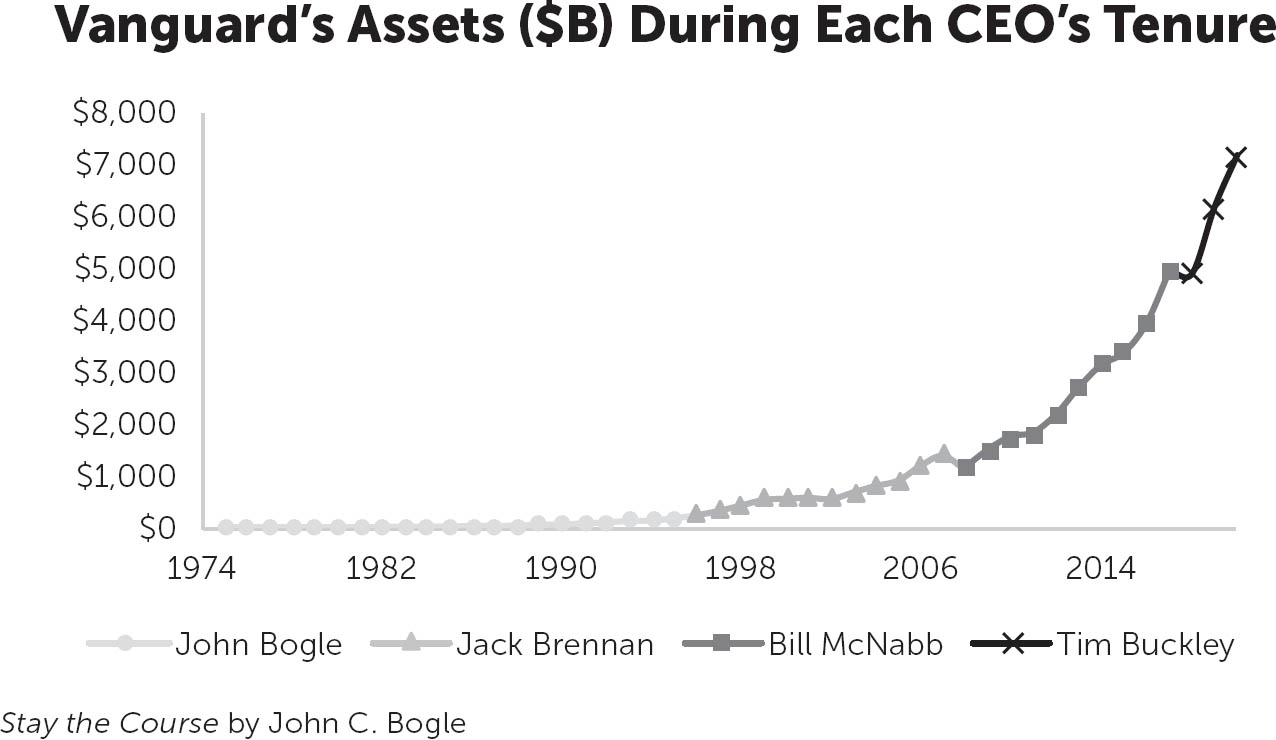

The author starts off the book by giving a rational for writing a book about John Bogle, who himself has written a ton of books. Is there something new that he intends to add to the existing literature on Vanguard by Bogle himself ? The popular frame of reference about John Bogle is that he is father of indexing and he is the man behind Vanguard. However not many know that Bogle was instrumental in creating a structure that works exactly opposite of a typical Wall Street Fund, which the author terms it as addition by subtraction. By relentlessly focusing on driving the expense ratio southwards, he has managed to save a trillion dollars of investors money. This book is not exactly a strict biography, says the author and invites the reader in to a journey that includes interviews with two dozen who’s who’s in the financial world.

The Vanguard Colossus

The chapter gives some of the numbers behind Vanguard Behemoth and makes an argument that various factors around Vanguard have saved investors a trillion dollars. The author breaks down the trillion dollars in to the following categories:

- Expense ratio:

$300bsavings from lower expense ratio of Vanguard funds - Turnover:

$250bsavings from lower trading costs - Vanguard Effect (active):

$200bsavings from forcing active to reduce fees - Vanguard Effect (passive):

$250bsavings from forcing new passive issuers to reduce fees

Metrics

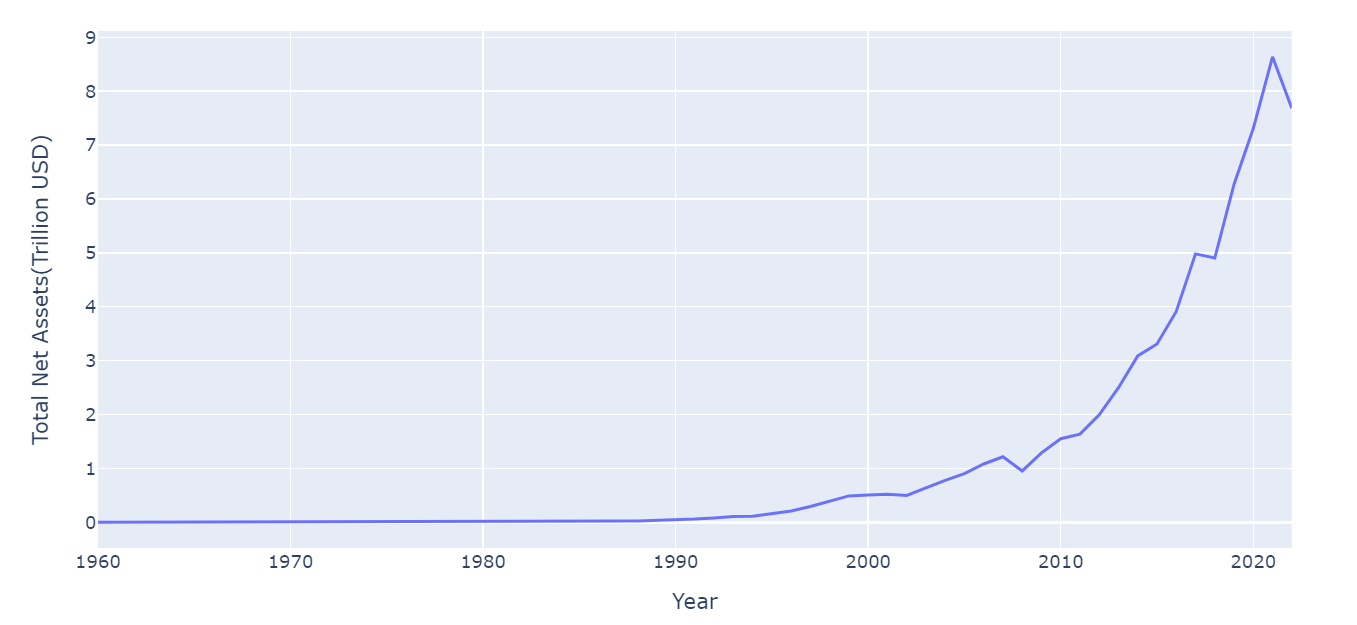

Some of the numbers are a bit dated as of today(). But that doesn’t deviate from what a mammoth company, Vanguard is, in today’s asset management world. Here are the latest numbers as of December 31, 2022.

| FundType | Active/Passive | Net Assets(Billion USD) | Percentage |

|---|---|---|---|

| Exchange Traded Funds | Active | 13 | 0.2 |

| Exchange Traded Funds | Passive | 2,021 | 26.3 |

| Insurance Funds | Active | 18 | 0.2 |

| Insurance Funds | Passive | 20 | 0.3 |

| Mutual Funds | Active | 2,102 | 27.3 |

| Mutual Funds | Passive | 3,514 | 45.7 |

| Total | 7,687 | 100 |

- Vanguard AUM by Active passive split

- Active 27 percentage of AUM

- Passive 73 percentage of AUM

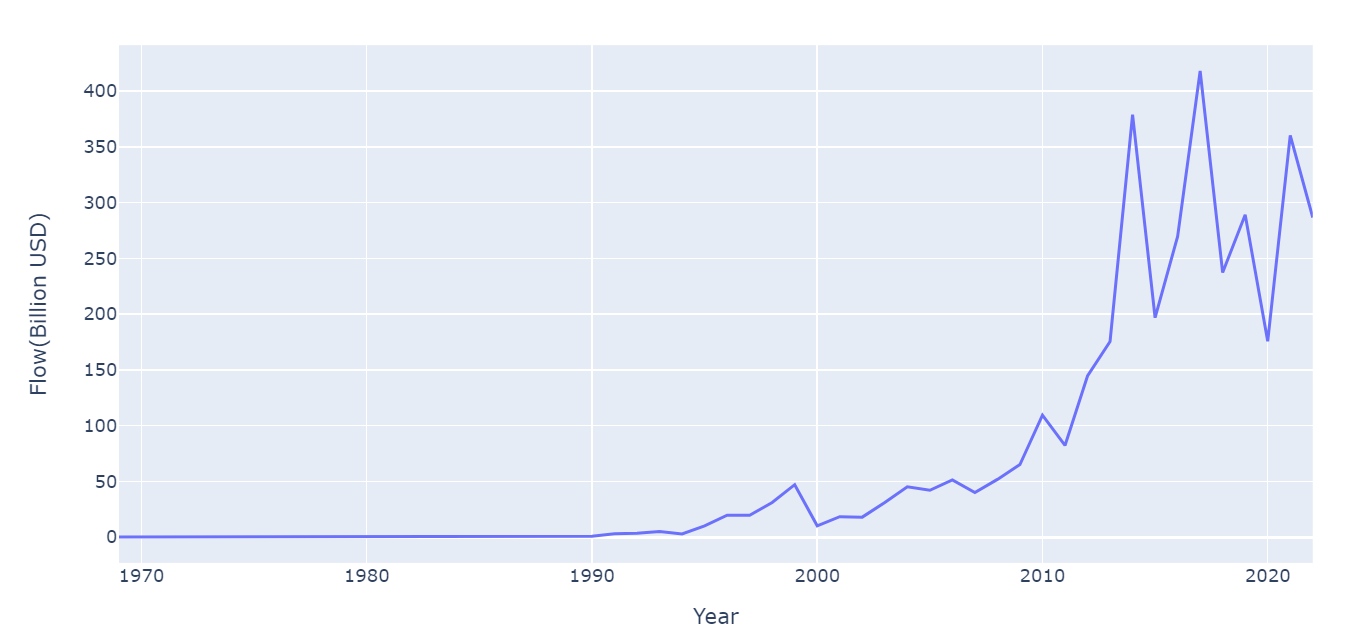

- Takes in

$1Bof assets every day for the last ten years - Net inflows in 2022 about

$151Bin 2022, down from$300Bin 2021, because of sharp downturn in 2022. Have tried replicating this numbers from a datasource and got numbers that are close enough - Vanguard’s ETF arm registered net inflows of

$210.1bnlast year, down 39 per cent on 2021 while BlackRock’s iShares ETF division saw inflows fall 28 per cent to$220bn. - Vanguard manages money for

30Minvestors - Vanguard Total Stock Market Index Fund has about

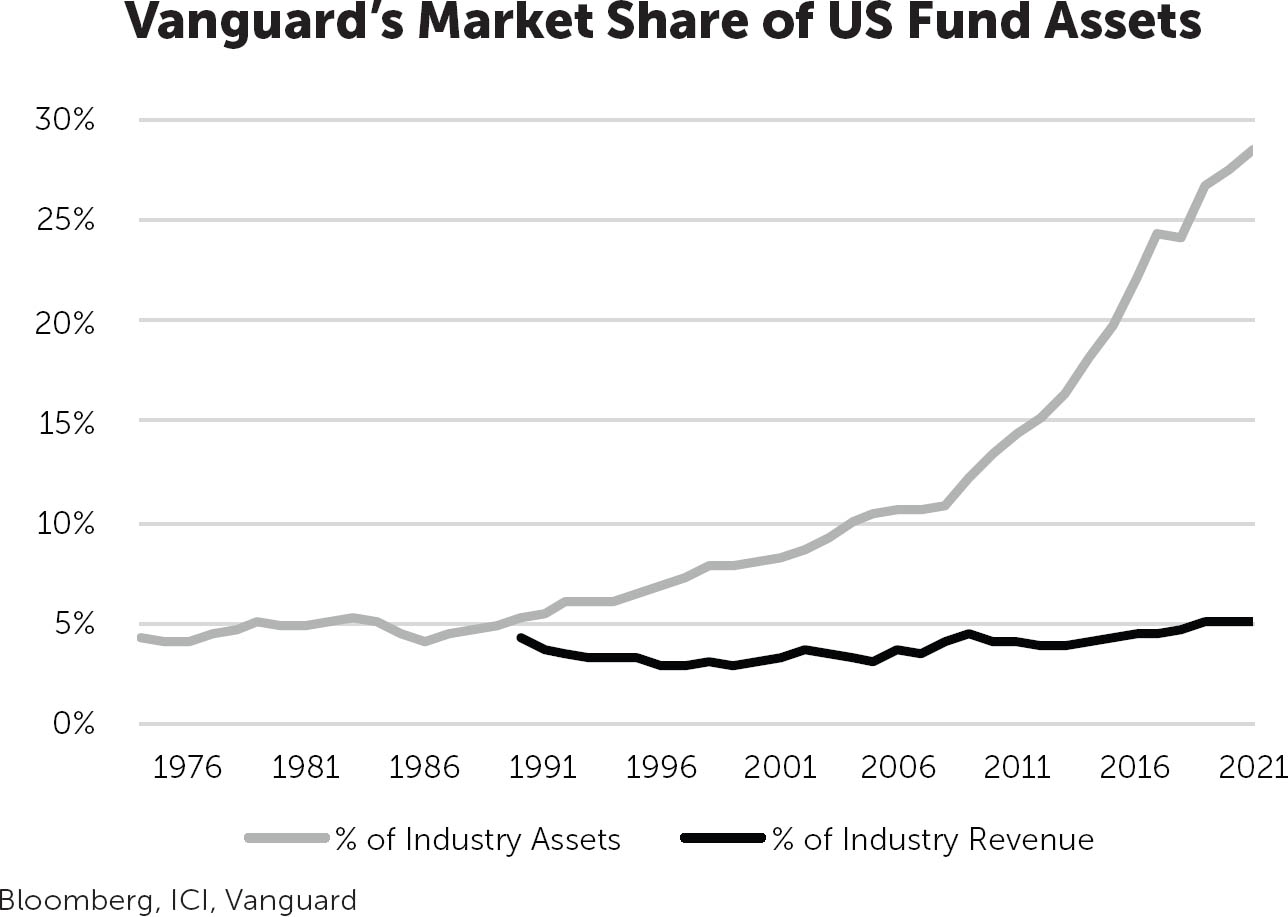

$1.1Tin assets as of Dec 31, 2022 - Vanguard has a 29 percentage of all US assets

- Active ETFs in the US are

$343.7bnin assets and passive ETFs are$6.2bnas of the end of December, 2022. - Investors poured in

$505.8bninto US passive ETFs last year(2022) and$87.8bninto active ETFs - In 2022, Active mutual funds in the US posted

$1tnin net outflows. The second-highest net redemptions from the products occurred in 2018, when investors pulled$336.5bnfrom the funds - In 2022, Active mutual funds had

$11.6tnin assets as of December 31, and index mutual funds had$4.7tn - Despite having 29 percent market share in assets, Vanguard only accounts for 5 percent of the industry’s total revenue

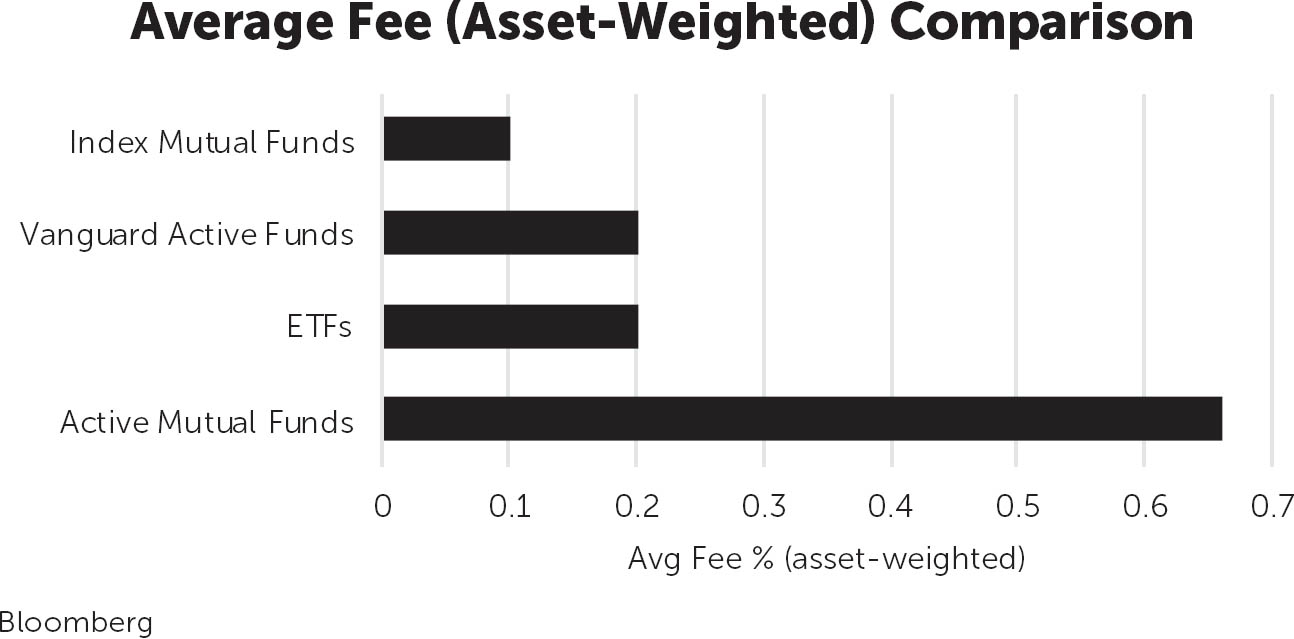

- Active Funds average fee in 2018 us about 70 bps whereas the Vanguard charges 10bps across all the funds

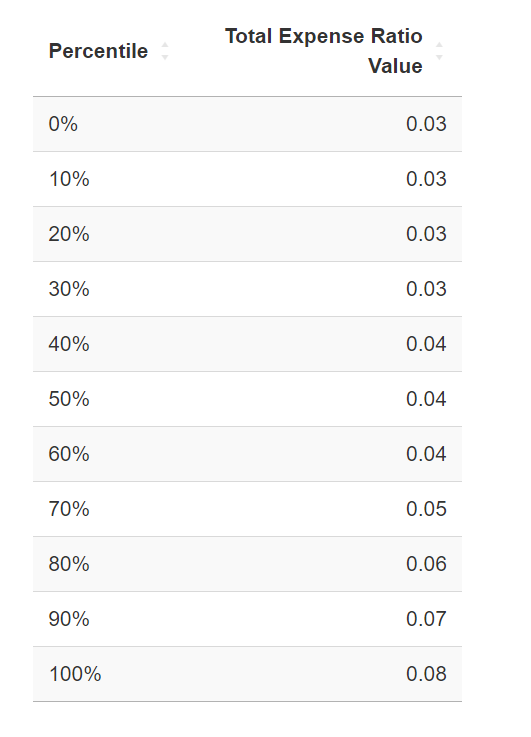

Expense ratio of all the Vanguard funds with AUM greater than 50m across its

active and passive offerings

The above shows that you can get pretty much any fund for a few bps of expense ratio.

Declaration of Independence

This chapter is all about the unique fund structure that gives Vanguard clarity on what it should be doing in bear or bull markets. Unlike most of the asset management companies, Vanguard’s shareholders are its investors and vice-versa. Vanguard Group is not owned by private owners or external retail owners. Vanguard Group is owned by Vanguard Funds that are in turn owned by Vanguard investors. This unique structure where there is only one master means it doesn’t have to vacillate between shareholders and investors interests, when they diverge. The story goes that Bogle was working for Wellington Fund that partnered with a Boston based firm, Ivest Fund, to avoid asset stagnation. The partnership turned sour and Bogle was fired. Instead of accepting the decision and moving away, he fought with the Ivest Fund founders, worked with the board of directors and created a unique management structure, and called it Vanguard. The firm administered the funds but the investment advisory services was left to Wellington Management.

This fund structure is unique in the asset management industry and somehow not been copied by many. Why? If you take Fidelity, Blackrock and all the big management firms, they serve two masters - shareholders and investors. In the case of Vanguard, there is only one master to serve. In times of distress, owners always worry about profits and sometimes their interest are at loggerheads with shareholders interest. This doesn’t arise in the case of Vanguard.

Average Is the New Great

The chapter talks about Bogle and indexing idea. It was way back in 1951 that the indexing idea came to Bogle. However it was only a month after he started Vanguard(Oct 1974), he came across an article in Journal of Portfolio Management by Paul Samuelson that laid out the case for why active managers cannot “deliver the goods” and are weighted down by “deadweight transaction costs”. It was only in 1975 that Vanguard filed for the First Index Investment trust. It attracted a seed capital of 11.3 musd. For the first decade, there were hardly any flows in to the fund, the main reason being, the funds didn’t have any loads or sales commissions. Bogle cites three reasons for the growth of index funds AUM

- Actual investor experience

- Tools to evaluate fund performance

- Educators adopted the new reality and gave it academic acceptance

- Vanguard’s preached the gospel far and wide

- Internet

The author tries to paint a more apt label for Bogle, i.e. “father of low cost investing” by recounting interviews, view points from several practitioners in the field.

Explaining Bogle

The author explains various personality traits of Bogle in such a way that it doesn’t get boring. Various stories around Bogle show that Bogle wanted adversity so that he could work on the problems that it created. Going against established institutions was in his DNA. His grandfather tirelessly advocated against insurance companies and tried to reform them. I guess there are also multitude of random factors that lead to Bogle creating Vanguard. His chance encounter with a Fortune article in Princeton library that lead him to write a thesis on passive investing. Bogle set up his company in Philadelphia, far away from the hustle bustle of Wall Street environment. It shows that he was pretty serious in the Vanguard’s direction. Bogle had so many close encounters with death that in one sense it would have helped in having immense clarity on what he intended to accomplish with Vanguard. The circumstances mentioned in the book makes the reader believe that Bogle was not some sort of guy who could see 50 years in to the future. He was a guy with a solid conviction and it was a set of fortuitous incidents that led him to asset management industry. Once a part of the industry, he experimented with all sorts of formats with one common theme - low cost investing.

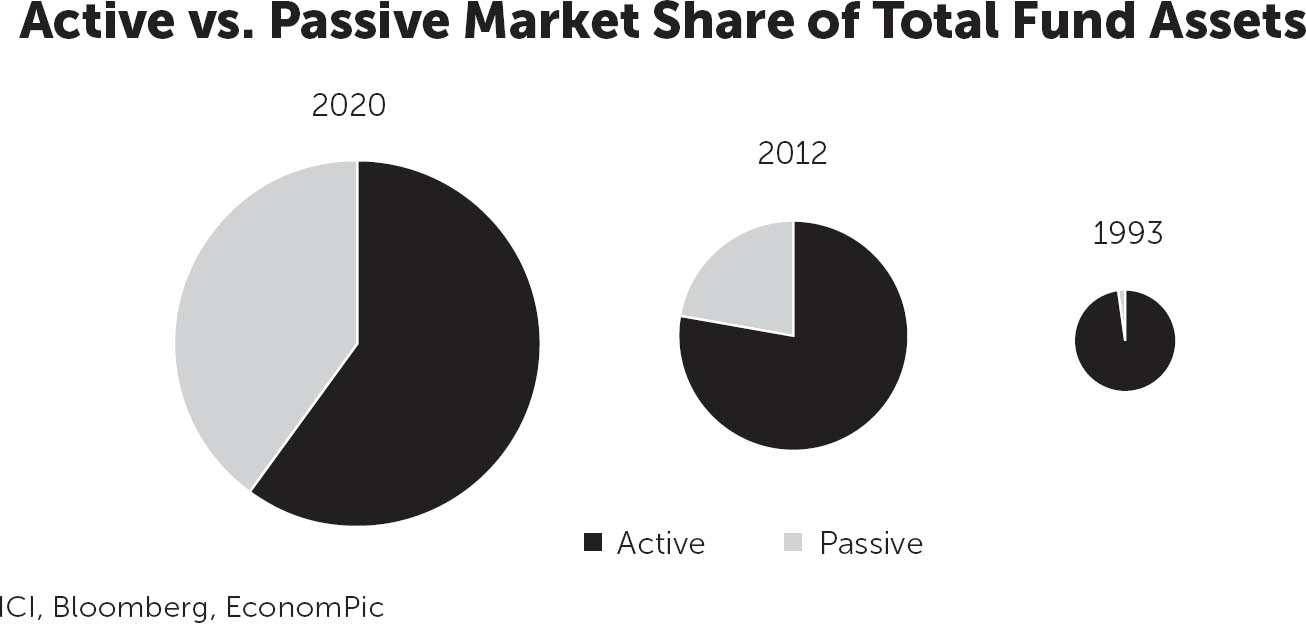

The Fall and Rise of Active

The chapter talks about the way active funds have morphed themselves to fight against the onslaught of cheap low cost index funds. Active funds used to be the core of investor portfolios decades ago. It is no longer the case. Passive low cost beta funds are sitting at the core of many client portfolios, who choose to go for passive funds rather than sticking to benchmark hugging active funds. The author goes through a whirlwind tour of smart beta indexing products, thematic funds, Bond funds, ESG funds, AARK funds to drive home the point that active investing is not dead but has morphed in to playing a complementary role in a client’s portfolio.

The reason for active losing the game is clear - they have resisted the move to low cost environment. By making it a percentage based fees, the absolute amount of dollars earned by the active players runs in to hundreds of billions. A peculiarity of asset management industry is that AUM grows if markets go up. This means that the fund complex gets paid handsomely if the market goes up(even if they don’t do anything). Resisting the Steve Jobs rule Cannibalize yourself to stay relevant is something that the active managers world wide have not followed and hence seeing a slow death

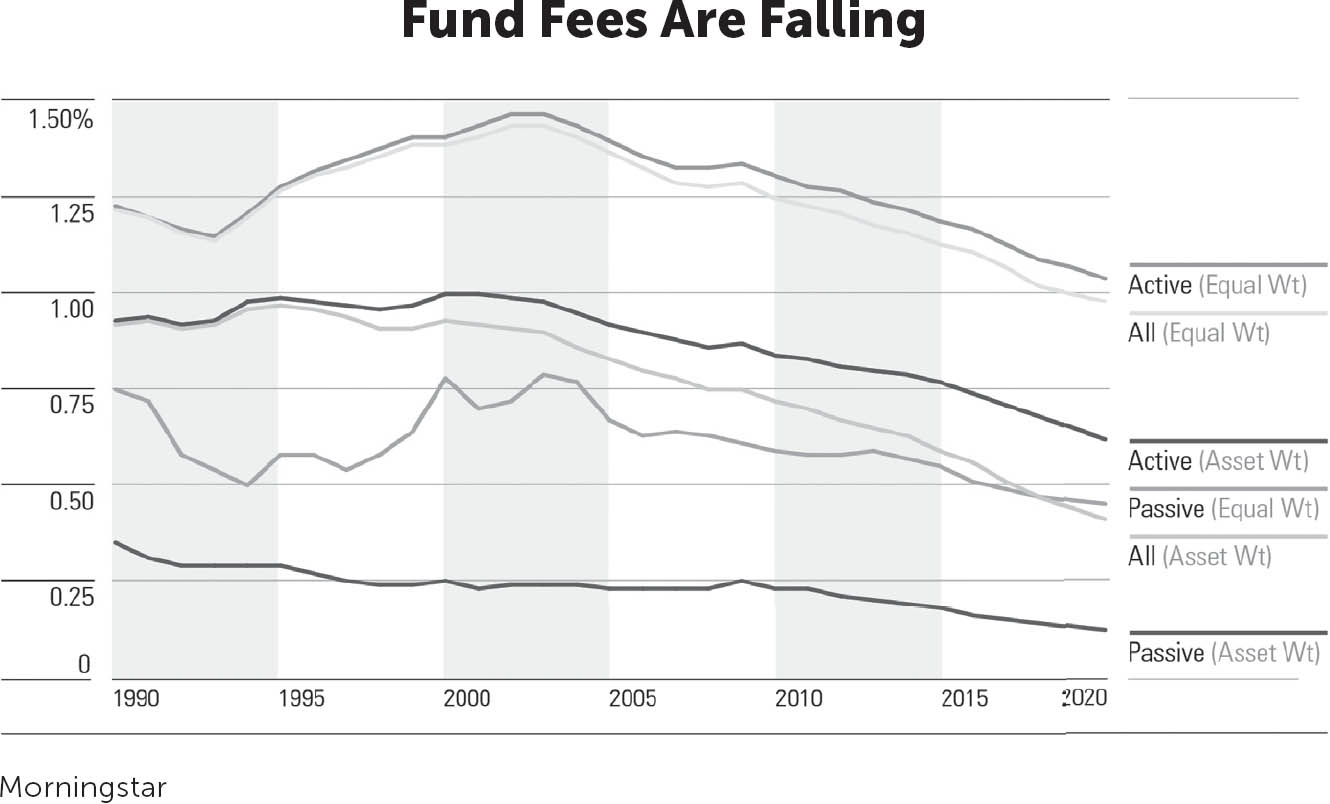

The following visual shows that active funds have really not reduced the fees, that will make them marginal players in the long run

Bogle and ETFs - Its complicated

The author talks about the fact that Bogle was always against ETFs from the get

go. Bogle dismissed Nathan Most’s idea of ETF and the rest is history. One might

wonder how does Vanguard boast of 2tn assets in ETF funds, despite the founder

being critical about the structure. The story is more nuanced. Bogle was against

ETFs for two main reasons 1) It makes investors trade 2) There is a lot of

unnecessary marketing around ETFs. However the management team at Vanguard

introduced ETFs mainly as a way to bifurcate their investor base in to a)

investors who don’t want to trade regularly b) hot money, investors who belive

in passive but are more likely to trade. Vanguard’s ETF vehicles became a

massive hit as it was the first time anyone can own a Vanguard fund unit with a

click of button. It allows brokers, advisors and retail investors to easily

access Vanguard complex.

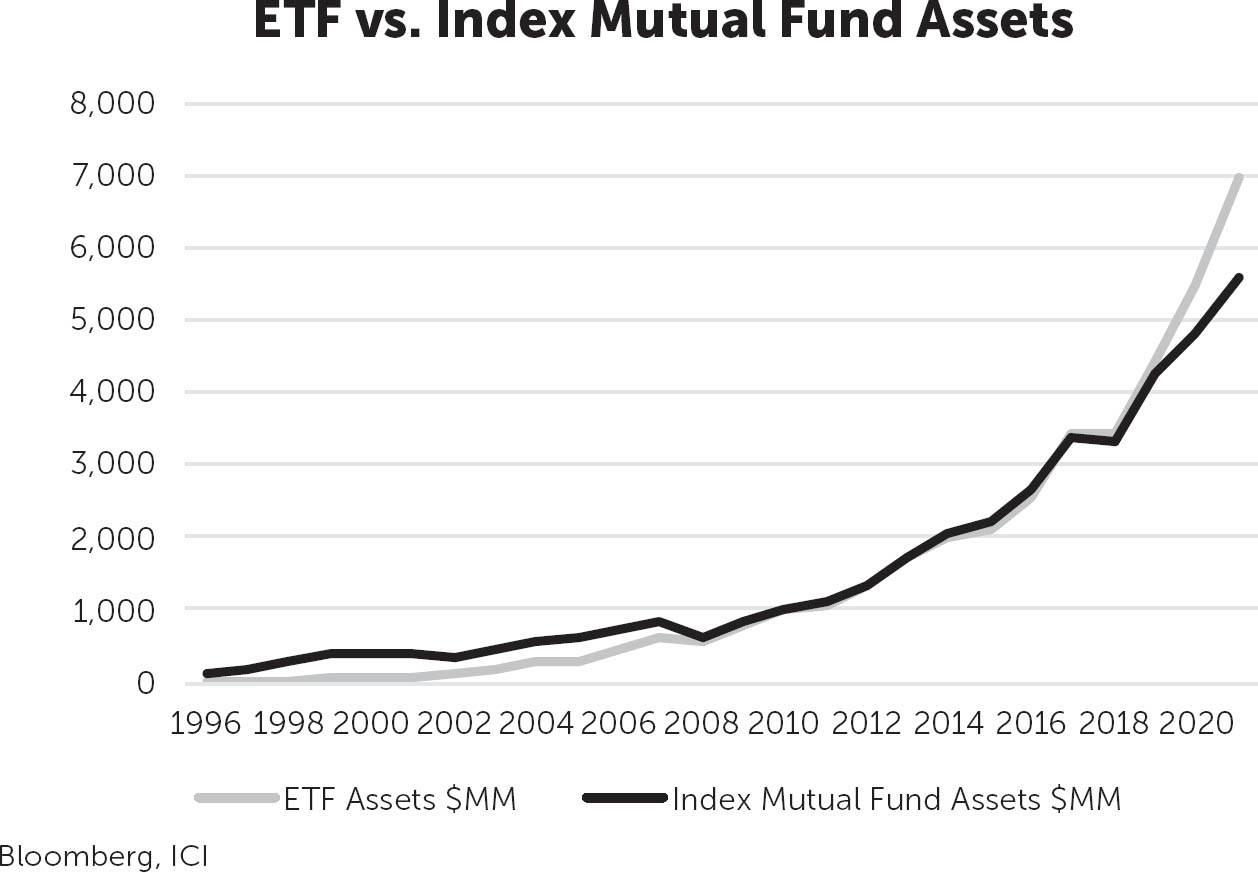

If one looks at the assets under index and ETF funds, the latter has surpassed the former, a few years ago

Have learnt an interesting aspect of Vanguard from this chapter

Vanguard is in a unique position to take great advantage of this tax efficiency issue. It has a special patent in which its ETF is a share class of the bigger mutual fund.

While crunching the numbers for AUM, I did realize that Vanguard had a special share class for ETF investors for a given fund. I never knew that Vanguard has a patent to issue ETF as a share class to an existing fund

Great Cost Migration

Despite the many trends that get mentioned in the media such as active to passive shift, passive funds to ETFs, etc., none of them are as clear as the trend “Money moving from high cost to low cost”. Expense ratio has become the defacto standard of comparision among the funds rather than the past performance of a fund. The data shows that. Correlation between low expense ratio and flows are seen everywhere in all types of funds.

The trend of money moving from high cost to low cost is seen in the US pension funds that have put massive amount of dollars in target date funds that have EFTs as the backbone.

The other players or areas where cost migration is being felt are:

- Fidelity moving to index business and lowering its fees. It has become a legit

passive player with

1tnin index assets - Fidelity race to the bottom when it announced zero fee index mutual funds

- Massive cost pressure and competition among passive and ETF funds

- Advisory fees getting lower. Prediction that it will become an hourly rate rather than AUM based

The author does a bit of crystal gazing here and puts out the following points as future trends:

- Active mutual funds will be a disaster in the coming bear market when they are

hit by triple whammy

- Older investors take out money in time of panic and hence outflows.Gives tax conscious investors to book losses and hence there is outflows

- Passive funds hold up in bear and bull markets. More so relatively in bear markets. Most of the fund flows will end up in passive low cost funds.

- Baseline of outflows that are going from active to passive.

- More and more mutual funds will convert to ETFs

- Vanguard is going to disrupt the Advisory space by introducing low cost advisory service

- Be Cheap or Be Niche will be the mantra for existing and future funds

- Direct Indexing might become more popular

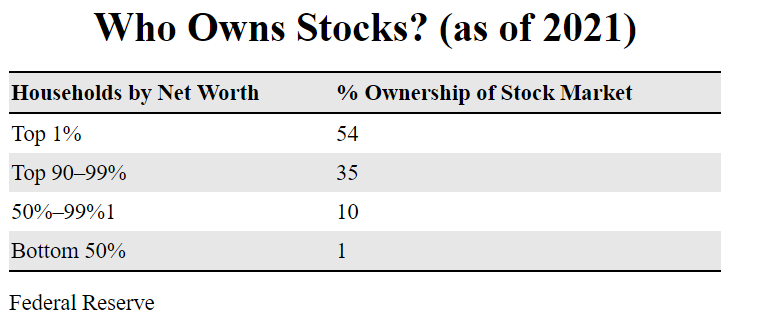

Some Worry

The author points out some of the worries voiced out by various industry participants as the size of passive becomes big

- Passive funds can cause market bubbles

- Passive funds can distort the market

- Can create a liquidity mismatch

- Too much of voting power

- Bad customer service

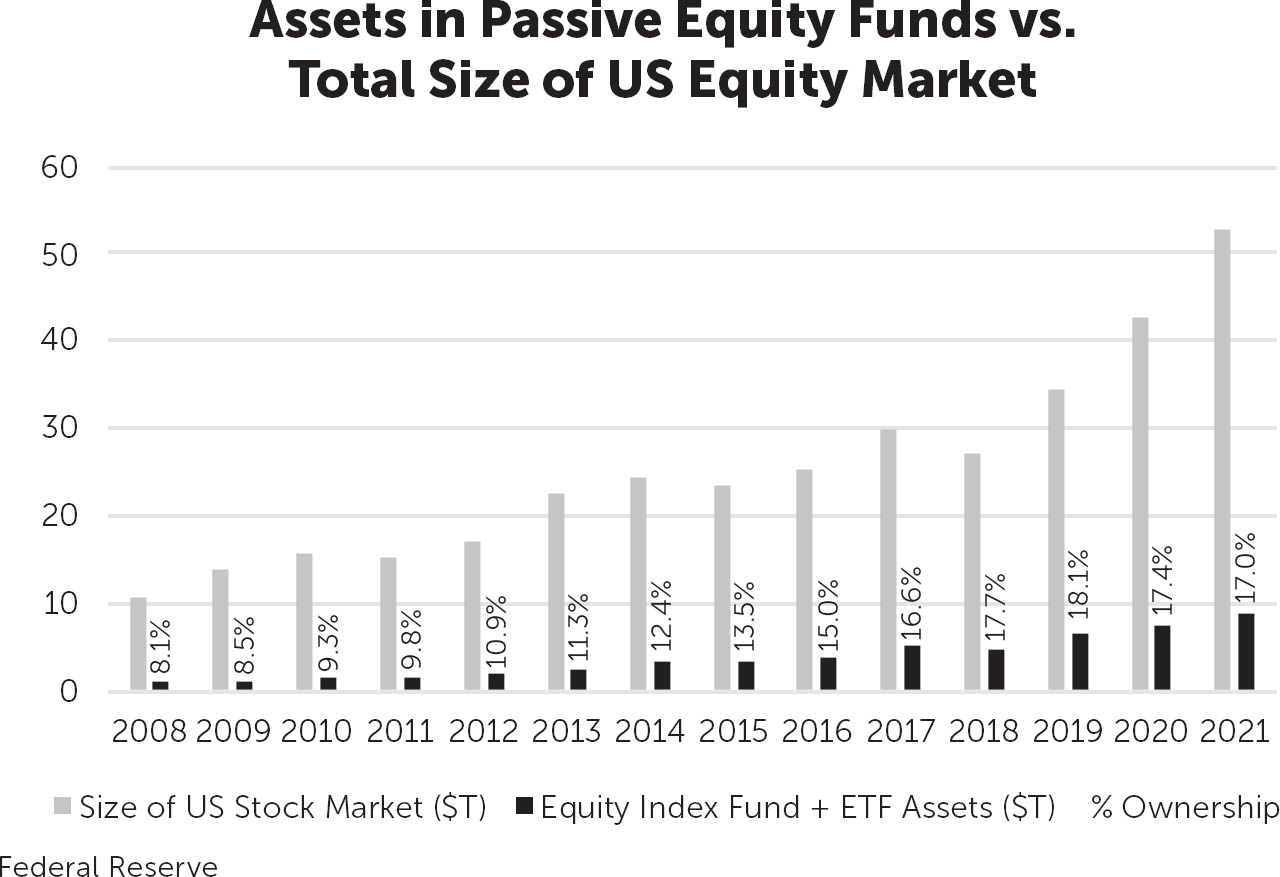

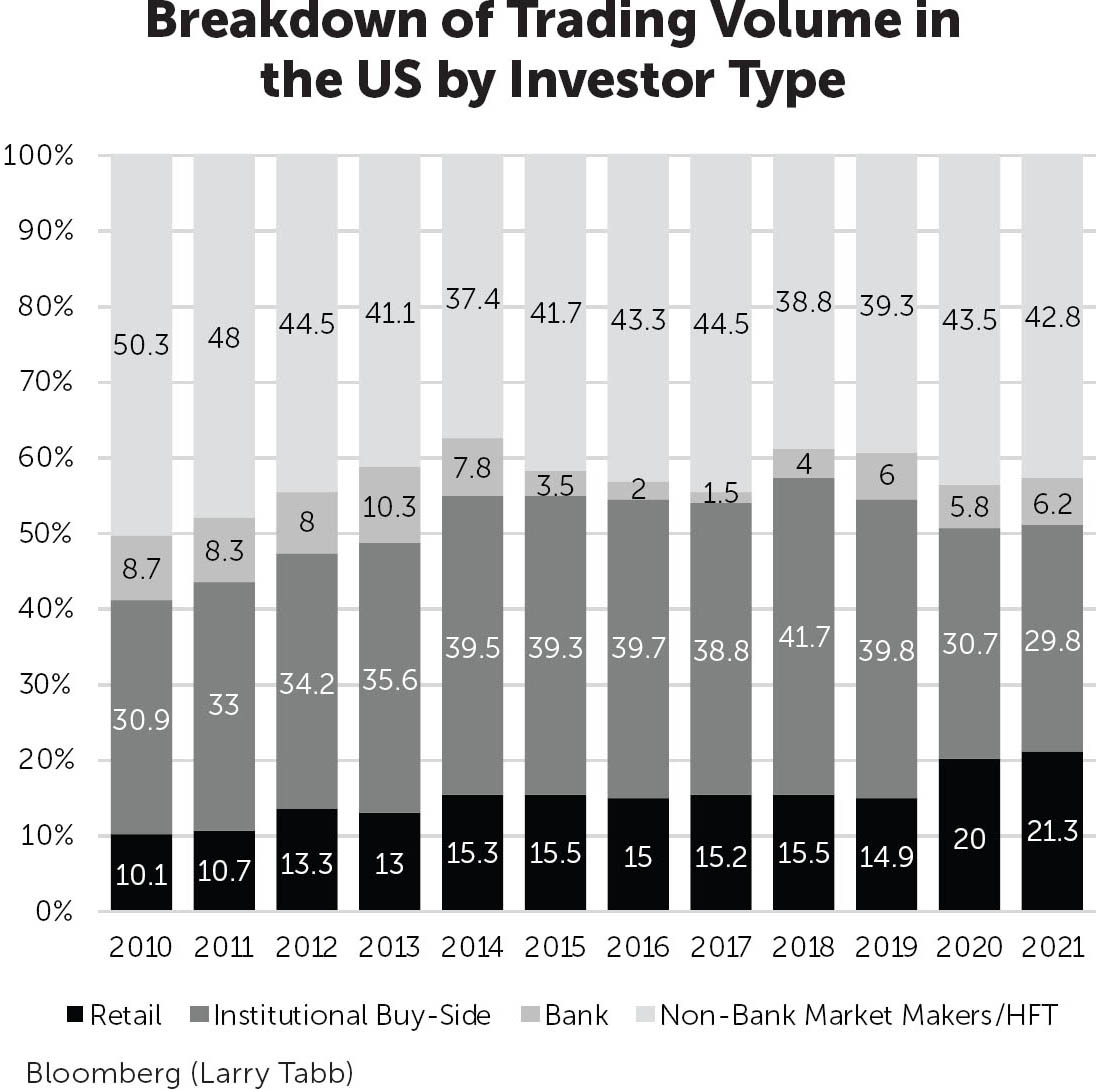

Here are some of the metrics and visuals from this chapter

- Of that $53 trillion worth of US stocks, index funds and ETFs own 17 percent. The remaining 83 percent of stock shares are owned by households, active mutual funds, institutions, foreign investors, hedge funds, and businesses.

Rest of the book

The last three chapters of the book spice up the content. Nothing specific stuck in my mind.

Here are some metrics and visuals from the remaining chapters

- Bogle was way ahead of this trend when he launched the Vanguard Quantitative Portfolios fund, in 1986, the first retail quant fund. Since then, Vanguard has expanded its factor offerings to include a large suite of funds. It has a whole department for this called the Quantitative Equity Group (QEG), which has a healthy—albeit modest for Vanguard—$50 billion in assets. The thirty-four-person team oversees forty-one mandates, including factors and liquid alternatives (hedge fund–style strategies). At the end of the day, there are clients who like to invest this way.

- There are about 4k companies listed in US. There are about 3000 ETF funds and there are about 35k mutual funds in USA

- In 1950s, the annual turnover of the entire stock market (the volume of stocks

traded in dollar terms divided by the total sum of the market cap of all

stocks) was about 15 percent. It rose to 100 percent by the late 1990s, only

to hit 250 percent in 2011. In 2020, it was 317 percent. To break that down,

this means that there was

$120trillion worth of stock (and ETFs) trading, yet the total market cap of the stock market was “only”$38trillion.

Takeaway

This book is a great read for someone who wants to get an up to date knowledge on the trends in the passive asset management industry. Even though the book is about Vanguard, the metrics and interviews quoted across the book make it a very interesting and informative read. I had access to all the Vanguards funds data and hence managed to replicate most of the numbers mentioned in the book. I like this book mainly because it is not a single track book (given the title), but it is a combination of many types of content all in one book - data and metrics about asset management industry, practitioners opinions, good narrative on the history of Vanguard and Bogle, various fund structures in the industry and future trends in the asset management industry. Overall, happy to have spend some time going through this book.