Trillions - Book Review

Contents

This blogpost is a brief summary of the book titled “Trillions”, by Robin Wigglesworth.

Buffets Bet

The first chapter is all about a bet between Warren Buffet and Ted Seides about the performance of index vs fund of funds. A decade spanning bet that was ultimately won by Buffet serves as a great start to the book highlighting the power of passive fund performance against the brainy hedge fund managers.

Figure 1: Bet

When Ted Seides wrote a letter to Warren Buffett accepting his offer of a bet to pit hedge funds against an index fund, he was delighted when Berkshire Hathaway’s chairman scrawled his positive response and sent it back

The Godfather

Figure 2: Leonard Jimmie Savage

The author mentions Savage’s role in popularizing the work of Louis Bachelier

Figure 3: Louis Bachelier

The story of Louis Bachelier is known to every math fin student as this was the first recorded attempt at modeling stock prices as a function of brownian motion

Figure 4: Alfred Cowles

The author narrates the story of Alfred Cowles who went on to set up Cowles Commission for Research in Economics, which housed many economists and financial academics

Figure 5: James Lorie

The author narrates the story of James Lorie who worked with CRSP database and churned out very interested research findings.

Taming the demon of chance

This chapter talks about the Chicago school academic stalwarts who came up with efficient markets hypothesis. These include Harry Markowitz, Gene Fama, William Sharpe, Most of the students of finance will be familiar with the content of this chapter.

Figure 6: Harry Markowitz

The cerebral, philosophy-loving Harry Markowitz is one of the most influential economists of all time. To many admirers, his modern portfolio theory is the genesis of modern finance and underpins much of the academic groundwork behind the invention of index funds.

Figure 7: William Sharpe

Harry Markowitz’s protégé William Sharpe showed that the entire stock market was the optimal trade-off between risk and reward. His work earned both Sharpe and Markowitz Nobel laureates in economics, and helped pave the way for the birth of the first passive, market-tracking fund.

The Quantifiers

The author gives the story behind three people who became known for offering index products to institutional clients. Behind the firms are of course the stories of people who made it possible and they are :

Figure 8: McQuown

McQuown was made in charge of Management Sciences division at Well Fargo, where he went to launch “Stagecoach Fund” that was aimed to give index returns to pension funds

Figure 9: Rex Singqufield

Singqufield worked at American National Bank of Chicago and tried to convince the board in launching a beta product for its institutional clients

Figure 10: Dean LeBaron

Dean LeBaron started Batterymarch ventures and one of the first products to be launched was Batterymarch Market portfolio that was offered as a separately managed account.

Bastions of Unorthodoxy

The chapter talks about the way Wells Fargo took the analytical groundwork by Scholes and Black on passive funds and implemented as a product that investors could then put in their money.

In a Dec 1969 report to Wells Fargo, Scholes and Black proposed three options

- Passive fund that would buy the entire stock market and juice its returns by also borrowing money

- Passive fund that would buy only low-beta stocks but again use borrowed money to lift its overall volatility to the market average

- Fund that would buy low beta stocks ad actually bet against higher beta stocks

Wells Fargo took the second option and launched a fund names “Stagecoach Fund”, in an homage to the bank’s famous gold rush-era logo. The fund was soon shelved because of regulatory concerns.

The people who were the brains in implementing “Stagecoach Fund” and later an internal unit called Wells Fargo Investment Advisors were:

Figure 11: McQuown

John “Mac” McQuown was a former farmhand and Navy engineer who entered finance with an unusual amount of drive and love for computers. The combination proved vital when he launched the inaugural index fund at Wells Fargo.

Figure 12: Jim Vertin

Figure 13: William Fouse

Notes

- Wells Fargo, American National and Batterymarch initiatives represented one of the biggest and the most influential innovations of the modern era

- By 1975, Wells Fargo, Batterymarch and American National Bank of Chicago were all successfully running cheap index-based strategies for a clutch of forward thinking pension funds and endowments

- LeBaron closed down Batterymarch’s index-tracking strategy in 1980, thinking that the industry has become too commoditized

- American National Banks products did not get much traction in the early years.

The Hedgehog

Figure 14: John Bogle

The chapter starts off mentioning a paper written by John Bogle, under the pseudonym, John B. Armstrong, stating that common stock funds have shown better long-term results than the Dow Jones. The hedgehog in the title of the book is meant to refer John Bogle who tirelessly advocated for passive low cost investing.

The story about Bogle makes the reader wonder about so many coincidences that put him on the path to indexing.

- Because of his good grades, he was sent to Blair academy instead of his brothers. The family could not afford education for all

- Bogle stumbled on to an article in Fortune that talked about active management and then ended up writing a thesis

- Bogle joins Wellington and helps the firm launch a fund that invest purely in stocks,that was subsequently managed by John Neff

- Bogle partnered with Ivest Fund who eventually fired Bogle

- Bogle instead managed to convince the board that Wellington continue to handle all fund operations except administration. The administration would be done by a subsidiary company

Bogles Folly

This chapter narrates the Vanguard’s story right from the first index launched until 1980, when it had secured its position in the industry.

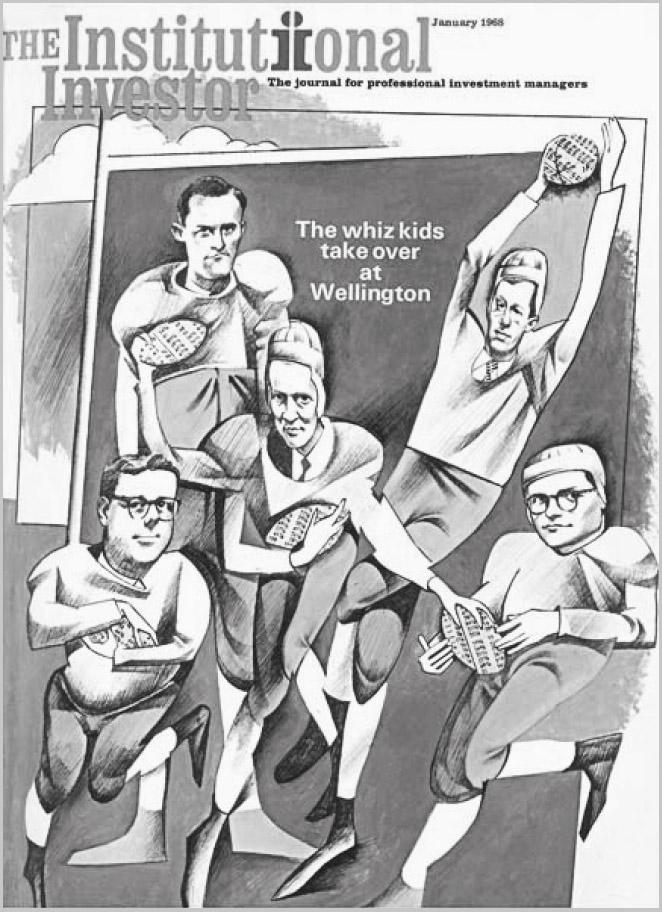

Figure 15: Bogle Ivest Marriage

Initially, the merger of Wellington and the Boston-based firm TDP&L looked like the perfect marriage of “whiz kid” money managers with a pedigreed investment house in need of new blood—as this Institutional Investor cover from 1968 showed. But the marriage quickly soured

Notes

- Bogle’s therapist advice - keep your bitterness in a mental box and try to lock it away. Occasionally, he should lift the lid and feel bitterness again

- Vanguard incorporated in 1974

- Jan Twardowski set about researching the indexing concept, and wrote some programs testing it out in APL

- Vanguard filed for First Index Investment Trust in Dec 1975. By the end of

1976, it had managed to gather only

14mnUSD. It did not cross the100mnUSD mark until the end of 1981 - In the tougher 1970s, some of the mutual fund groups started to convert to a no-load fund

- Vanguard launched a fund in 1977 that allowed it to invest in US municipal bonds.

Vanguard Rising

This chapter talks about the story of Vanguard from its initial fund launch to the massive company that is has become today. The main characters of the story are(of course, besides Bogle)

Figure 16: George Sauter

Figure 17: John Brennan

Earlier this week, I read a book by Eric Balchunas on Bogle, that I thoroughly enjoyed. Since most of the content of the book was fresh in my mind, this content of this chapter felt repetitive for my mind.

Figure 18: Bogle Boys

The Bogle Boys. Vanguard’s founder Jack Bogle always had a young assistant to mentor, and every year all past and present assistants would have a boozy Christmas dinner with their boss. From top left to right: Jeremy Duffield, Jim Riepe, Daniel Butler, Jan Twardowski, Duncan McFarland. From bottom left to right: Jack Brennan, Tim Buckley, Jack Bogle, Jim Norris.

Notes

- First Index Investment Trust was rechristened as the Vanguard 500 Index Trust in 1980

- Vanguard has 100musd in 1982 and reached 1bn usd by 1988

- Banks such as Wells Fargo Investment Advisor,State Street and Bankers Trust, whose index strategies were all growing strongly among institutional investors were precluded from entering the retail arena

- Vanguard 500 in April 2000 vaulted past Fidelity’s famed Magellan Fund

- In 1992, Vanguard launched Total Stock Market Index fund

- Brennan and Bogle’s fight

New Dimensions

The chapter talks about origins of Dimensional Fund advisors. Until reading this book, I never knew that the word “dimension” was chosen as a marketing ploy as “small-cap dimensional fund” was more cooler sounding term than “small-cap index fund”.

The story revolves around three people who came together with a single motive of selling more meaningful financial products to investors.

Figure 19: David Booth

The chapter traces the story of David Booth through Univ of Chicago - Wells Fargo - AG Becker to DFA

Figure 20: Rex Sinquefield

Figure 21: Jeanne Sinquefield

The chapter traces the story of Rex Sinquefield through Univ of Chicago - American National Bank and ending up as DFA founder. It is also mentioned that Jeanne Sinquefield who joined as head of trading, played a pivotal role in the success of DFA

Figure 22: Larry Klotz

David Booth met Klotz at AG Becker and the duo worked together for creating a small cap fund. However AG Becker was not interested in money management and hence they went ahead and created their own firm and called Dimensional Fund Advisors

Figure 23: DFA

When David Booth, Rex Sinquefield, and Larry Klotz teamed up to start Dimensional Fund Advisors and run the next-generation of index funds, they enlisted their mentors John McQuown and Gene Fama to sit on their board. From left to right: McQuown, Klotz, Fama, Booth, Sinquefield.

Notes

- DFA’s initial investor money came from pension plans

- A chance rejection at the military lead David Booth in to academia

- Fama’s connection to Wells Fargo helped Booth get his first job

- Bogle agreed to do all the administrative heavy lifting for DFA at a modest fee

- Bogle introduced DFA to a lawyer who then helped the founders in setting up a board of directors

- DFA’s board comprised academic superstars from Chicago’s school of business

- DFA launched its first fund in Dec 1981

Bionic Betas

This chapter is mainly DFA’s foray in to other funds/dimensions. However the title of the chapter is rather intriguing for a modern day reader. What is bionic about beta. Digged around the internet to learn the following:

What does the word bionic mean ?

The word bionic, coined by Jack E. Steele in August 1958, is a portmanteau from biology and electronics[2] that was popularized by the 1970s U.S. television series The Six Million Dollar Man and The Bionic Woman, both based upon the novel Cyborg by Martin Caidin. All three stories feature humans given various superhuman powers by their electromechanical implants.

Why was it called bionic ?

The process of putting a portfolio together using various risk factors is known in institutional and academic circles as multifactor investing. But that’s not a sexy term. Something with more spice always raises eyebrows and sells better. Rosenberg’s multifactor models became known in the industry as “Barra’s Bionic Betas” because it was the 1970s.

Institutional investors flocked to Bionic Beta, and a May 1978 issue of Institutional Investor made Rosenberg a cult figure. The cover depicted him sitting in a pink robe on top of a mountain with hands lifted in the air, flowers around his neck and shoulders, and throngs of money manager giving praise to this disciple.

The chapter mentions the following people to narrate the story of DFA venturing in to value funds, growth funds and all sorts of factor based funds that investors were willing to buy.

Figure 24: Stephen Ross

Stephen Ross with his APT captured the imagination of DFA founders

Figure 25: French and Fama

French and Fama published their research that gave wings to DFA’s idea that there could be value in packaging various factors as funds

Figure 26: Dan Wheeler

It was Dan Wheeler’s idea that DFA should sell funds to fee-only financial

advisors. Fantastic idea that has worked wonders for DFA. Today 2/3 of DFA’s

600bn assets are from financial advisor accounts

Notes

-

Klotz was kicked out of DFA

-

Academic superstars on board helped in selling DFA

-

DFAs seminars and workshops have over the years players a vital role in disseminating the academic theories among America’s army of financial advisors

-

French and Fama three factor model was the beginning of a big big breakthrough for DFA

-

Barr Rosenberg came up with Bionic betas strategy. Ultimately he was charged by SEC for not divulging the model details to his clients

-

Smart beta investing is just another fancy name for factor based investing

-

Money in pension plans in US accounts to $30T as of today

The Spiders Birth

Figure 27: Nathan Most

The chapter traces the life of Nate Most and the circumstances that led him to a role at Amex in charge of Amex derivatives unit. Amex was losing market share and was desperate for new product that could boost the trading volumes. It was an SEC report on the postmortem of Black Monday that triggered the thought process of Nate Most and Steven Bloom at Amex. SEC noted that

“An alternative approach be examined” and suggested that if traders could have turned to a single product for trading entire basket of stocks, it might have ameliorated the turmoil by providing a kind of shock absorber between the futures market and individual stocks.

Based on the above statement, many exchanges started filing for products that could fill this need. Most of the products carried names such as “Cash index participation shares”, “Index participation shares”.

Most’s idea was to mimic the structure that he had seen as a commodities trader in the Pacific.

Most’s electic background also provided the spark behind the invention of what would become known as the ETF. During his travels around the Pacific, he had appreciated the efficiency of how traders would buy and sell warehouse receipts of commodities, rather than the more cumbersome physical vats of coconut oil, barrels of crude, or ingots of gold. This opened up a panoply of opportunities for creative financial engineers.

The chapter traces the troubles that Most and Amex had to go through in launching the first ETF in the US market. The ETF application was filed with SEC in 1990 but it faced a long and arduous approval process. IN the mean time, Toronto stock exchange launched Toronto 35 Index Participation Funds, technically the first ETF in the world. Seeing that a product was already launched in Canada made the Amex team and the other rival players in the US market vie for launching a fund in US. It was only in 1993 that SPDR finally began trading with a fee of 20 bps a year. However it had a rocky ride. Amex at one point in time considered scrapping it. Thanks to some chance events, SPDR lived on and today it is the largest ETF in the world with 356 busd.

As an aside, I have learnt a new word sliding door moment

The term a sliding doors moment became a term popularised in the late 20th-century meaning seemingly inconsequential moments that nonetheless alter the trajectory of future events. The term originated from the 1998 film Sliding Doors, written and directed by Peter Howitt and starring Gwyneth Paltrow

WFIA 2.0

It was Wells Fargo Investment Advisors that came up with the idea of indexing, but somehow could not sustain it. The mounting tension between Wells Fargo and WFIA lead to many people leaving WFIA. The author tells the resurrection of WFIA via two characters, Patricia Dunn and Fredrick Grauer.

Figure 28: Patricia Dunn

Figure 29: Fredrick Grauer

The story of the way WFIA became Wells Fargo Nikkon Investment Advisors and subsequently acquired by Barclays Global is very interesting. The chapter reads like a non-fiction thriller.

Figure 30: Robert Tull

There is also a mention of Robert Tull whose brain child was OPALS(Optimized portfolios as listed securities). The chapter traces the way his work culminated in WEBS, that was rechristened to iShares. His bio at CFA site read as follows

Robert S. Tull, Jr., has been a well-recognized expert in the exchange-traded fund (ETF) market since 1993, when he was one of the principals behind the development of WEBS, the precursor to iShares ETFs. Since then, he has consulted with issuers and governments on ETF infrastructure support, become a named inventor on multiple security patents involving exchange-traded products, and played a leading role in the design and development of over 400 exchange-traded products in the United States, Europe, and the Pacific Rim. Recently, Tull was presented the ETF 2018 Nate Most Lifetime Achievement Award.

Figure 31: Lee Kranefuss

Lee Kranefuss also played a major role in making sure that WFIA, the acquired unit became a profitable division with in Barclays. The chapter does a great job of weaving his contribution to iShares success story.

Notes

- Patricia Dunn, a rookie was given

25bnfund to manage - Vanguard was skeptical about ETFs but helped Nate Most shape his ideas

- Burton Malkeil was on the board of Vanguard. Malkeil also chaired Amex and was enamored by Most’s idea

- Nate Most spent most of his life in the commodities business

- SEC’s hint started off a race for launching index products

- CFTC killed off IPS product from Amex

- SPDR name : Inspired by Amex’s role in introducing American Depositary receipts - in essense US listed versions of stocks trading on overseas exchanges - they eventually went for Standard & Poor’s Depositary receipts - SPDRs

- On Mary 9, 1990 Toronto 35 Index participation fund was launched

- By 1993, SPDR finally broke the $300 million of assets mark

- Trusts have a finite life span. But they can also tied to the longevity of individual people, so it was later and amended and pegged to eleven children born around 1990-1993

- ETFs were called WEBS before it was rechristened to iShared in May 2000

Larrys Gambit

This chapter has a ton of interesting people mentioned. Firstly all the founders of the mortgage trading team, later called as Blackrock. The founders reached to Blackstone and hence the founders of Blackstone played a pivotal role in the birth of Blackrock, then called as Blackstone Financial Management.

The chapter narrates the story of Larry Fink creating a superstar team and then becoming a part of Blackstone. From Blackstone to PNC to Blackrock IPO, the author does a great job of narrating the story behind BlackRock

Figure 32: Stephen Schwarzman

Figure 33: Pete Peterson

Here is the founding member team who then went on to become Blackrock

Figure 34: Larry Fink

Figure 35: Rob Kapito

Figure 36: Ralph Schlosstein

Figure 37: Barbara Novick

Figure 38: Ben Golub

Figure 39: Keith Anderson

Figure 40: Susan Wagner

Figure 41: Hugh Frater

Notes

- Merill Lynch Investment Managers was acquired by BlackRock

- BlackRock’s Aladdin - Asset Liability, Debt and Derivative Investment Network was the crown jewel of the company.

- Six other founders of the BlackRock’s core team received equal stake

- Fink wanted a separate identity for his team and hence managed to convince Blackstone to have the group name as “Black Rock Financial Management”

- Fink started his day at 6:30 AM every day. Wow!

Deal of the century

Figure 42: Mark Weidman

This chapter talks about the integration troubles between BlackRock and BGI and the role of Mark Weidman in the transition of BGI culture to BlackRock culture.

Purdey Shotguns

Why is the chapter titled Purdey Shotgun ? Well, it is thanks to Bogle’s quote

The ETF is a little bit like the famed Purdey shotgun that you buy over in London. It is the greatest shotgun ever made. It’s great for killing big game in Africa, but it’s also great for suicide

The chapter gives a list of niche ETFs that have been launched in the recent years. The point the author is trying to make is that ETFs are now smelling as active funds with super niche objectives

Here is a quote to show the various flavors

It is fair to say the attendees of the carnival-like conference just outside Miami took little note of McNabb’s consternation. Investors have in recent years been able to buy niche, “thematic” ETFs that purport to benefit from—deep breath—the global obesity epidemic; online gaming; the rise of millennials; the whiskey industry; robotics; artificial intelligence; clean energy; solar energy; autonomous driving; uranium mining; better female board representation; cloud computing; genomics technology; social media; marijuana farming; toll roads in the developing world; water purification; reverse-weighted US stocks; health and fitness; organic food; elderly care; lithium batteries; drones; and cybersecurity. There was even briefly an ETF that invested in the stocks of companies exposed to the ETF industry. Some of these more experimental funds gain traction, but many languish and are eventually liquidated, the money recycled into the latest hot fad.

Rest

The rest of the book highlights some of the issues that we are already facing with the growth of passive funds. It also highlights several issues that will be critical if the passive funds dominate. Interesting read but it looks more like reading various FT articles and should have been left out of the book.

It is not only passive funds but also index construction companies that have become superpowerful in terms of inclusions and exclusions.

Notes

-

Inspire investing launched “biblically responsible” exchange traded fund in 2017

-

The vast majority of the money is housed inside the big, mainstream ETFs, such as State Street’s pioneering SPDR, or the equivalent S&P 500 ETFs managed by rivals BlackRock and Vanguard. It is also still primarily a US-based industry. Outside of Japan, the first Asian ETF was launched in 1999, and Europe saw its first one in 2000, yet ETFs listed on North American exchanges still account for almost two-thirds of the total, according to JPMorgan.

-

There are three million indices that track something or the other

-

In contrast, there are only about forty-one thousand public companies in the world today.8 In reality, probably only three to four thousand of those stocks are tradable.

- Do we need so many indices ?

- Do we need so many ETFs?

-

Inverse and leveraged exchange-traded products are not ETFs, and they don’t perform like ETFs under stress. That’s why iShares does not offer them

-

Many inverse, leveraged, and otherwise derivatives-based ETPs suffered another blow in the market mayhem that followed the COVID-19 pandemic. Over forty—most of which linked to commodity indices—were quickly aborted by their sponsors

-

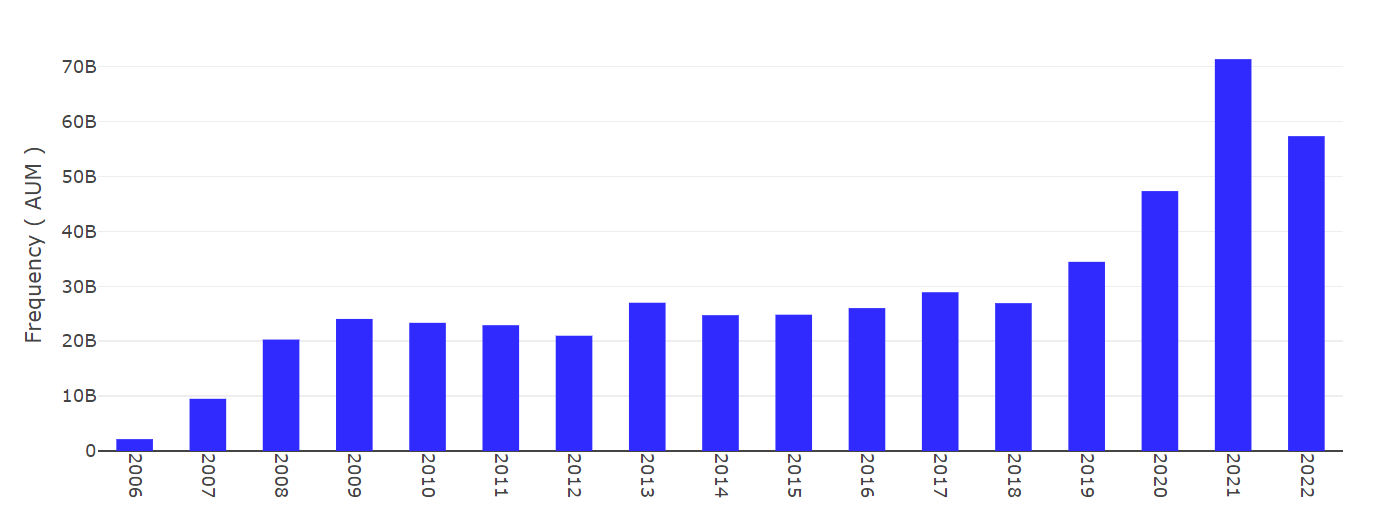

The first leveraged ETF was launched by a small upstart investment group called ProShares in 2006, and the overall assets held by leveraged or inverse ETFs rose to over 60bn by 2022

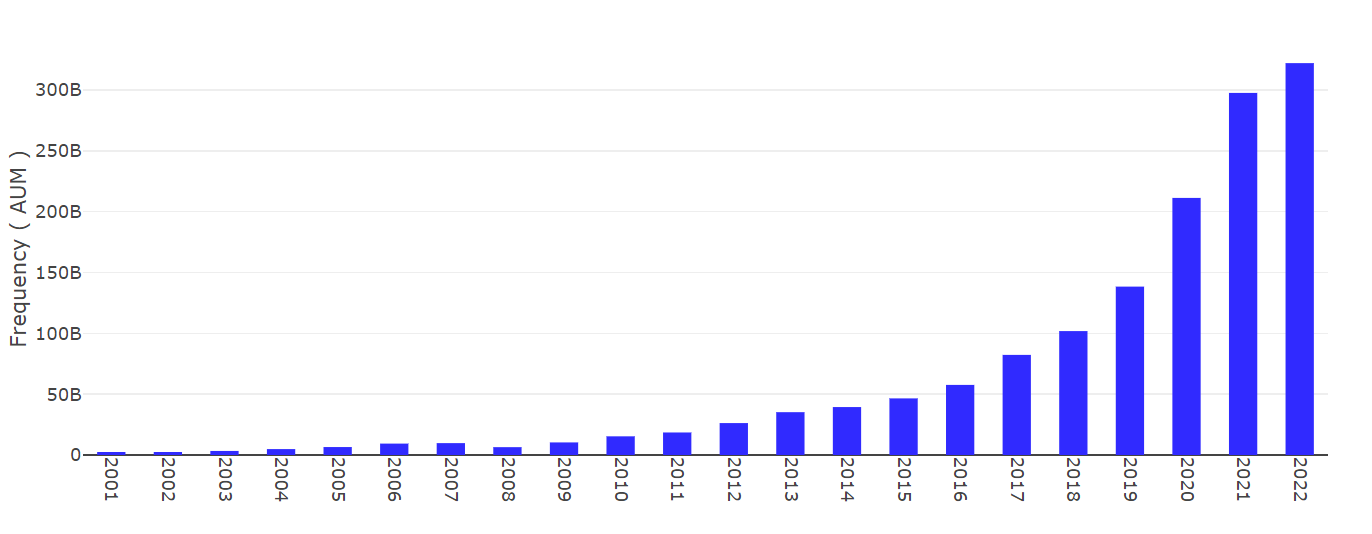

Figure 43: Proshares AUM

-

Active funds have grown massively in the last decade. As of 2022, there are 266 funds with AUM of 300bn dollars

Figure 44: Active ETF AUM

-

The three biggest index providers are MSCI, FTSE Russell, and S&P Dow Jones Indices

-

THE POWER OF MSCI, FTSE RUSSELL, and S&P Dow Jones Indices is largely over only stock markets. Of even greater and direct importance to countries are their presence and weighting in various influential bond market indices. These may not have the cachet of the brand-name stock market benchmarks bandied about on TV bulletins, but indices like the Bloomberg Barclays Global Aggregate or JPMorgan’s EMBI and GBI-EM are also powerful in their own wayTHE POWER OF MSCI, FTSE RUSSELL, and S&P Dow Jones Indices is largely over only stock markets. Of even greater and direct importance to countries are their presence and weighting in various influential bond market indices. These may not have the cachet of the brand-name stock market benchmarks bandied about on TV bulletins, but indices like the Bloomberg Barclays Global Aggregate or JPMorgan’s EMBI and GBI-EM are also powerful in their own way

-

Green reckons that Wallace’s “This Is Water” parable is the perfect metaphor to describe passive investing’s now all-encompassing effect on markets and his industry. “Indices were designed as measures, but once you begin investing in them you actually distort them,” Green argues. “The moment they became participants and began to grow, they affected markets.”

-

Of the 21,175 publicly registered US corporate bonds outstanding in 2018, only 246 of them traded at least once a day that year, according to research by Citigroup. But almost every corner of the fixed-income market is less actively traded than stocks. The worry among some skeptics is that a bond ETF struck with a spate of investor withdrawals might be unable to sell its holdings to meet them, and collapse.

-

pendulum has swung against traditional investment styles in favor of quantitative and passive ones over the past decade

-

end game is likely to be cost-free investing, at least for simple, plain-vanilla index funds.

Podcasts

Here are a list of podcasts that you could listen to, if you are short of time and want to get a gist of the book:

- Author speaking at Fordham Gabelli School of Business

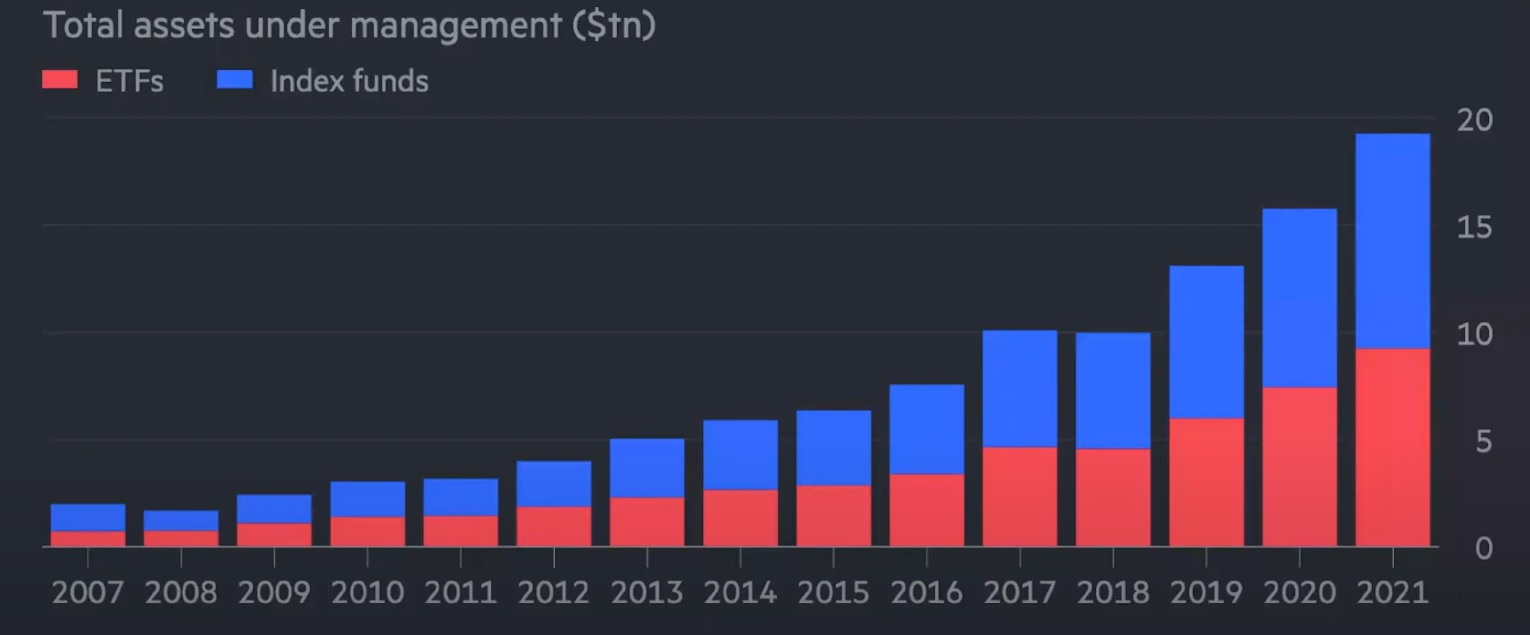

- ETFs AUM as of 2021 is about 10T USD and Index Funds is about 10T USD. Blackrock estimated that internally client managed accounts has about 7T USD that tracks some index. One can estimate that the total passive funds is about 30T USD

- The biggest equity fund in the world is an index fund - Vanguard Total Stock market fund managed more than trillion dollars

- The biggest bond fund in the world is an index fund - 316 busd

- The biggest gold ETF owns more physical gold than most central banks in the world.

- More than 2 trillion dollars have been saved because of passive funds.

- Passive investing is an example of “software eating the world”

- Examples

- Thematic ETF

- Obesity ETF(Janus)

- Faith based ETF(Inspire)

- Quintuple inverse leverage of QQQ

- Marijuana ETF

- Biotech ETF

- Rise of Robots ETF(Lyxor)

- Mounting evidence that passive funds are wrecking the market structure - bogus

Figure 45: Passive funds growth

- Top Traders Unplugged

- 401k and beyond podcast

- Index funds free load of active investing

- There are more hedge fund managers, index fund managers, private equity managers than ever. They have fatter profit margins that should come off, before we start worrying about it

- 20 cents of every dollar that goes in to S&P goes in to Big Tech

- Factor ETFs - The line between active and passive will be blurred out because of the rise of direct investing

Takeaway

At the outset, this book is more suited for someone who wants to know the story behind passive investing revolution, without being too data heavy. Bogle effect was more data driven. This book is more suited for lying down on a couch and reading leisurely about all the people that were involved in passive management industry. Reading about the people who have contributed to something is always fascinating and especially more so in finance, if your day job is tied to it. Book is well written and deserves to be read by anyone curious about the origins of passive investment.