Granger Test Vs ECM

Purpose The purpose is to explore the unstability arising from structural change in the time series data. Till this point in time, I was merely analyzing the timeseries data with out any consideration of structural shift

I am using a different script to generate the dataset needed for testing the structural shifts in pairs data.

Basic steps :

- Shortlist the pairs

> library(fArma)

> library(fSeries)

> library(TSA)

> library(pspline)

> library(fUnitRoots)

> library(RSQLite)

> library(lmtest)

> program.date <- "feb18"

> ticker.data <- "tickers.csv"

> date.start <- "2009-02-02"

> date.end <- "2010-02-18"

> setwd("C:/Cauldron/garage/R/soulcraft/Data/Pairs")

> source("C:/Cauldron/garage/R/soulcraft/Volatility/Pairs/RelativeValue/ZCT.R")

> INITIAL.CAPITAL <- 1e+06

> UNITS <- 1e+05

> all.pairs.file <- paste("all_pairs_", program.date, "_v1.csv",

+ sep = "")

> shortlisted.pairs.file <- paste("shortlisted_pairs_", program.date,

+ "_v1.csv", sep = "")

> arma.file <- paste("arma_", program.date, "_revised.csv", sep = "")

> final.pairs.file <- paste("finalpairs_", program.date, ".csv",

+ sep = "")

> discuss.pairs.file <- paste("disusspairs_", program.date, ".csv",

+ sep = "")

> eacf.result.file <- paste("eacf_resultfile_", program.date, ".csv",

+ sep = "")

> db <- "C:/sqlite/mydbases/pairs/pairsv1.s3db"

> drv <- dbDriver("SQLite")

> con <- dbConnect(drv, dbname = db)

> query <- paste("') \n\t\t\t\t\t\t\t\torder by ticker_id, trade_date asc ",

+ sep = "")

> security.db <- dbGetQuery(con, query)

> security.db <- security.db[, 3:4]

> security.db1 <- unstack(security.db, form = security.db$price ~

+ security.db$ticker)

> stkreturns <- returns(ts(security.db1), "simple")

> stkreturns <- stkreturns[-1, ]

> n <- dim(stkreturns)[2]

> pair.combinations <- matrix(data = NA, nrow = n * (n + 1)/2,

+ ncol = 2)

> rowcount <- 1

> for (i in 1:n) {

+ for (j in 1:i) {

+ pair.combinations[rowcount, 1] <- i

+ pair.combinations[rowcount, 2] <- j

+ rowcount <- rowcount + 1

+ }

+ }

> pair.combinations <- data.frame(pair.combinations)

> colnames(pair.combinations) <- c("i", "j")

> lookupi <- tickers[, c("tickers", "ticker_id", "mktcap.cr", "sector",

+ "sector_id")]

> lookupj <- tickers[, c("tickers", "ticker_id", "mktcap.cr", "sector",

+ "sector_id")]

> colnames(lookupi) <- c("tickeri", "i", "mktcap.cr.i", "sector.i",

+ "sector.i.id")

> colnames(lookupj) <- c("tickerj", "j", "mktcap.cr.j", "sector.j",

+ "sector.j.id")

> d1 <- merge(pair.combinations, lookupj, by.x = "j", by.y = "j",

+ all.x = T)

> d2 <- merge(d1, lookupi, by.x = "i", by.y = "i", all.x = T)

> d3 <- d2[d2$i != d2$j, c("i", "j", "tickeri", "tickerj", "sector.i",

+ "mktcap.cr.i", "sector.j", "mktcap.cr.j", "sector.i.id",

+ "sector.j.id")]

> samesector <- d3[d3$sector.i.id == d3$sector.j.id, ]

> x <- pmax(samesector$mktcap.cr.i, samesector$mktcap.cr.j)/pmin(samesector$mktcap.cr.i,

+ samesector$mktcap.cr.j)

> x <- round(x, 0)

> cumsum(table(x)) * 100/sum(table(x))

1 2 3 4 5 6 7 8

20.51282 37.94872 52.30769 61.53846 68.20513 74.10256 77.69231 79.74359

9 10 11 12 13 14 15 16

81.02564 82.82051 84.61538 85.12821 86.41026 86.92308 87.94872 88.71795

17 18 19 21 22 23 24 25

89.48718 90.00000 91.02564 92.05128 93.07692 93.58974 94.10256 94.61538

26 27 28 29 31 33 36 45

95.12821 95.38462 95.64103 95.89744 96.15385 96.66667 96.92308 97.17949

49 51 55 60 64 69 75 84

97.43590 97.94872 98.20513 98.46154 98.71795 98.97436 99.23077 99.74359

87

100.00000

> samesector <- samesector[which(x <= 8), ] |

> sector.tests <- samesector

> sector.tests$p.a.b.1 <- 0

> sector.tests$p.a.b.2 <- 0

> sector.tests$p.a.b.3 <- 0

> sector.tests$p.b.a.1 <- 0

> sector.tests$p.b.a.2 <- 0

> sector.tests$p.b.a.3 <- 0

> sector.tests$lag.coeff.a.b <- 0

> sector.tests$lag.coeff.b.a <- 0

> sector.tests$p.a.b.3.W <- 0

> sector.tests$p.b.a.3.W <- 0

> npairs <- dim(samesector)[1]

> pair = 1

> for (pair in 1:npairs) {

+ a <- samesector[pair, "tickeri"]

+ b <- samesector[pair, "tickerj"]

+ y1 <- (security.db1[, a])

+ x1 <- (security.db1[, b])

+ p.a.b.3.W <- (grangertest(y1 ~ x1, order = 1))[2, 4]

+ y1 <- log(security.db1[, a])

+ x1 <- log(security.db1[, b])

+ fit <- lm(y1 ~ x1)

+ if (summary(fit)$coefficients[1, 4] < 0.05) {

+ error <- residuals(fit)

+ }

+ else {

+ fit <- lm(y1 ~ x1 + 0)

+ error <- residuals(fit)

+ }

+ n <- length(error)

+ res <- unitrootTest(error, lag = 1, type = "c")

+ p.a.b.1 <- attr(res, "test")$p.value[1]

+ dy1 <- diff(y1)

+ dx1 <- diff(x1)

+ error.lag <- error[-n]

+ fit <- lm(dy1 ~ error.lag + dx1)

+ fit.summary <- summary(fit)

+ p.a.b.2 <- fit.summary$coefficients[2, 4]

+ z <- data.frame(embed(cbind(dy1, dx1), 2))

+ colnames(z) <- c("dy1", "dx1", "dy1.1", "dx1.1")

+ error.lag <- error[-c(1, n)]

+ fit <- lm(dy1 ~ error.lag + dy1.1 + dx1.1, data = z)

+ fit.summary <- summary(fit)

+ p.a.b.3 <- fit.summary$coefficients[2, 4]

+ lag.coeff.a.b <- fit.summary$coefficients[2, 1]

+ y1 <- (security.db1[, b])

+ x1 <- (security.db1[, a])

+ p.b.a.3.W <- (grangertest(y1 ~ x1, order = 1))[2, 4]

+ y1 <- log(security.db1[, b])

+ x1 <- log(security.db1[, a])

+ fit <- lm(y1 ~ x1)

+ if (summary(fit)$coefficients[1, 4] < 0.05) {

+ error <- residuals(fit)

+ }

+ else {

+ fit <- lm(y1 ~ x1 + 0)

+ error <- residuals(fit)

+ }

+ n <- length(error)

+ res <- unitrootTest(error, lag = 1, type = "c")

+ p.b.a.1 <- attr(res, "test")$p.value[1]

+ dy1 <- diff(y1)

+ dx1 <- diff(x1)

+ error.lag <- error[-n]

+ fit <- lm(dy1 ~ error.lag + dx1)

+ fit.summary <- summary(fit)

+ p.b.a.2 <- fit.summary$coefficients[2, 4]

+ z <- embed(cbind(dy1, dx1), 2)

+ colnames(z) <- c("dy1", "dx1", "dy1.1", "dx1.1")

+ error.lag <- error[-c(1, n)]

+ fit <- lm(z[, "dy1"] ~ error.lag + z[, "dy1.1"] + z[, "dx1.1"])

+ fit.summary <- summary(fit)

+ p.b.a.3 <- fit.summary$coefficients[2, 4]

+ lag.coeff.b.a <- fit.summary$coefficients[2, 1]

+ sector.tests[pair, "p.a.b.1"] <- p.a.b.1

+ sector.tests[pair, "p.a.b.2"] <- p.a.b.2

+ sector.tests[pair, "p.a.b.3"] <- p.a.b.3

+ sector.tests[pair, "p.b.a.1"] <- p.b.a.1

+ sector.tests[pair, "p.b.a.2"] <- p.b.a.2

+ sector.tests[pair, "p.b.a.3"] <- p.b.a.3

+ sector.tests[pair, "lag.coeff.a.b"] <- lag.coeff.a.b

+ sector.tests[pair, "lag.coeff.b.a"] <- lag.coeff.b.a

+ sector.tests[pair, "p.a.b.3.W"] <- p.a.b.3.W

+ sector.tests[pair, "p.b.a.3.W"] <- p.b.a.3.W

+ } |

There are 6 categories which I want to explore

> dim(sector.tests)

[1] 311 20

> temp <- sector.tests[, c("p.a.b.1", "p.a.b.2", "p.a.b.3", "p.b.a.1",

+ "p.b.a.2", "p.b.a.3", "p.a.b.3.W", "p.b.a.3.W", "lag.coeff.a.b",

+ "lag.coeff.b.a")]

> temp$stat.a.b.1 <- ifelse(temp$p.a.b.1 < 0.05, 1, 0)

> temp$stat.b.a.1 <- ifelse(temp$p.b.a.1 < 0.05, 1, 0)

> temp$stat.a.b.2 <- ifelse(temp$p.a.b.2 < 0.05, 1, 0)

> temp$stat.b.a.2 <- ifelse(temp$p.b.a.2 < 0.05, 1, 0)

> temp$stat.a.b.3 <- ifelse(temp$p.a.b.3 < 0.05, 1, 0)

> temp$stat.b.a.3 <- ifelse(temp$p.b.a.3 < 0.05, 1, 0)

> temp$stat.a.b.3.W <- ifelse(temp$p.a.b.3.W < 0.05, 1, 0)

> temp$stat.b.a.3.W <- ifelse(temp$p.b.a.3.W < 0.05, 1, 0)

> temp$stat.lag.a.b <- ifelse(temp$lag.coeff.a.b < 0, 1, 0)

> temp$stat.lag.b.a <- ifelse(temp$lag.coeff.b.a < 0, 1, 0)

> temp$stat.a.b.1 <- as.factor(temp$stat.a.b.1)

> temp$stat.b.a.1 <- as.factor(temp$stat.b.a.1)

> temp$stat.a.b.2 <- as.factor(temp$stat.a.b.2)

> temp$stat.b.a.2 <- as.factor(temp$stat.b.a.2)

> temp$stat.a.b.3 <- as.factor(temp$stat.a.b.3)

> temp$stat.b.a.3 <- as.factor(temp$stat.b.a.3)

> temp$stat.a.b.3.W <- as.factor(temp$stat.a.b.3.W)

> temp$stat.b.a.3.W <- as.factor(temp$stat.b.a.3.W)

> temp$stat.lag.a.b <- as.factor(temp$stat.lag.a.b)

> temp$stat.lag.b.a <- as.factor(temp$stat.lag.b.a) |

- Questions of interest

- Does the unit root test distinguish betweeen lm(yx) and lm(xy)

> p <- ggplot(temp, aes(x = p.a.b.1, y = p.b.a.1)) > q <- p + geom_point() + geom_abline(slope = 1, intercept = 0) > print(q) |

Clearly there are difference in p values based on what you use dependent and independent variables as

> temp1 <- subset(temp, p.a.b.1 < 0.05) > p <- ggplot(temp1, aes(x = p.a.b.1, y = p.b.a.1)) > q <- p + geom_point() + geom_abline(yintercept = 0, slope = 1) > print(q) > temp2 <- subset(temp, p.b.a.1 < 0.05) > p <- ggplot(temp2, aes(x = p.a.b.1, y = p.b.a.1)) > q <- p + geom_point() + geom_abline(yintercept = 0, slope = 1) > print(q) |

> table(x = temp$stat.a.b.1, y = temp$stat.b.a.1) y x 0 1 0 176 8 1 14 113 |

Clearly the table output shows that it does not matter which way you regress the unit root test gives the same result ''

> temp.bkup <- temp > temp <- temp.bkup > condition1 <- temp$stat.a.b.1 == 1 & temp$stat.b.a.1 == 1 > temp <- temp[condition1, ] > table(x = temp$stat.a.b.1, y = temp$stat.b.a.1) y x 0 1 0 0 0 1 0 113 > table(x = temp$stat.a.b.2, y = temp$stat.b.a.2) y x 0 1 0 0 16 1 17 80 > table(x = temp$stat.a.b.3, y = temp$stat.b.a.3) y x 0 1 0 9 50 1 44 10 > table(x = temp$stat.a.b.3.W, y = temp$stat.b.a.3.W) y x 0 1 0 34 39 1 35 5 > table(x = temp$stat.lag.a.b, y = temp$stat.lag.b.a) y x 0 1 0 0 12 1 13 88 |

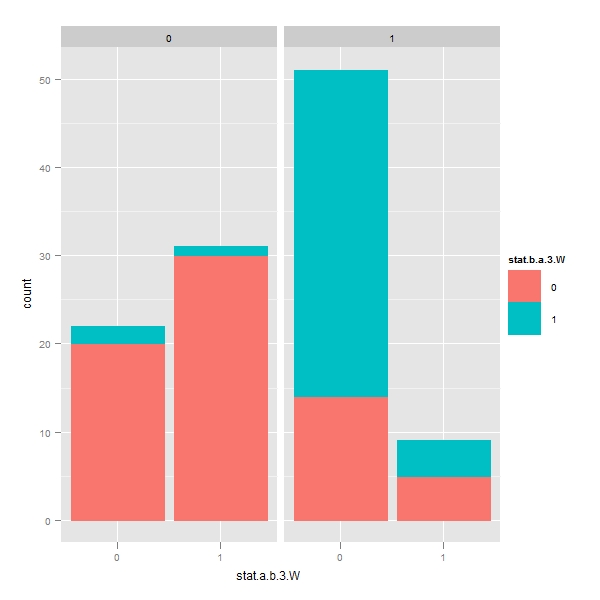

General plots on the unit root test results

> p <- ggplot(temp, aes(x = stat.a.b.3.W, color = stat.b.a.3.W, + fill = stat.b.a.3.W)) > q <- p + geom_bar() > print(q) > q <- p + geom_bar() + facet_grid(. ~ stat.a.b.3) > print(q) > q <- p + geom_bar() + facet_grid(. ~ stat.b.a.3) > print(q) |

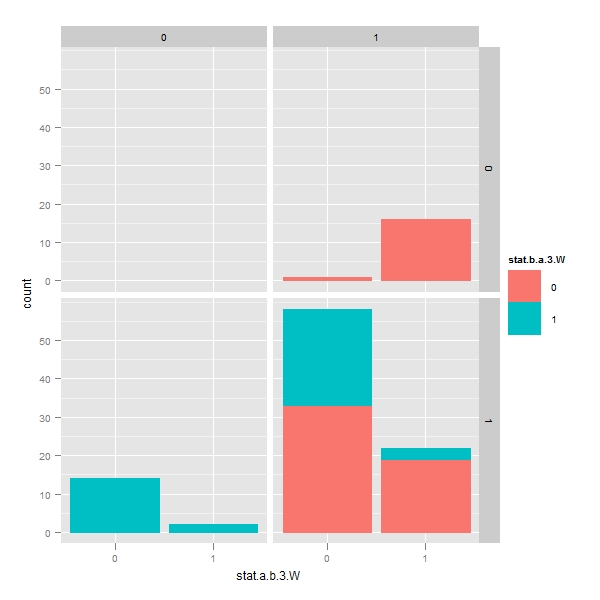

Faceting with chriss procedure

> q <- p + geom_bar() + facet_grid(stat.b.a.2 ~ stat.a.b.2) > print(q) |

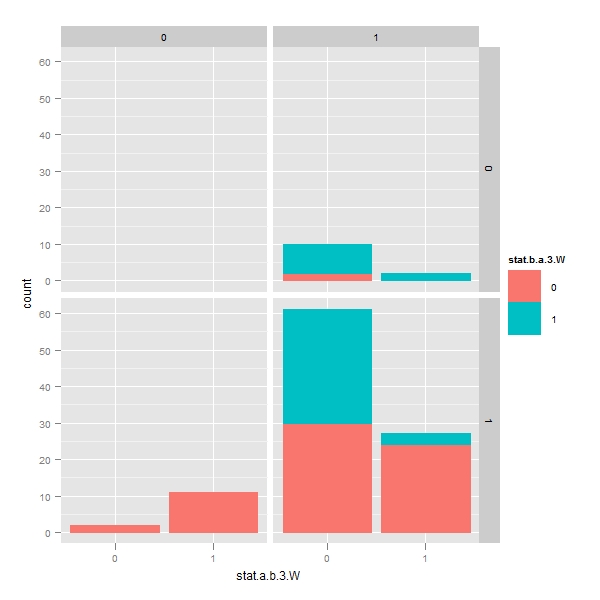

Faceting with lag term procedure

> q <- p + geom_bar() + facet_grid(stat.lag.a.b ~ stat.lag.b.a) > print(q) |

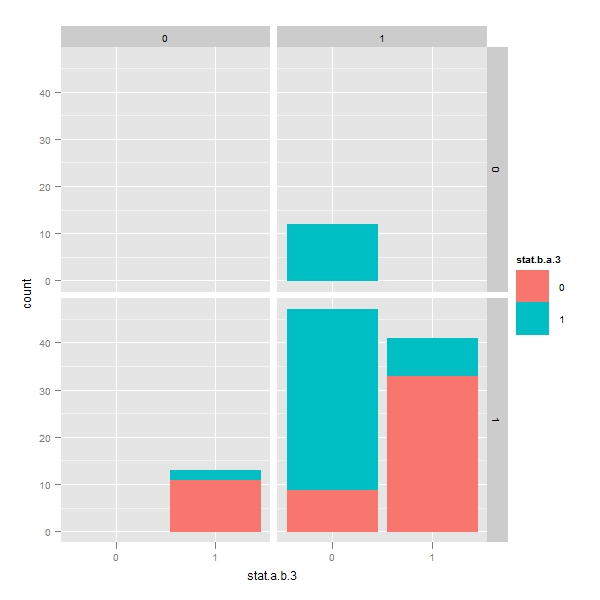

> p <- ggplot(temp, aes(x = stat.a.b.3, color = stat.b.a.3, fill = stat.b.a.3)) > q <- p + geom_bar() > print(q) > q <- p + geom_bar() + facet_grid(stat.lag.a.b ~ stat.lag.b.a) > print(q) |

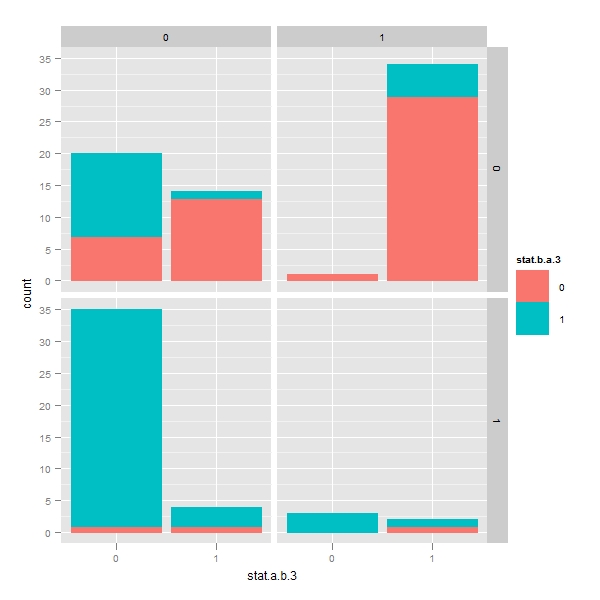

THE MOST IMPORTANT GRAPH OUT OF SPENDING ALMOST 6-7 HOURS !!! Faceting with pfaff procedure

> p <- ggplot(temp, aes(x = stat.a.b.3, color = stat.b.a.3, fill = stat.b.a.3)) > q <- p + geom_bar() + facet_grid(stat.b.a.3.W ~ stat.a.b.3.W) > print(q) |

The above facet shows that in the second quadrant, there are about 35 pairs which do not show any granger causality. Out of which, 30 pairs pass the error correction mechanisms. These are out of the trading portfolio. I have to analyze these!

Why are 27 pairs which pass error correction model described by pfaff do not get picked up by Granger test ?

This is the question that needs to be answered..