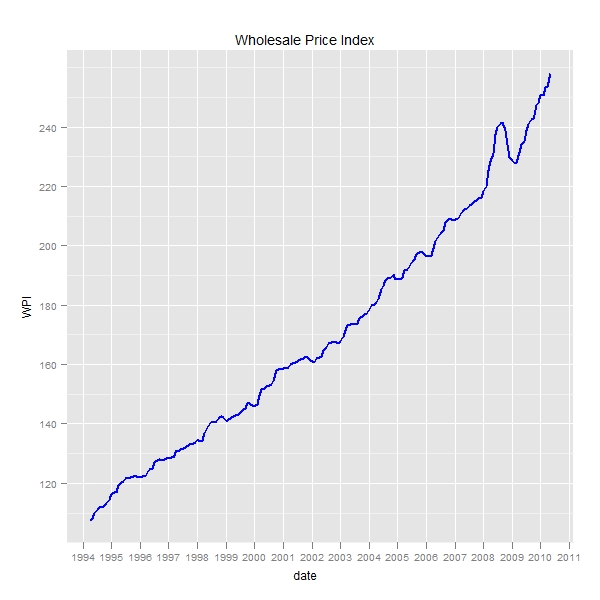

WPI Growth

Purpose

Check WPI numbers

Plotting the raw WPI

> library(ggplot2)

> file <- "C:/Cauldron/Benchmark/PMS/LifeCycleFund/wpi.csv"

> wpi <- read.csv(file, header = T, stringsAsFactors = F)

> wpi$date <- as.Date(wpi$Date, format = "%d-%m-%Y")

> wpi <- wpi[, c("date", "WPI")]

> p <- ggplot(wpi, aes(x = date, y = WPI)) + scale_x_date()

> q <- p + geom_line(colour = "blue", lwd = 0.9)

> q <- q + scale_x_date(major = "years")

> q <- q + scale_y_continuous("WPI")

> q <- q + opts(title = "Wholesale Price Index")

> print(q) |

Plotting the annualized wpi growth rate

> annualized.returns <- function(x) {

+ n <- length(x)

+ (x[n] - x[1])/x[1]

+ }

> wpi.xts <- xts(wpi$WPI, wpi$date)

> wpi.roll <- rollapply(wpi.xts[, 1], width = 13, annualized.returns,

+ align = "right")

> wpi.roll.df <- as.data.frame(wpi.roll)

> wpi.roll.df$date <- as.Date(rownames(wpi.roll.df))

> p <- ggplot(wpi.roll.df, aes(x = date, y = wpi.roll * 100)) +

+ scale_x_date()

> q <- p + geom_line(colour = "blue", lwd = 0.9)

> q <- q + scale_x_date(major = "years")

> q <- q + scale_y_continuous(" Growth Rate")

> q <- q + opts(title = "Wholesale Price Index")

> print(q)

> median(wpi.roll.df[, 1])

[1] 0.05122276 |

The median for the growth rates is about 5.12 percent

If inflation is about 5.12 percent , then it takes about 5 years to reduce your net worth by 25 percent. This has to be factored in the investments.